Lion Links 6/20/25: Risk Assessment And Expected Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lion Links 6/20/25: Risk Assessment and Expected Returns – A Comprehensive Analysis

June 20th, 2025 marked a pivotal moment for Lion Links, a significant player in the [Specify Industry: e.g., renewable energy, fintech, etc.] sector. Investors are keenly interested in understanding the inherent risks and potential returns associated with Lion Links' trajectory, particularly concerning their 6/20/25 bonds. This article provides a comprehensive analysis, aiming to clarify the situation for both seasoned investors and those new to the market.

Understanding Lion Links' Current Market Position:

Lion Links has experienced [Describe recent performance: e.g., substantial growth, a period of consolidation, a recent downturn] in recent months. Key factors contributing to this include [List 2-3 key factors: e.g., successful product launches, regulatory changes, market competition]. This dynamic landscape significantly impacts the risk profile of their 6/20/25 bonds.

Risk Assessment: Navigating the Uncertainties:

Investing in any bond carries inherent risk. For Lion Links' 6/20/25 bonds, we can identify several key risk factors:

- Interest Rate Risk: Fluctuations in interest rates directly impact bond prices. Rising rates generally lead to lower bond values. A detailed analysis of prevailing interest rate forecasts is crucial for assessing this risk. [Link to a relevant financial news source discussing interest rates]

- Credit Risk: This encompasses the possibility of Lion Links defaulting on its obligations. Analyzing their credit rating from agencies like Moody's, S&P, and Fitch is essential for gauging this risk. [Potentially link to a reputable credit rating agency]

- Market Risk: Broader market downturns can negatively affect even the most stable companies. Diversification within a portfolio can help mitigate this risk.

- Specific Company Risks: These are risks unique to Lion Links, such as dependence on key suppliers, technological disruptions, or intense competition within their industry. Further research into the company's financial statements and strategic plans is necessary.

Expected Returns: Balancing Risk and Reward:

The expected returns on Lion Links' 6/20/25 bonds are directly tied to the assessed risks. Several factors influence potential returns:

- Coupon Rate: The fixed interest payment Lion Links offers on these bonds is a primary component of the return. [Mention the coupon rate if available].

- Maturity Value: The repayment of the principal amount at maturity (6/20/25) constitutes another significant portion of the return.

- Potential for Capital Appreciation/Depreciation: Depending on market conditions and Lion Links' performance, the bond's market price could appreciate or depreciate before maturity.

Conclusion: Informed Investment Decisions:

Investing in Lion Links' 6/20/25 bonds requires a careful consideration of the interplay between risk and reward. Thorough due diligence, including a comprehensive review of their financial statements, industry analysis, and macroeconomic factors, is crucial before making any investment decision. Remember to consult with a qualified financial advisor to tailor investment strategies to your individual risk tolerance and financial goals.

Disclaimer: This article provides general information and analysis and does not constitute financial advice. Investment decisions should be made based on independent research and professional guidance. Past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lion Links 6/20/25: Risk Assessment And Expected Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Milliet Determined To End Strong Ahead Of International Duty

Jun 21, 2025

Milliet Determined To End Strong Ahead Of International Duty

Jun 21, 2025 -

Discuss Matchday 7 Of The 2025 Gold Cup Live Thread

Jun 21, 2025

Discuss Matchday 7 Of The 2025 Gold Cup Live Thread

Jun 21, 2025 -

Actress Ali Larter Faces Backlash Defends Controversial Landman Role

Jun 21, 2025

Actress Ali Larter Faces Backlash Defends Controversial Landman Role

Jun 21, 2025 -

Lion Links 6 20 25 Practical Applications And Interpretations

Jun 21, 2025

Lion Links 6 20 25 Practical Applications And Interpretations

Jun 21, 2025 -

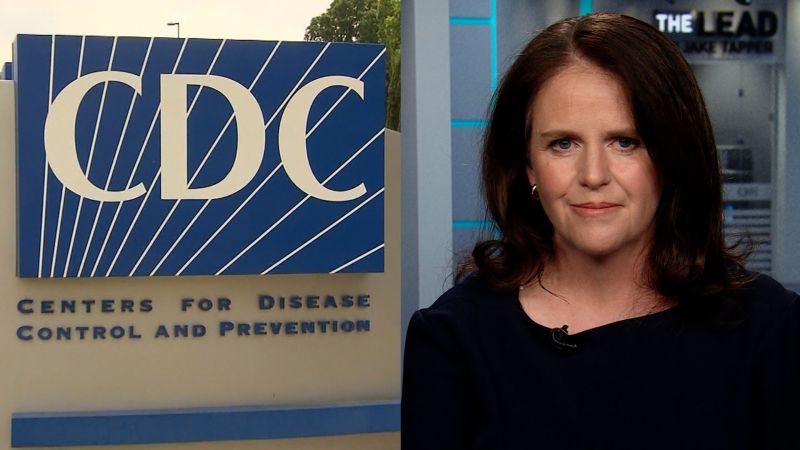

Exclusive Infectious Disease Specialist Details Reasons Behind Cdc Departure

Jun 21, 2025

Exclusive Infectious Disease Specialist Details Reasons Behind Cdc Departure

Jun 21, 2025

Latest Posts

-

Life Under Fear In Iran Todays News Also Covers The Dodger Stadium Dispute

Jun 22, 2025

Life Under Fear In Iran Todays News Also Covers The Dodger Stadium Dispute

Jun 22, 2025 -

Fourth Of July Weekend Summer Travel Demand To Surge

Jun 22, 2025

Fourth Of July Weekend Summer Travel Demand To Surge

Jun 22, 2025 -

Beyond Words Taking Action To Support Black Communities

Jun 22, 2025

Beyond Words Taking Action To Support Black Communities

Jun 22, 2025 -

Obama On Us Politics A Dangerous Drift Towards Autocratic Rule

Jun 22, 2025

Obama On Us Politics A Dangerous Drift Towards Autocratic Rule

Jun 22, 2025 -

Higher Education Students Advised To Anticipate Discomforting Course Material

Jun 22, 2025

Higher Education Students Advised To Anticipate Discomforting Course Material

Jun 22, 2025