LMB Investment Report: Q3 2023 Market Analysis And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

LMB Investment Report: Q3 2023 Market Analysis and Predictions – Navigating a Turbulent Landscape

The third quarter of 2023 presented a complex and volatile investment landscape. Geopolitical uncertainties, persistent inflation, and fluctuating interest rates left many investors questioning their strategies. LMB's latest investment report provides a comprehensive analysis of Q3 2023, offering insights and predictions to help navigate this challenging market.

Key Findings from the LMB Q3 2023 Investment Report:

This quarter saw a mixed bag of performance across various asset classes. While some sectors experienced growth, others faced significant headwinds. Our analysis reveals several key trends:

-

Inflation Remains a Concern: Despite some easing, inflation continues to be a major factor influencing monetary policy and impacting investment returns. Central banks remain cautious, suggesting interest rates may stay elevated for longer than initially anticipated. This has implications for bond yields and the overall cost of capital. Learn more about the impact of inflation on your portfolio by reading our article on .

-

Geopolitical Instability: The ongoing geopolitical situation continues to create uncertainty in the markets. Supply chain disruptions and energy price volatility remain significant risks, impacting various sectors and impacting global economic growth.

-

Tech Sector Volatility: The technology sector, a key driver of market performance in previous years, experienced a period of consolidation and correction in Q3. While some tech giants showed resilience, others faced significant challenges. Understanding the nuances of this sector is crucial for effective portfolio management.

-

Emerging Markets Show Resilience: Despite global headwinds, certain emerging markets demonstrated surprising resilience, offering potentially attractive investment opportunities for diversified portfolios. However, careful due diligence and risk assessment remain paramount.

LMB's Q3 2023 Market Predictions:

Based on our rigorous analysis, LMB offers the following predictions for the remainder of the year and into 2024:

-

Interest Rate Hikes to Continue (but at a Slower Pace): We anticipate further interest rate hikes, albeit at a more measured pace than earlier in the year. This suggests a potential stabilization, but not a complete reversal, of current monetary policies.

-

Continued Volatility in Equity Markets: Expect continued fluctuations in equity markets as investors grapple with economic uncertainty and corporate earnings reports. Diversification and a long-term investment strategy remain crucial.

-

Opportunities in Value Investing: The current market environment may present attractive opportunities for value investors, particularly in sectors that have been undervalued due to market sentiment.

-

Focus on Sustainable and ESG Investments: The demand for sustainable and environmentally, socially, and governance (ESG)-conscious investments continues to grow. This trend is expected to drive innovation and investment opportunities in the renewable energy and sustainable technology sectors.

Actionable Insights for Investors:

The LMB Q3 2023 Investment Report emphasizes the importance of:

- Diversification: Spread your investments across different asset classes to mitigate risk.

- Long-term Perspective: Avoid making impulsive decisions based on short-term market fluctuations.

- Professional Advice: Consider seeking advice from a qualified financial advisor to tailor your investment strategy to your individual needs and risk tolerance.

Download the Full LMB Q3 2023 Investment Report:

For a complete and detailed analysis, download the full LMB Q3 2023 Investment Report . This report provides in-depth insights, charts, and data to help you make informed investment decisions. Don't miss out on this valuable resource!

Disclaimer: This article provides general market commentary and does not constitute investment advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on LMB Investment Report: Q3 2023 Market Analysis And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Human Ai Coexistence The Waymo Robotaxi Experience

Jun 28, 2025

Human Ai Coexistence The Waymo Robotaxi Experience

Jun 28, 2025 -

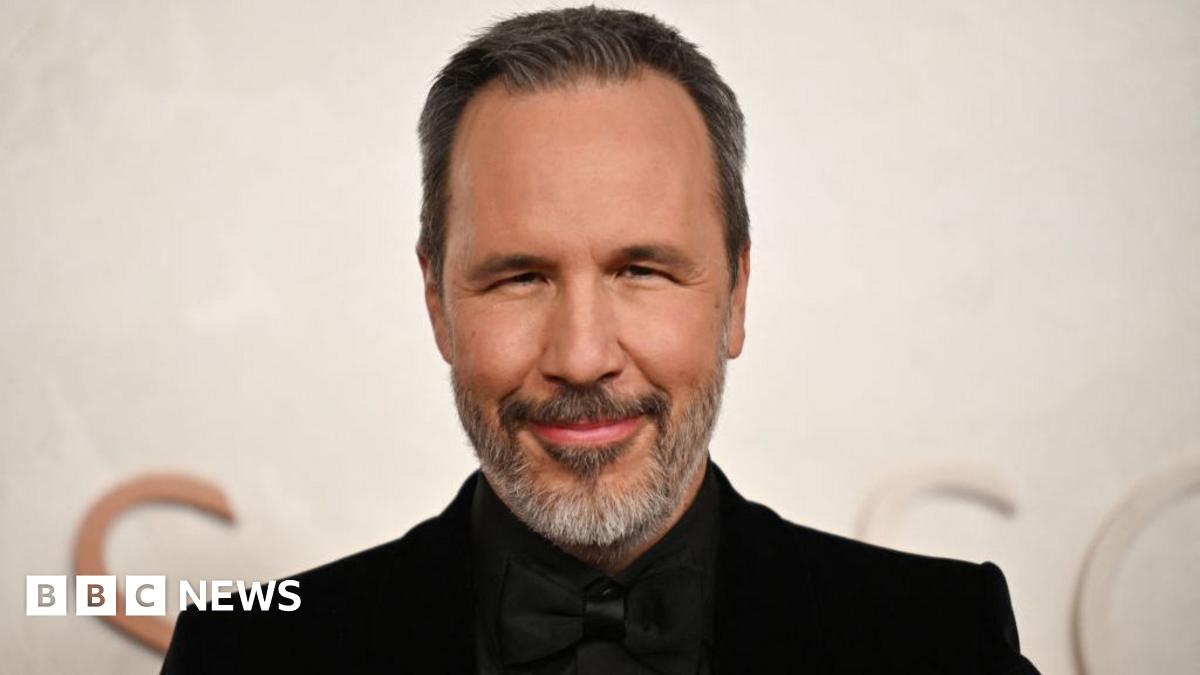

Could Denis Villeneuve Direct The Next James Bond Movie

Jun 28, 2025

Could Denis Villeneuve Direct The Next James Bond Movie

Jun 28, 2025 -

Newspaper Headlines Target Starmer A Deeper Look At The Denial And Russia Allegations

Jun 28, 2025

Newspaper Headlines Target Starmer A Deeper Look At The Denial And Russia Allegations

Jun 28, 2025 -

Wembley Wow Dua Lipas Stage Presence Cant Save Her New Album

Jun 28, 2025

Wembley Wow Dua Lipas Stage Presence Cant Save Her New Album

Jun 28, 2025 -

Synthetic Human Genome Project What It Means For Medicine And Humanity

Jun 28, 2025

Synthetic Human Genome Project What It Means For Medicine And Humanity

Jun 28, 2025

Latest Posts

-

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025 -

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025 -

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025 -

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025 -

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025