LMB Stock: Is Limbach Company A Buy Today?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

LMB Stock: Is Limbach Company a Buy Today? A Deep Dive into the HVAC Construction Sector

The construction sector, particularly within specialized niches, presents unique investment opportunities. Limbach Holdings, Inc. (LMB), a leading provider of mechanical, electrical, and plumbing (MEP) construction services, including HVAC systems, has caught the attention of investors. But is LMB stock a buy today? Let's delve into the company's performance, prospects, and potential risks to help you make an informed decision.

Understanding Limbach Holdings, Inc. (LMB)

Limbach Holdings, Inc. focuses on the design, engineering, procurement, and construction of complex HVAC and other building systems for commercial, industrial, and institutional clients. They operate primarily in North America, serving a diverse range of sectors including healthcare, data centers, and higher education. This specialization positions them within a relatively stable, albeit cyclical, market.

Recent Performance and Key Financials:

LMB's recent performance has been a mixed bag. While the company has shown signs of growth in certain areas, investors should carefully analyze recent quarterly reports and financial statements for a comprehensive understanding of their financial health. Key metrics to consider include:

- Revenue Growth: Examine the trend of revenue growth over the past few quarters and years. Is it consistent, accelerating, or decelerating?

- Profitability: Analyze profit margins, return on equity (ROE), and other profitability indicators to assess the company's efficiency and earning power.

- Debt Levels: High levels of debt can pose a significant risk. Assess Limbach's debt-to-equity ratio and its ability to service its debt obligations.

- Backlog: A strong backlog of future projects indicates a healthy pipeline and potential for future revenue growth. This is a crucial metric for companies in the construction industry.

Factors Influencing LMB Stock Price:

Several factors can significantly influence LMB's stock price:

- Industry Trends: The overall health of the construction industry, particularly the HVAC sector, plays a crucial role. Economic downturns or shifts in government regulations can impact demand.

- Competition: Limbach faces competition from other MEP contractors. Their ability to differentiate their services and secure contracts is essential.

- Project Execution: Successful project execution, on time and within budget, is critical for maintaining profitability and client satisfaction.

- Supply Chain Issues: The ongoing challenges related to supply chain disruptions can impact project costs and timelines.

Risks to Consider:

Before investing in LMB stock, it's essential to acknowledge potential risks:

- Economic Slowdown: A general economic slowdown could significantly reduce demand for construction services.

- Project Delays and Cost Overruns: Unforeseen delays or cost overruns on projects can negatively impact profitability.

- Competition: Intense competition from larger and more established players could pressure margins.

Is LMB Stock a Buy Today?

The question of whether LMB stock is a buy today depends on your individual investment strategy, risk tolerance, and market outlook. Conduct thorough due diligence, including reviewing financial statements, analyst reports, and industry trends. Consider consulting with a qualified financial advisor to assess if LMB aligns with your investment goals.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and you could lose money. Always conduct your own thorough research before making any investment decisions.

Further Research:

For more in-depth information, consider visiting the Limbach Holdings, Inc. investor relations website and reviewing financial news sources for the latest updates on the company and the construction industry. You can also find valuable information from financial analysis websites like Yahoo Finance and Google Finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on LMB Stock: Is Limbach Company A Buy Today?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

