Lengthening Loan Terms: First-Time Buyers Face 31-Year Mortgages

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lengthening Loan Terms: First-Time Buyers Face 31-Year Mortgages

The dream of homeownership is becoming increasingly elusive for first-time buyers, with a worrying trend emerging: significantly longer mortgage terms. Instead of the traditional 25-year mortgage, many are now facing loan terms stretching to a staggering 31 years, or even longer. This shift has significant implications for borrowers, impacting everything from monthly payments to overall interest paid.

This article explores the reasons behind this lengthening trend, the financial consequences for first-time homebuyers, and what potential solutions might exist.

Why are Mortgage Terms Lengthening?

The primary driver behind these extended mortgage terms is the affordability crisis gripping many housing markets. Soaring house prices, coupled with stagnant or slowly rising wages, have created a significant gap between what buyers can afford and what properties cost. Lenders, recognizing this challenge, are offering longer loan terms as a way to lower monthly payments and make homeownership more attainable, at least on paper.

- Increased affordability (in the short-term): Stretching the repayment period reduces the monthly payment, making it seem more manageable for borrowers struggling to meet stricter affordability criteria with shorter-term loans.

- Increased competition: Lenders are competing aggressively for customers in a challenging market. Offering longer repayment options is one way to attract borrowers.

- Rising interest rates: While interest rates may fluctuate, longer loan terms can help offset the impact of higher rates on monthly payments, although it usually means paying significantly more interest overall.

The Financial Implications of 31-Year Mortgages

While a lower monthly payment initially appears attractive, the long-term financial consequences of a 31-year mortgage are substantial:

- Significantly higher total interest paid: Extending the loan term dramatically increases the total interest paid over the life of the mortgage. This can amount to tens of thousands, even hundreds of thousands, of extra dollars.

- Reduced equity growth: Borrowers will build equity more slowly with a longer term mortgage. This can limit their ability to refinance or access home equity in the future.

- Increased risk: A longer repayment period exposes borrowers to greater risk associated with unforeseen circumstances like job loss or interest rate hikes.

What Can First-Time Buyers Do?

Facing the prospect of a 31-year mortgage can be daunting, but there are steps first-time buyers can take:

- Improve credit score: A higher credit score can lead to better interest rates and potentially shorter loan terms. Check your credit report regularly and address any inaccuracies. Learn more about .

- Save a larger down payment: A larger down payment reduces the loan amount, potentially leading to lower monthly payments and shorter terms.

- Explore government assistance programs: Many governments offer programs designed to assist first-time homebuyers, including grants and subsidies. Research local and national programs to see if you qualify.

- Shop around for mortgages: Don't settle for the first mortgage offer you receive. Compare rates and terms from multiple lenders to find the best deal.

The Future of Mortgage Lending

The trend of lengthening mortgage terms highlights the ongoing challenges in the housing market. While providing short-term affordability, it ultimately shifts a greater financial burden onto borrowers. This necessitates a broader discussion about housing affordability and sustainable solutions beyond simply extending loan terms. This includes addressing issues like housing supply, zoning regulations, and wage stagnation.

Call to Action: Are you a first-time homebuyer facing similar challenges? Share your experiences in the comments below. Let's start a conversation about finding solutions to this growing problem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lengthening Loan Terms: First-Time Buyers Face 31-Year Mortgages. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Karen Read Murder Trial Updates Watch The Witness Testimony

Jun 03, 2025

Karen Read Murder Trial Updates Watch The Witness Testimony

Jun 03, 2025 -

Crack The Nyt Spelling Bee Spangram And Answer Guide June 3rd

Jun 03, 2025

Crack The Nyt Spelling Bee Spangram And Answer Guide June 3rd

Jun 03, 2025 -

Live Coverage Crucial Witness Testimony In Karen Read Murder Trial

Jun 03, 2025

Live Coverage Crucial Witness Testimony In Karen Read Murder Trial

Jun 03, 2025 -

The Hidden Lives Of Mormon Wives Swinging Betrayal And The Price Of Silence

Jun 03, 2025

The Hidden Lives Of Mormon Wives Swinging Betrayal And The Price Of Silence

Jun 03, 2025 -

Harry Siegels Momentum Can Mamdani Win The Nyc Democratic Mayoral Primary

Jun 03, 2025

Harry Siegels Momentum Can Mamdani Win The Nyc Democratic Mayoral Primary

Jun 03, 2025

Latest Posts

-

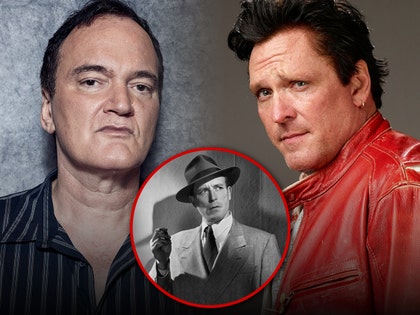

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025