Limbach Holdings (LMB): Bull Of The Day Stock Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Limbach Holdings (LMB): A Bullish Outlook? Stock Analysis and Investment Potential

Limbach Holdings (LMB) has recently caught the attention of investors, sparking debate about its future performance. This in-depth analysis explores the company's current position, recent developments, and potential for growth, helping you decide if LMB is a worthy addition to your portfolio. Is Limbach Holdings truly a "bull of the day," or are there hidden risks lurking beneath the surface? Let's delve into the details.

Understanding Limbach Holdings (LMB): A Quick Overview

Limbach Holdings, Inc. is a leading provider of mechanical, electrical, and plumbing (MEP) services for large-scale construction projects. They operate primarily in the United States, servicing various sectors including healthcare, education, and commercial real estate. Their expertise lies in complex, technically demanding projects requiring specialized engineering and construction management. Understanding their core business model is crucial for evaluating LMB's investment potential.

Recent Developments and Financial Performance:

LMB's recent financial performance has been a key driver of investor interest. While quarterly earnings reports should always be examined closely, focusing on key metrics like revenue growth, profit margins, and backlog provides a clearer picture. [Insert specific data points and relevant charts here, linking to reliable financial sources like Yahoo Finance or Google Finance]. This data should be analyzed to determine if recent trends support a bullish or bearish outlook. Any significant news, such as contract wins, partnerships, or strategic acquisitions, should also be included here.

Factors Contributing to a Potentially Bullish Outlook:

Several factors might contribute to a positive outlook for LMB:

- Strong Demand in Construction: The overall construction market, particularly in specific sectors like healthcare and renewable energy, shows considerable promise. This increasing demand for MEP services positions Limbach Holdings favorably for future growth.

- Strategic Acquisitions and Partnerships: Has Limbach Holdings engaged in any strategic moves to expand its market reach or capabilities? Analyzing these acquisitions and partnerships is essential in evaluating their long-term growth potential.

- Experienced Management Team: A strong and experienced leadership team can be a significant asset. Highlighting the expertise and track record of LMB's management is crucial to showcasing the company's potential.

- Technological Advancements: Does LMB leverage advanced technologies to improve efficiency and reduce costs? Exploring their approach to innovation and technology can provide insights into their competitive advantage.

Potential Risks and Challenges:

While the outlook might appear bullish, it's crucial to acknowledge potential challenges:

- Competition: The MEP industry is competitive. Examining LMB's competitive landscape and their strategic response to market pressures is vital.

- Economic Downturn: The construction industry is susceptible to economic fluctuations. Analyzing LMB's resilience to potential economic downturns is a key consideration.

- Supply Chain Disruptions: The impact of supply chain issues on LMB's operations and profitability needs to be carefully evaluated.

- Project Delays and Cost Overruns: Construction projects often face delays and cost overruns. Assessing LMB's ability to manage these risks is crucial.

Investment Considerations and Conclusion:

Determining if Limbach Holdings (LMB) is a "bull of the day" requires a comprehensive evaluation of its financial performance, strategic direction, and the broader market conditions. Investors should conduct thorough due diligence, considering both the potential upside and the associated risks before making any investment decisions. This analysis provides valuable insights but does not constitute financial advice. Always consult with a qualified financial advisor before making any investment choices.

Keywords: Limbach Holdings, LMB, Stock Analysis, Bull of the Day, Investment, MEP Services, Construction, Stock Market, Financial Performance, Growth Potential, Risk Assessment, Stock Investment, Construction Industry, Financial News.

Call to Action: Stay informed about market trends and company performance by regularly reviewing financial news and conducting your own research. Consider subscribing to reputable financial news sources for up-to-date information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Limbach Holdings (LMB): Bull Of The Day Stock Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unveiling The Beauty A Photographers Focus On Miniature Life

