June 2025 Social Security: Understanding The Proposed 15% Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June 2025 Social Security: Understanding the Proposed 15% Reduction – What You Need to Know

A looming crisis? The potential 15% reduction in Social Security benefits scheduled for June 2025 has sent shockwaves through millions of American retirees and those nearing retirement. This significant cut isn't a done deal, but understanding the proposal and its potential impact is crucial for everyone relying on Social Security. This article will break down the proposed changes, explore the reasons behind them, and offer advice on how to prepare.

What's the proposed 15% reduction?

The current concern stems from projections showing the Social Security trust fund is nearing depletion. While the exact date remains uncertain and subject to ongoing debate and potential legislative changes, some projections indicate the fund could be insolvent by June 2025. This potential insolvency could trigger automatic benefit reductions of approximately 15%, impacting millions of retirees and beneficiaries. It's crucial to note that this is a projected reduction; Congress could still act to prevent or mitigate the cuts.

Why is this happening?

The impending crisis is a complex issue with multiple contributing factors:

- Aging Population: The US is experiencing an aging population, meaning more people are drawing benefits while fewer are contributing through payroll taxes.

- Increased Life Expectancy: People are living longer, requiring Social Security to pay out benefits for an extended period.

- Declining Birth Rates: Lower birth rates contribute to a smaller workforce supporting a growing number of retirees.

- Economic Factors: Economic downturns and periods of high unemployment can reduce the amount of payroll taxes collected.

What can be done to prevent the cuts?

The situation is far from hopeless. Several solutions are under discussion in Congress, including:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Social Security Tax Cap: Expanding the amount of earnings subject to Social Security taxes.

- Adjusting Benefit Formulas: Modifying the way benefits are calculated to ensure long-term solvency.

- Cutting Benefits Gradually: Implementing smaller, phased benefit reductions instead of a drastic single cut.

These options all have potential implications for different groups of people, and the debate surrounding them is fierce. It's essential to follow the news and understand the proposals being put forward.

What should I do now?

While the future of Social Security remains uncertain, taking proactive steps can help you prepare:

- Stay Informed: Monitor news and updates from reputable sources like the Social Security Administration (SSA) website and major news outlets.

- Review Your Retirement Plan: Assess your savings and retirement income to understand how a potential 15% reduction might affect your financial security.

- Consult a Financial Advisor: A financial advisor can help you create a personalized plan to mitigate the potential impact of Social Security cuts.

- Contact Your Elected Officials: Voice your concerns to your representatives in Congress and encourage them to prioritize finding a solution.

The Road Ahead:

The potential 15% reduction to Social Security benefits in June 2025 is a serious concern requiring immediate attention. While the situation is complex, understanding the factors contributing to the crisis and the potential solutions is the first step towards ensuring the long-term viability of this vital program. Staying informed and engaging with the political process is crucial for everyone relying on Social Security for their retirement income. Learn more by visiting the official .

Keywords: Social Security, Social Security benefits, Social Security cuts, Social Security reduction, June 2025, retirement, retirement planning, Social Security trust fund, insolvency, financial planning, retirement income.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June 2025 Social Security: Understanding The Proposed 15% Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Coastal Town Rocked By 73 Arrests Over Memorial Day Weekend

