June 2025 Social Security: New Rules And Potential Impact Of 15% Payment Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 2025 Social Security: New Rules and the Looming Threat of a 15% Payment Reduction

The anxiety is palpable. For millions of Americans relying on Social Security benefits, June 2025 looms large, casting a shadow of potential financial hardship. The looming threat of a 15% reduction in payments has sparked widespread concern and ignited a firestorm of debate surrounding the future of this vital social safety net. What's behind this potential crisis, and what can retirees expect?

Understanding the Potential 15% Cut:

The projected 15% reduction isn't a sudden policy change, but rather a consequence of the Social Security Trust Fund approaching insolvency. The system's current funding model relies on payroll taxes and investment returns, but as the baby boomer generation enters retirement, the ratio of beneficiaries to contributors is shifting dramatically. The Social Security Administration (SSA) has warned for years about the impending shortfall, projecting that the trust fund could be depleted as early as 2028. This depletion doesn't mean Social Security will immediately disappear, but it does mean benefits will likely need to be reduced unless Congress acts. The 15% figure represents a potential outcome if no legislative action is taken.

New Rules and Potential Changes:

While a 15% cut is the most alarming possibility, several other potential changes are being discussed. These include:

- Increased Retirement Age: Raising the full retirement age is a frequently proposed solution. This would mean individuals would need to wait longer to receive their full benefits.

- Reduced Benefits for Higher Earners: Some proposals suggest reducing benefits for higher-income retirees, a move that faces significant political challenges.

- Increased Payroll Taxes: Raising the payroll tax rate is another potential solution, but this would increase the tax burden on working Americans.

- Benefit Formula Adjustments: Changes to the formula used to calculate benefits could also be considered, potentially affecting future retirees.

These are not concrete changes yet; they represent potential solutions under discussion in Congress. The actual outcome will depend heavily on political negotiations and the ability of lawmakers to reach a bipartisan agreement.

What You Can Do Now:

The uncertainty surrounding Social Security's future can be unsettling. Here's what you can do to prepare:

- Stay Informed: Monitor news reports and updates from the SSA to stay abreast of developments. Websites like the SSA's official site ([insert SSA website link here]) offer valuable information.

- Plan for Potential Reductions: While hoping for the best, prepare for the worst. Consider creating a realistic budget that accounts for a potential 15% decrease in your Social Security income.

- Diversify Your Retirement Income: Relying solely on Social Security is risky. Ensure you have other sources of retirement income, such as savings, investments, or a pension.

- Contact Your Representatives: Reach out to your elected officials in Congress to express your concerns and encourage them to find a sustainable solution for Social Security.

The Road Ahead:

The situation surrounding Social Security remains fluid. The coming months will be crucial in determining the future of this vital program. The debate is complex, and the potential consequences are significant. Staying informed and proactive is essential for ensuring your financial security in retirement. We will continue to monitor these developments and provide updates as the situation unfolds.

Keywords: Social Security, Social Security Reform, Social Security cuts, Social Security benefits, retirement, retirement planning, June 2025, 15% reduction, Social Security Administration, SSA, retirement income, financial planning, baby boomers, trust fund, insolvency.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 2025 Social Security: New Rules And Potential Impact Of 15% Payment Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sustainable Gardening The Benefits Of Coffee Grounds For Lawns

