Lion Links 6/20/25 Explained: Risks And Potential Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lion Links 6/20/25 Explained: Risks and Potential Returns

Unveiling the Lion Links 6/20/25 Strategy: A Deep Dive into Potential and Peril

The financial world is abuzz with innovative investment strategies, and Lion Links 6/20/25 is rapidly gaining attention. But what exactly is it? This in-depth analysis will dissect this complex strategy, clarifying its mechanics, highlighting potential rewards, and frankly addressing the inherent risks involved. Understanding these nuances is crucial before considering this type of investment.

What is Lion Links 6/20/25?

Lion Links 6/20/25 isn't a singular investment but rather a descriptive term often used to refer to a specific type of structured note or bond strategy. It typically involves a complex arrangement linking the performance of a portfolio (often a basket of equities or indices) to a defined payoff structure. The "6/20/25" refers to key parameters:

- 6%: This often represents a minimum guaranteed return (though this can vary). Investors are assured of at least a 6% return over the investment period.

- 20%: This signifies a potential participation rate in upside performance. If the linked portfolio performs exceptionally well, investors may share in up to 20% of those gains.

- 25: This likely refers to the investment's maturity date, suggesting a 25-year timeframe.

Understanding the Mechanism:

The Lion Links strategy typically uses derivatives to achieve its payoff structure. These derivatives are complex financial instruments, and understanding their intricacies is essential. Essentially, the investor’s return is tied to the performance of an underlying asset or basket of assets over the specified period. If the underlying assets outperform the predetermined threshold, the investor benefits from the participation rate. Conversely, if the performance lags, the investor receives the minimum guaranteed return.

Potential Returns: The allure of Lion Links 6/20/25 lies in the potential for significant returns. If the underlying assets perform strongly, investors can significantly exceed the guaranteed 6%, potentially achieving substantial capital appreciation. The combination of a guaranteed minimum and upside participation makes it an attractive proposition for some investors seeking a balance between risk and reward.

Risks and Considerations:

While potentially lucrative, Lion Links 6/20/25 carries substantial risks:

- Market Risk: The value of the underlying assets can fluctuate significantly, impacting potential returns. Bear markets can severely limit or negate the upside participation.

- Complexity: The intricate nature of the strategy requires a high level of financial literacy. Understanding the terms and conditions, including the potential for losses, is paramount.

- Credit Risk: There's always a risk that the issuer of the structured note might default, jeopardizing the investor’s principal and any accrued returns. Thoroughly vetting the issuer’s creditworthiness is crucial.

- Liquidity Risk: These types of investments are often illiquid, meaning it can be difficult to sell them before maturity without incurring significant losses.

Who Should Consider Lion Links 6/20/25?

Lion Links 6/20/25 strategies are generally suited to sophisticated investors with a long-term investment horizon and a high risk tolerance. It's not a suitable investment for those seeking short-term gains or those with limited financial knowledge. Always conduct thorough due diligence and seek professional financial advice before investing.

Disclaimer: This article provides general information and should not be considered investment advice. The information presented here is for educational purposes only. Investment decisions should be based on individual circumstances and after consulting with a qualified financial advisor. The specifics of any Lion Links structure will vary, so it is critical to review the offering documents carefully before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lion Links 6/20/25 Explained: Risks And Potential Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maximize Your Fantasy Baseball Team Waiver Wire Targets From The D Backs Rockies Series

Jun 21, 2025

Maximize Your Fantasy Baseball Team Waiver Wire Targets From The D Backs Rockies Series

Jun 21, 2025 -

Maximize Your Fantasy Baseball Roster Waiver Wire Targets From The D Backs Rockies Matchup

Jun 21, 2025

Maximize Your Fantasy Baseball Roster Waiver Wire Targets From The D Backs Rockies Matchup

