Lockheed Martin Stock Investment: A 20-Year Performance Review

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lockheed Martin Stock Investment: A 20-Year Performance Review – Was it Worth It?

Lockheed Martin (LMT), a global security and aerospace company, has long been a favorite among investors seeking steady, long-term growth. But how has a 20-year investment in Lockheed Martin stock actually performed? This in-depth analysis explores the company's stock performance over the past two decades, examining key factors influencing its growth and considering whether it remains a sound investment for the future.

The Rollercoaster Ride of the Last Two Decades:

Investing in any stock, especially over a long period, involves navigating market fluctuations. The last 20 years have presented their share of economic ups and downs, including the 2008 financial crisis and the recent COVID-19 pandemic. Understanding how Lockheed Martin weathered these storms is crucial in assessing its long-term viability.

To truly understand the performance, we need to look beyond simple percentage gains. We need to consider factors like:

- Dividend Reinvestment: Lockheed Martin has a history of paying dividends. For many investors, reinvesting these dividends compounds returns significantly over the long term. Factoring dividend reinvestment into the calculation paints a more complete picture of total return. [Link to a reputable financial resource on dividend reinvestment].

- Inflation Adjustment: A 100% return over 20 years might sound impressive, but inflation erodes purchasing power. Adjusting for inflation provides a more realistic view of the real growth experienced. [Link to a reliable inflation calculator].

- Market Comparison: Comparing Lockheed Martin's performance to the broader market (e.g., the S&P 500) helps determine if it outperformed or underperformed comparable investments. This benchmark comparison offers valuable context. [Link to a reputable financial index website].

Key Factors Influencing Lockheed Martin's Stock Performance:

Several key factors contributed to Lockheed Martin's performance over the last 20 years:

- Government Contracts: As a major defense contractor, Lockheed Martin's revenue is heavily reliant on government contracts. Changes in defense spending, both domestically and internationally, directly impact the company's profitability and stock price.

- Technological Innovation: The company's investment in research and development (R&D) plays a crucial role in securing future contracts and maintaining a competitive edge. Innovation in areas like aerospace, missile defense, and cybersecurity is vital to its long-term success.

- Global Political Climate: Geopolitical instability and international conflicts often lead to increased demand for defense systems, positively affecting Lockheed Martin's financial performance. However, periods of relative peace can result in decreased demand.

- Economic Conditions: Overall economic health impacts both government spending and consumer confidence, which in turn influences investor sentiment towards Lockheed Martin stock.

Analyzing the Data (Illustrative Example):

Let's assume, for illustrative purposes, that an investment of $10,000 in Lockheed Martin stock 20 years ago resulted in a current value of $30,000, including dividend reinvestment. While this represents a 200% nominal gain, adjusting for inflation and comparing it to the S&P 500 performance over the same period provides a more accurate assessment of its success. (Specific data analysis should be conducted using reliable financial data sources).

Looking Ahead: Future Outlook and Investment Considerations:

While past performance doesn't guarantee future results, Lockheed Martin's position in the defense industry, coupled with its ongoing technological advancements, suggests continued growth potential. However, investors should carefully consider the risks associated with its reliance on government contracts and the impact of shifting geopolitical landscapes.

Conclusion:

A 20-year investment in Lockheed Martin stock has likely delivered a positive return for many investors, although the actual performance would vary based on the specific investment timing and the inclusion of dividend reinvestment. A thorough analysis, incorporating inflation adjustment and market comparison, is crucial for a comprehensive understanding of its long-term performance. Future performance will depend on various factors, including government spending, technological innovation, and global political stability. Prospective investors should conduct their own thorough due diligence before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lockheed Martin Stock Investment: A 20-Year Performance Review. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Students Urged To Prepare For Potentially Offensive Content In University Courses

Jun 22, 2025

Students Urged To Prepare For Potentially Offensive Content In University Courses

Jun 22, 2025 -

Long Term Lockheed Martin Stock Investment A 20 Year Growth Examination

Jun 22, 2025

Long Term Lockheed Martin Stock Investment A 20 Year Growth Examination

Jun 22, 2025 -

Lockheed Martin Stock Lmt First American Banks Increased Investment Signals Confidence

Jun 22, 2025

Lockheed Martin Stock Lmt First American Banks Increased Investment Signals Confidence