May 28, 2025

Coastal Town Rocked By 73 Arrests Over Memorial Day Weekend

May 28, 2025 -

Macron Denies Aggressive Behavior After Video With Brigitte Surfaces Online

May 28, 2025

Macron Denies Aggressive Behavior After Video With Brigitte Surfaces Online

May 28, 2025 -

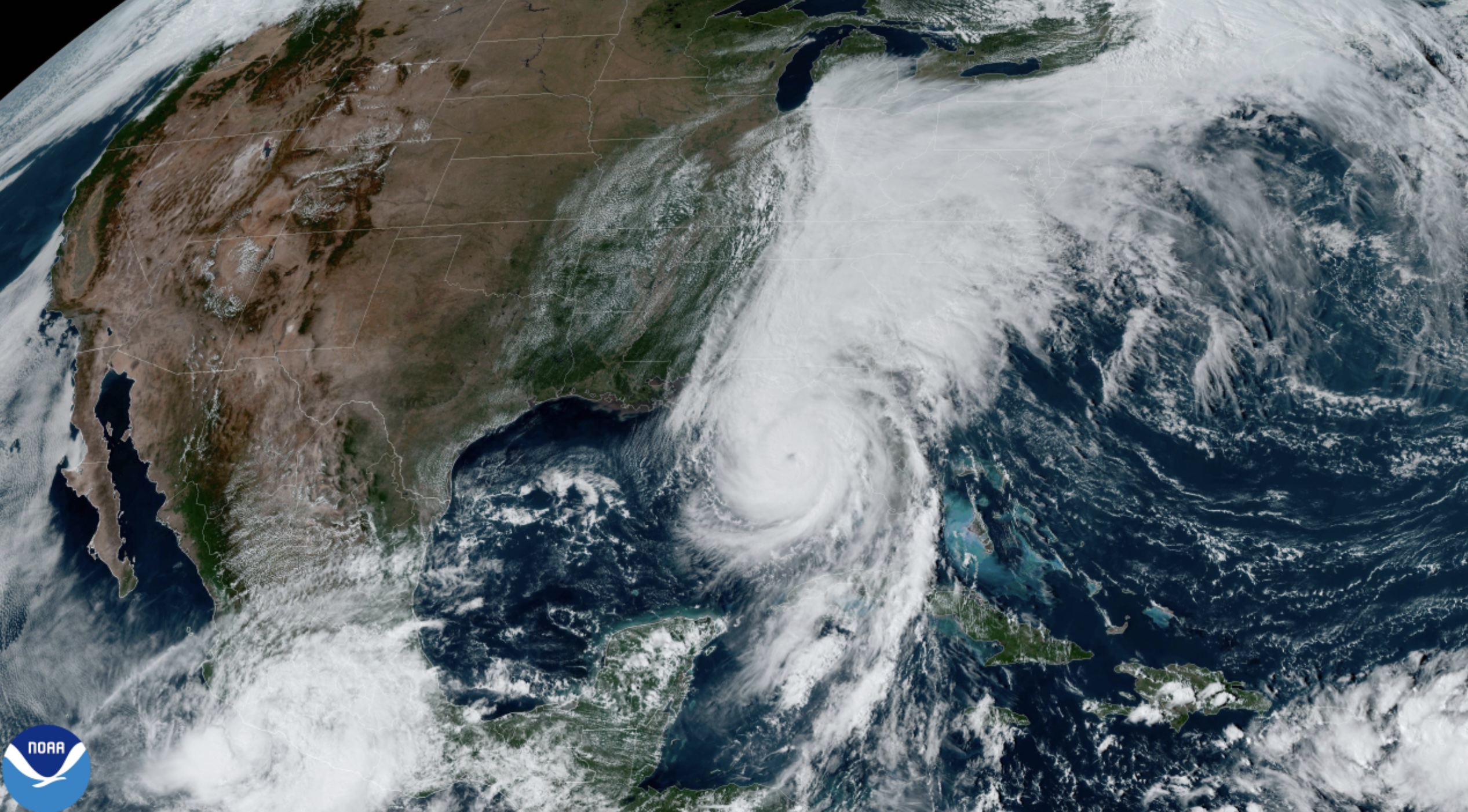

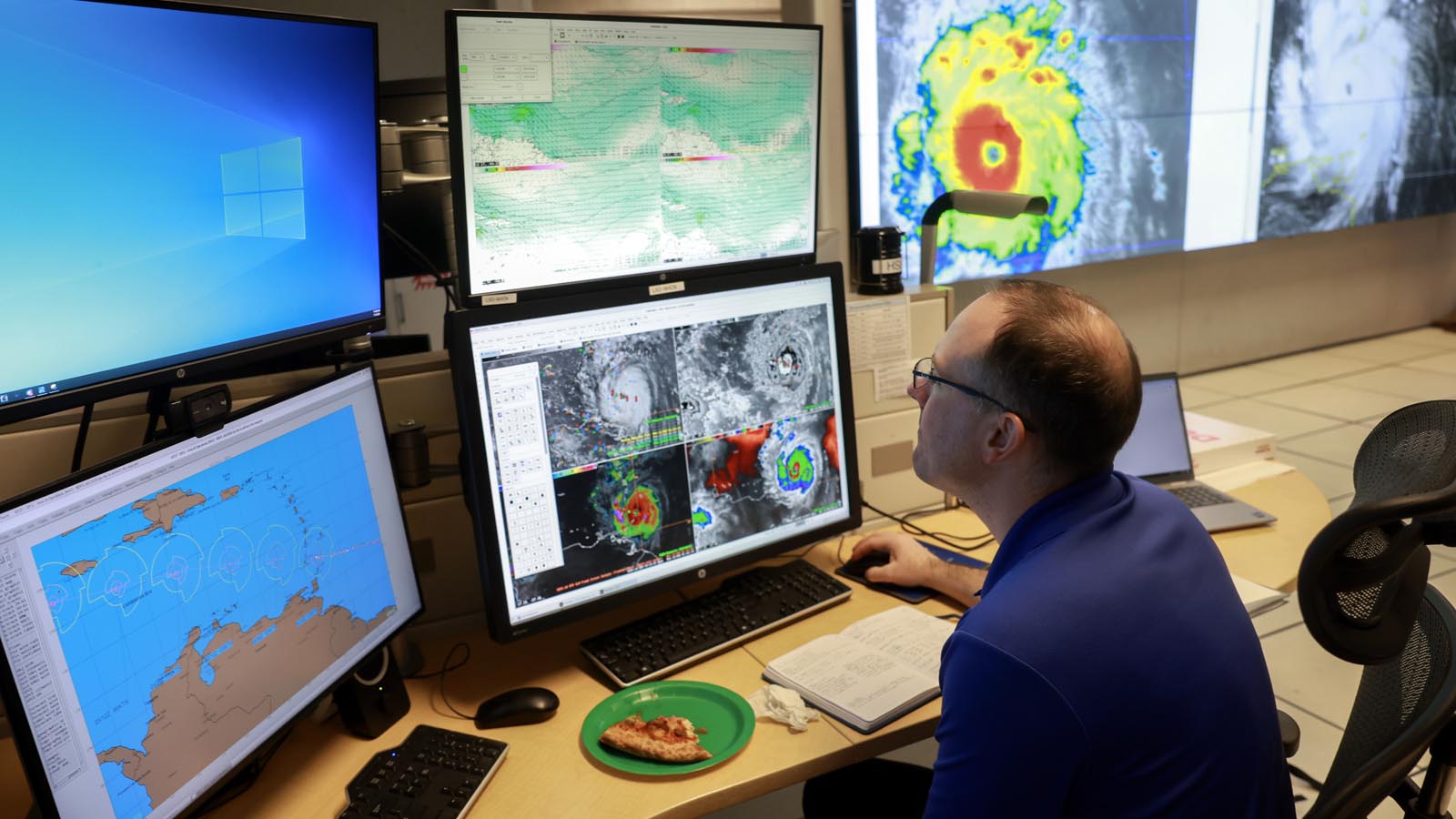

Us Summer Hurricane Outlook Above Normal Conditions Suggest 10 Potential Storms

May 28, 2025

Us Summer Hurricane Outlook Above Normal Conditions Suggest 10 Potential Storms

May 28, 2025 -

Memorial Day Weekend Chaos 73 Arrested In Beach Town Violence

May 28, 2025

Memorial Day Weekend Chaos 73 Arrested In Beach Town Violence

May 28, 2025 -

Explore Dark Wave Music Sirius Xm Playlist Hosted By Slicing Up Eyeballs 05 25 2025

May 28, 2025

Explore Dark Wave Music Sirius Xm Playlist Hosted By Slicing Up Eyeballs 05 25 2025

May 28, 2025

Latest Posts

-

Losing A Partner Too Soon The Reality Of Heart Attacks Before 50

May 29, 2025

Losing A Partner Too Soon The Reality Of Heart Attacks Before 50

May 29, 2025 -

Nba Trade Deadline Will Jrue Holiday Or La Melo Ball Join The Mavericks Antetokounmpo Update And Nets Draft Position

May 29, 2025

Nba Trade Deadline Will Jrue Holiday Or La Melo Ball Join The Mavericks Antetokounmpo Update And Nets Draft Position

May 29, 2025 -

Understanding Hurricane Model Accuracy Your Guide For 2025

May 29, 2025

Understanding Hurricane Model Accuracy Your Guide For 2025

May 29, 2025 -

Harvard Vs Trump A Critical Look And My Unexpected Conclusion

May 29, 2025

Harvard Vs Trump A Critical Look And My Unexpected Conclusion

May 29, 2025 -

Tourism In Canada Amidst Growing Us Boycott Concerns

May 29, 2025

Tourism In Canada Amidst Growing Us Boycott Concerns

May 29, 2025