May 27, 2025

Sustainable Gardening The Benefits Of Coffee Grounds For Lawns

May 27, 2025 -

Lacrosse Championship Final Maryland Takes On Cornell For National Title

May 27, 2025

Lacrosse Championship Final Maryland Takes On Cornell For National Title

May 27, 2025 -

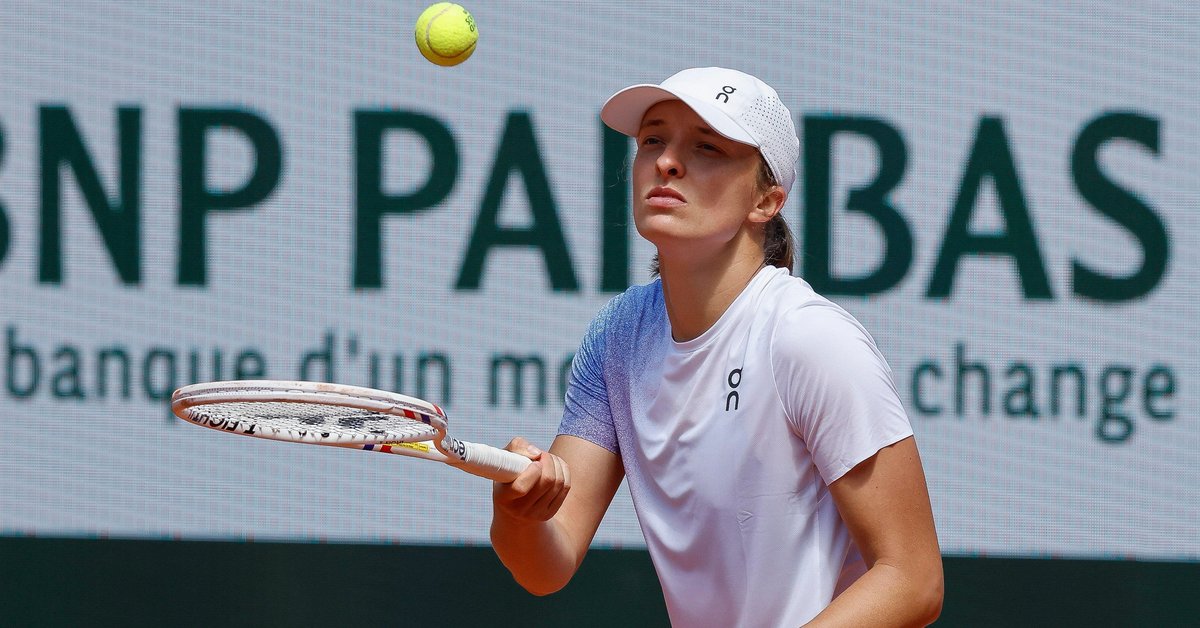

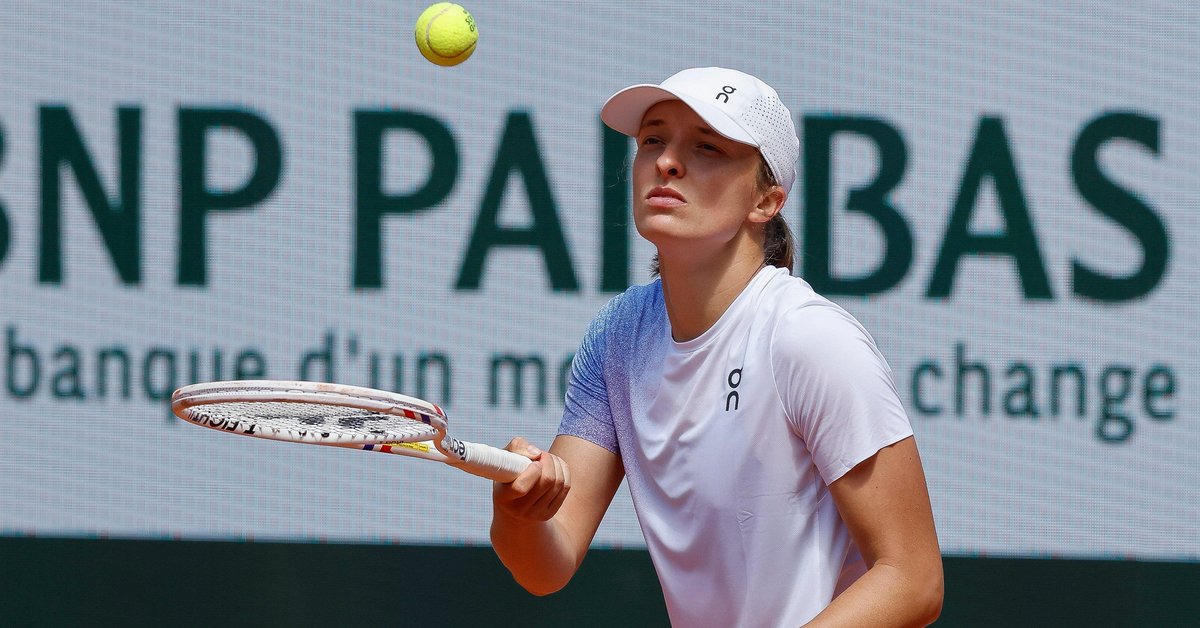

Iga Swiatek Roland Garros Godzina I Data Pierwszego Spotkania

May 27, 2025

Iga Swiatek Roland Garros Godzina I Data Pierwszego Spotkania

May 27, 2025 -

Slicing Up Eyeballs Presents Sirius Xm Dark Wave Playlist 5 25 25

May 27, 2025

Slicing Up Eyeballs Presents Sirius Xm Dark Wave Playlist 5 25 25

May 27, 2025 -

Iga Swiatek W Roland Garros Pelny Harmonogram Pierwszego Meczu

May 27, 2025

Iga Swiatek W Roland Garros Pelny Harmonogram Pierwszego Meczu

May 27, 2025

Latest Posts

-

Trump Grants Pardons To Reality Tv Couple Guilty Of Bank Fraud And Tax Evasion

May 30, 2025

Trump Grants Pardons To Reality Tv Couple Guilty Of Bank Fraud And Tax Evasion

May 30, 2025 -

Call For Cannabis Decriminalisation In London Gains Mayors Support

May 30, 2025

Call For Cannabis Decriminalisation In London Gains Mayors Support

May 30, 2025 -

Viral Video Passengers Unexpected Encounter With Birds On A Delta Flight

May 30, 2025

Viral Video Passengers Unexpected Encounter With Birds On A Delta Flight

May 30, 2025 -

Musica Comida E Traje Os Elementos Essenciais De Uma Festa Portuguesa

May 30, 2025

Musica Comida E Traje Os Elementos Essenciais De Uma Festa Portuguesa

May 30, 2025 -

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025

French Media Censorship Macrons Marital Ad Disappears

May 30, 2025