Lengthening Loan Terms: 31 Years The New Average For First-Time Mortgages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lengthening Loan Terms: 31 Years the New Average for First-Time Mortgages

The dream of homeownership is becoming increasingly distant for many, with soaring house prices and persistent inflation squeezing potential buyers. A significant shift in the mortgage market is exacerbating this challenge: the average loan term for first-time homebuyers is now stretching to a staggering 31 years. This dramatic increase has significant implications for borrowers, the housing market, and the broader economy.

The Rise of the 31-Year Mortgage: Why is it Happening?

Several factors contribute to this trend of longer mortgage terms. Firstly, the persistently high cost of living and inflation are leaving many prospective homeowners with less disposable income for a down payment and higher monthly mortgage payments. A longer loan term lowers monthly payments, making homeownership seemingly more attainable.

Secondly, rising interest rates are also playing a crucial role. While rates may fluctuate, the current higher rates increase the overall cost of borrowing. A longer loan term can offset this increased cost by reducing the monthly burden, even if the total interest paid increases significantly over the life of the loan.

Thirdly, lenders are increasingly offering longer-term mortgages to attract borrowers in a competitive market. This strategy allows them to expand their customer base, even if it means accepting a slightly higher risk associated with longer-term loans.

The Implications of Longer Loan Terms:

While longer mortgage terms offer short-term affordability, the long-term implications are complex and warrant careful consideration:

- Increased Total Interest Paid: The most obvious consequence is the significantly higher total interest paid over the life of the loan. A 31-year mortgage will accumulate far more interest than a 15- or 20-year mortgage.

- Reduced Equity Buildup: Borrowers will build equity more slowly with a longer term, meaning they will own a smaller percentage of their home in the early years.

- Extended Financial Commitment: A 31-year mortgage locks borrowers into a significant financial commitment for a longer period, limiting their financial flexibility.

- Impact on Housing Market: The increased affordability (in the short term) facilitated by longer loan terms can contribute to increased housing demand, potentially pushing prices higher and further exacerbating affordability issues.

What Does This Mean for First-Time Homebuyers?

For first-time homebuyers, navigating this new landscape requires careful planning and a realistic assessment of their financial situation. Before committing to a 31-year mortgage, it's crucial to:

- Shop around for the best rates: Comparing offers from multiple lenders is essential to secure the most favorable terms.

- Explore different loan options: Consider shorter-term loans if your budget allows, even if monthly payments are higher. The long-term savings in interest can be substantial.

- Consult with a financial advisor: A financial professional can provide personalized guidance based on your individual circumstances.

- Understand the total cost of borrowing: Don't just focus on monthly payments; consider the total interest you'll pay over the life of the loan.

The Future of Mortgage Lending:

The trend towards longer mortgage terms highlights the ongoing challenges in the housing market. Addressing affordability issues requires a multi-faceted approach, including policies to increase housing supply and initiatives to promote financial literacy among prospective homebuyers. The rise of the 31-year mortgage is a symptom of a larger problem and underscores the need for a more sustainable and equitable approach to homeownership. Only time will tell if this trend continues or if market forces will eventually lead to a readjustment in average loan terms. Staying informed and seeking professional advice is crucial for anyone considering purchasing a home in this evolving market.

Call to Action: Are you a first-time homebuyer facing these challenges? Share your experiences in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lengthening Loan Terms: 31 Years The New Average For First-Time Mortgages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Day Insert Day Number Key Matches And Results

Jun 03, 2025

French Open Day Insert Day Number Key Matches And Results

Jun 03, 2025 -

Post Match Mayhem Two Killed Hundreds Arrested After Psg Triumph

Jun 03, 2025

Post Match Mayhem Two Killed Hundreds Arrested After Psg Triumph

Jun 03, 2025 -

Volcanic Eruption Mt Etna Sends Huge Ash Plume Into The Air

Jun 03, 2025

Volcanic Eruption Mt Etna Sends Huge Ash Plume Into The Air

Jun 03, 2025 -

Tom Daley On The Challenges Faced By Closeted Queer Athletes

Jun 03, 2025

Tom Daley On The Challenges Faced By Closeted Queer Athletes

Jun 03, 2025 -

Candace Parker Number 3 Jersey Retirement Ceremony Announced

Jun 03, 2025

Candace Parker Number 3 Jersey Retirement Ceremony Announced

Jun 03, 2025

Latest Posts

-

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025

How Did The Manhattan Shooter Obtain A Gun Despite Past Psychiatric Holds

Aug 03, 2025 -

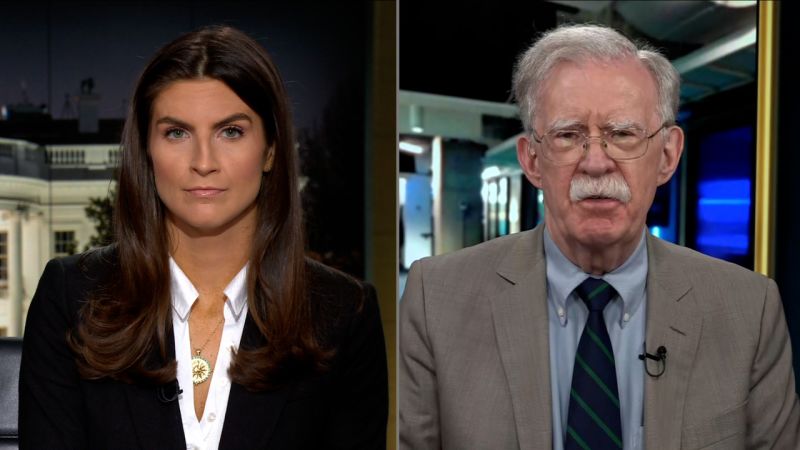

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025

Very Risky Business Bolton Criticizes Trumps Controversial Nuclear Submarine Plan

Aug 03, 2025 -

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025

International Condemnation Mounts Following Killing Of Aid Worker In Gaza

Aug 03, 2025 -

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025

Death Of Palestinian Red Crescent Worker Israeli Strike Condemned

Aug 03, 2025 -

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025