Jun 22, 2025 -

Storm Dominate Sparks In Absence Of Key Player Kelsey Plum

Jun 22, 2025

Storm Dominate Sparks In Absence Of Key Player Kelsey Plum

Jun 22, 2025 -

Ex Mlb Player Cozart No Trump Support If War Begins

Jun 22, 2025

Ex Mlb Player Cozart No Trump Support If War Begins

Jun 22, 2025

Latest Posts

-

Iran Links Diplomacy To Halt In Israeli Aggression

Jun 22, 2025

Iran Links Diplomacy To Halt In Israeli Aggression

Jun 22, 2025 -

Trump Dominates The Narrative A Look At The Nato Summit

Jun 22, 2025

Trump Dominates The Narrative A Look At The Nato Summit

Jun 22, 2025 -

Revealed The Inspiration For Machine Gun Kellys Daughters Name

Jun 22, 2025

Revealed The Inspiration For Machine Gun Kellys Daughters Name

Jun 22, 2025 -

A Punto De La Guerra El Analisis De La Decision De Trump Sobre Iran

Jun 22, 2025

A Punto De La Guerra El Analisis De La Decision De Trump Sobre Iran

Jun 22, 2025 -

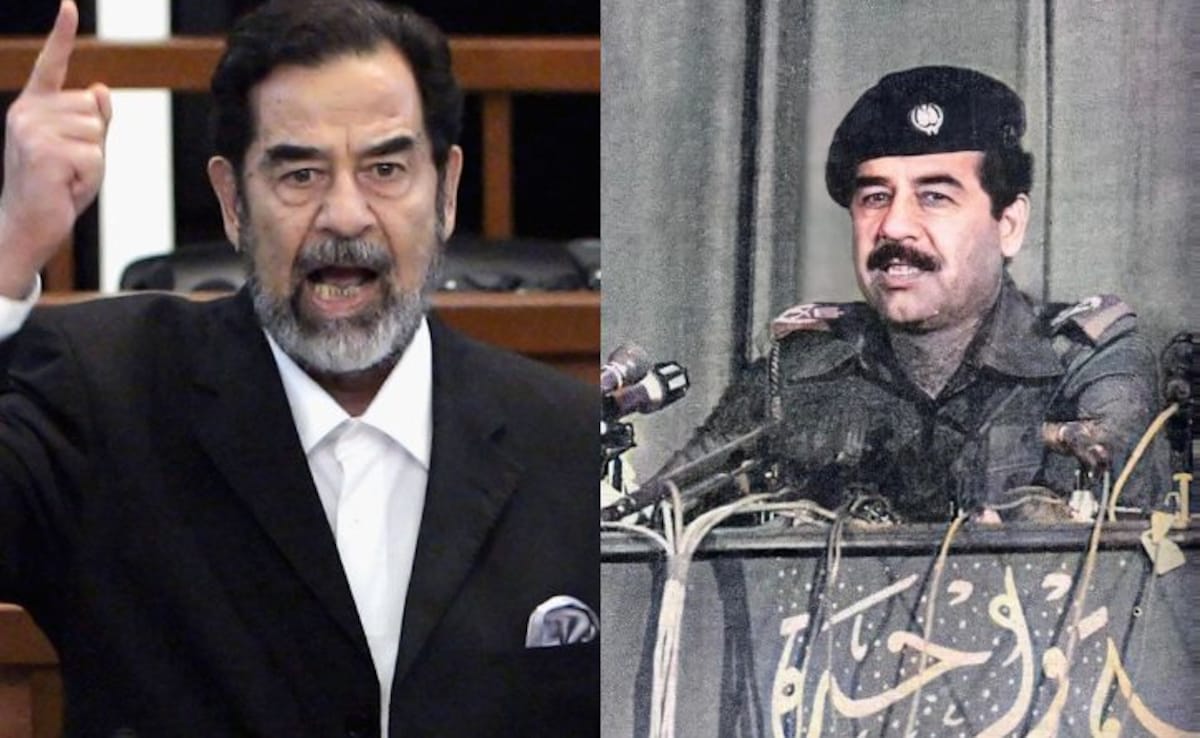

Mossads Failed Saddam Hussein Plot Operation Bramble Bush And Its Deadly Consequences

Jun 22, 2025

Mossads Failed Saddam Hussein Plot Operation Bramble Bush And Its Deadly Consequences

Jun 22, 2025