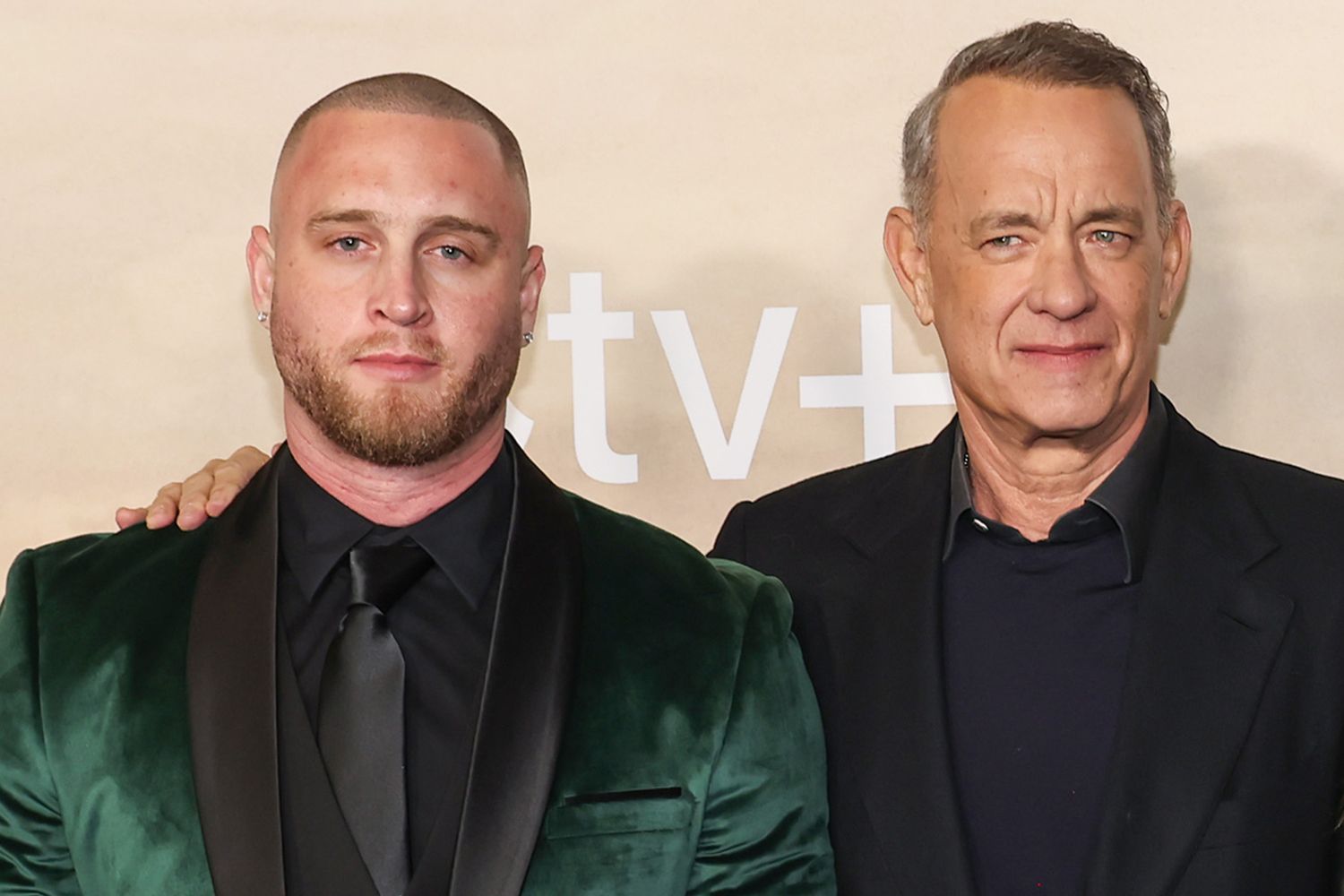

Tom Hanks Son Chet Shares Story Of Dads On Set Diva Behavior

Jun 28, 2025

Tom Hanks Son Chet Shares Story Of Dads On Set Diva Behavior

Jun 28, 2025 -

Former Nfl Player Uses Psychedelics To Treat Ocd Before Retirement

Jun 28, 2025

Former Nfl Player Uses Psychedelics To Treat Ocd Before Retirement

Jun 28, 2025 -

Dua Lipa And Charli Xcxs Surprise Collaboration Rocks Sold Out Show

Jun 28, 2025

Dua Lipa And Charli Xcxs Surprise Collaboration Rocks Sold Out Show

Jun 28, 2025 -

Ecuadorian Authorities Capture Fugitive Gang Leader Fito Cnn Video Shows Arrest

Jun 28, 2025

Ecuadorian Authorities Capture Fugitive Gang Leader Fito Cnn Video Shows Arrest

Jun 28, 2025 -

Dua Lipas Wembley Performance A Glittering Show But A Disappointing Album

Jun 28, 2025

Dua Lipas Wembley Performance A Glittering Show But A Disappointing Album

Jun 28, 2025

Latest Posts

-

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025

Man City Vs Chelsea Comparing Fifa Club World Cup Winnings

Jun 30, 2025 -

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025

Despite Legal Warnings Budapest Pride Holds Event

Jun 30, 2025 -

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025

Your Guide To The 2025 Fifa Club World Cup Schedule And Results

Jun 30, 2025 -

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025

Cnn Unveils 2025s Best Town Why Its A Must See

Jun 30, 2025 -

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025

Revelan El Motivo Por Que Las Hijas De Icardi Rechazan Convivir Con Eugenia Suarez

Jun 30, 2025