Jun 27, 2025

Unveiling The Beauty A Photographers Focus On Miniature Life

Jun 27, 2025 -

Live Streamed Murder Venezuelan Influencers Criticism Ends In Tragedy

Jun 27, 2025

Live Streamed Murder Venezuelan Influencers Criticism Ends In Tragedy

Jun 27, 2025 -

Father Son Duo Tom Hanks Unexpected Role In Chet Hanks Video

Jun 27, 2025

Father Son Duo Tom Hanks Unexpected Role In Chet Hanks Video

Jun 27, 2025 -

The Supreme Leaders Inheritance Leading Iran Through Transformation

Jun 27, 2025

The Supreme Leaders Inheritance Leading Iran Through Transformation

Jun 27, 2025 -

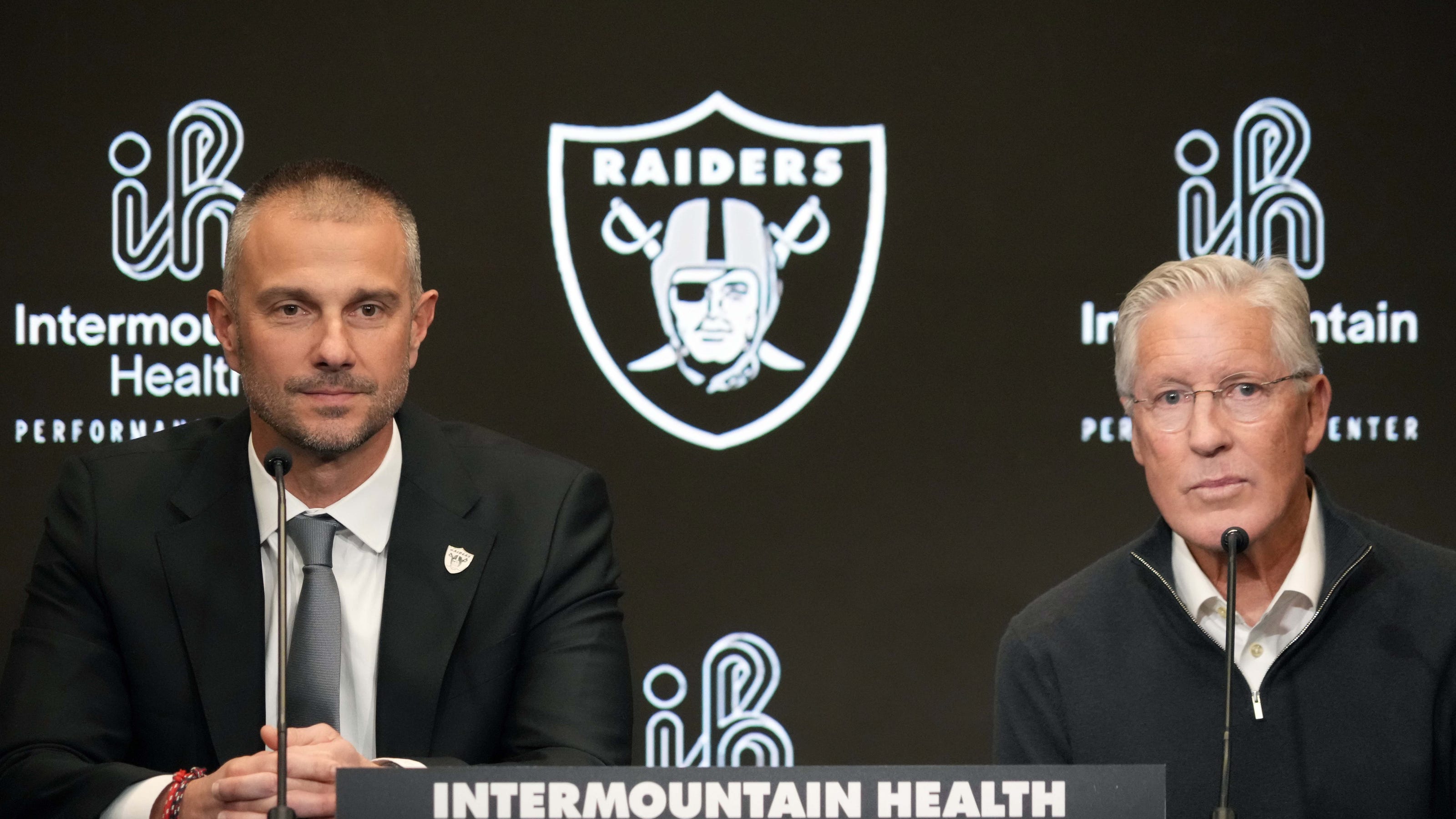

The Athletic Predicts Raiders To Dominate The 2025 Nfl Offseason

Jun 27, 2025

The Athletic Predicts Raiders To Dominate The 2025 Nfl Offseason

Jun 27, 2025