Jun 21, 2025 -

Colorado Suspects Familys Plea Suffering In Ice Custody

Jun 21, 2025

Colorado Suspects Familys Plea Suffering In Ice Custody

Jun 21, 2025 -

Gold Cup 2024 Jamaica And Guadeloupe To Clash Again

Jun 21, 2025

Gold Cup 2024 Jamaica And Guadeloupe To Clash Again

Jun 21, 2025 -

Karen Read Acquitted Again Key Takeaways From The Second Murder Trial

Jun 21, 2025

Karen Read Acquitted Again Key Takeaways From The Second Murder Trial

Jun 21, 2025

Latest Posts

-

Dodger Stadium Dispute Iranian Fears And Marijuana Risks Dominate Headlines

Jun 21, 2025

Dodger Stadium Dispute Iranian Fears And Marijuana Risks Dominate Headlines

Jun 21, 2025 -

Los Angeles Jd Vance Defends Troop Deployment

Jun 21, 2025

Los Angeles Jd Vance Defends Troop Deployment

Jun 21, 2025 -

The Shrinking Scope Of Juneteenth Examining The Impact Of Recent Policy Shifts

Jun 21, 2025

The Shrinking Scope Of Juneteenth Examining The Impact Of Recent Policy Shifts

Jun 21, 2025 -

Colorado Rockies Vs Arizona Diamondbacks Game Preview Betting Analysis And Predictions

Jun 21, 2025

Colorado Rockies Vs Arizona Diamondbacks Game Preview Betting Analysis And Predictions

Jun 21, 2025 -

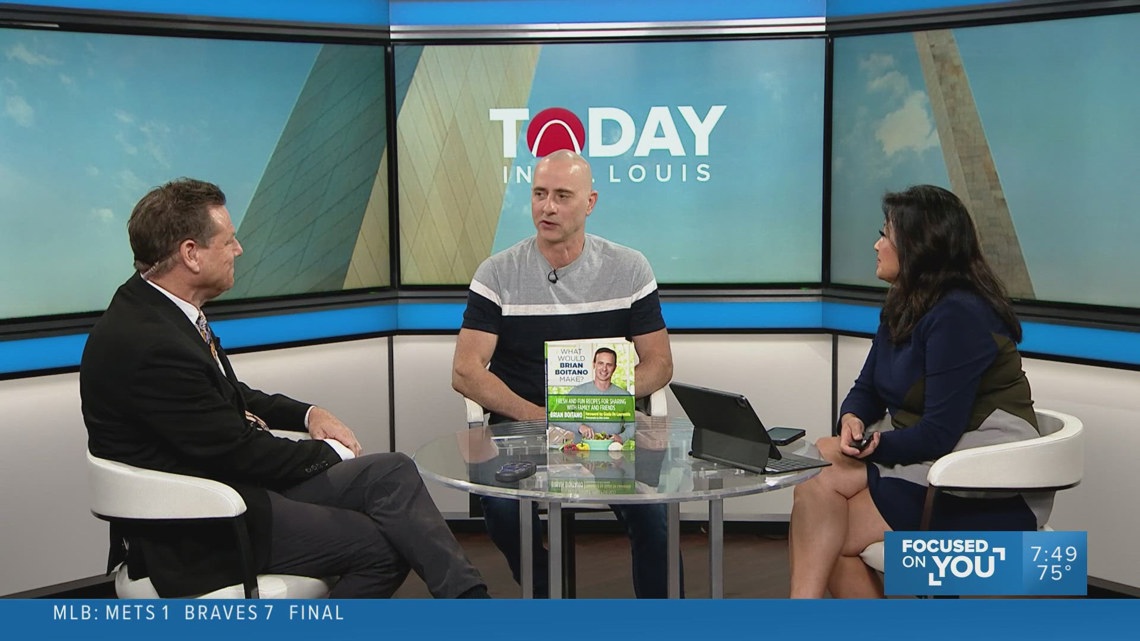

Today In St Louis Features Olympic Figure Skater Brian Boitano

Jun 21, 2025

Today In St Louis Features Olympic Figure Skater Brian Boitano

Jun 21, 2025