Lengthening Loan Terms: 31-Year Mortgages And The First-Time Buyer Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lengthening Loan Terms: Are 31-Year Mortgages the Answer for First-Time Buyers?

The dream of homeownership often feels out of reach for many first-time buyers, hampered by rising interest rates and increasingly unaffordable housing prices. But a new trend is emerging that could potentially ease the financial burden: longer mortgage terms, specifically 31-year mortgages. This article explores the implications of this lengthening trend and its potential impact on the first-time buyer market.

The Allure of the 31-Year Mortgage

For first-time homebuyers, the primary attraction of a 31-year mortgage lies in the significantly lower monthly payments compared to traditional 15- or 30-year options. By stretching the repayment period, the principal and interest payments are reduced, making homeownership more accessible to those with tighter budgets. This lower monthly payment can free up cash flow for other essential expenses, such as saving for emergencies or investing in home improvements.

Lower Monthly Payments: A Double-Edged Sword?

While the reduced monthly payments are undeniably appealing, it's crucial to understand the potential drawbacks. A longer loan term means paying significantly more interest over the life of the loan. This increased interest cost can ultimately negate the initial benefits of lower monthly payments in the long run. It's essential for prospective homeowners to carefully weigh the short-term benefits against the long-term financial implications.

Who Benefits Most from Longer Loan Terms?

Longer-term mortgages, like the emerging 31-year options, can be particularly beneficial for:

- First-time homebuyers with limited savings: The lower monthly payment allows them to enter the market despite having a smaller down payment and less disposable income.

- Buyers in high-cost housing markets: In areas with exorbitant property prices, longer terms can make homeownership more financially feasible.

- Individuals with fluctuating incomes: The flexibility of lower monthly payments can offer a safety net during periods of financial uncertainty.

Navigating the Complexities: Things to Consider

Before committing to a 31-year mortgage, potential homeowners should carefully consider several factors:

- Interest Rate Fluctuations: Interest rates are dynamic and can change throughout the life of the loan. A longer-term mortgage exposes borrowers to interest rate risk for a more extended period.

- Total Interest Paid: While monthly payments are lower, the total interest paid over 31 years will be substantially higher than a shorter-term mortgage. Use a mortgage calculator to accurately compare the total cost.

- Financial Flexibility: While lower monthly payments offer short-term relief, ensure you have a robust financial plan to manage potential future financial challenges.

- Prepayment Penalties: Some lenders impose penalties for early mortgage payoff. Carefully review the terms and conditions before signing the loan agreement.

The Future of Mortgage Lending and First-Time Homebuyers

The rise of 31-year mortgages reflects a broader shift in the mortgage lending landscape, responding to the evolving needs and challenges faced by first-time homebuyers. While these longer-term loans offer a potential pathway to homeownership for many, it’s vital to approach them with a thorough understanding of their implications. Thorough research, careful financial planning, and consulting with a financial advisor are crucial steps in making an informed decision.

Call to Action: Are you considering a 31-year mortgage? Share your thoughts and experiences in the comments below! Learn more about mortgage options and financial planning by visiting [link to a reputable financial resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lengthening Loan Terms: 31-Year Mortgages And The First-Time Buyer Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indiana Fever Utilize Hardship Exception To Sign New Player

Jun 03, 2025

Indiana Fever Utilize Hardship Exception To Sign New Player

Jun 03, 2025 -

Unlock The Nyt Spelling Bee Hints And Answers For Strands June 3rd

Jun 03, 2025

Unlock The Nyt Spelling Bee Hints And Answers For Strands June 3rd

Jun 03, 2025 -

Country Star Justin Moore A Look At His Career And Influences

Jun 03, 2025

Country Star Justin Moore A Look At His Career And Influences

Jun 03, 2025 -

Summer Travel Deals Find Cheap Flights With Last Minute Bookings

Jun 03, 2025

Summer Travel Deals Find Cheap Flights With Last Minute Bookings

Jun 03, 2025 -

Mc Migraine On Tik Tok Separating Myth From Reality In Headache Treatment

Jun 03, 2025

Mc Migraine On Tik Tok Separating Myth From Reality In Headache Treatment

Jun 03, 2025

Latest Posts

-

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025 -

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025

2028 Election Looms Pentagon Schedules Crucial Golden Dome Missile Defense Test

Aug 02, 2025 -

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025

Zelenskys Law Reversal A Victory For Young Ukrainians

Aug 02, 2025 -

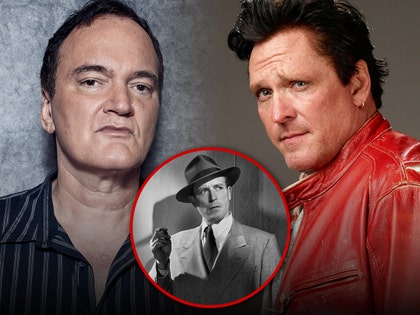

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025

Michael Madsen Defends Tarantinos Firing Of Lawrence Tierney

Aug 02, 2025