Lockheed Martin Stock Investment: Examining Two Decades Of Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lockheed Martin Stock Investment: Examining Two Decades of Growth

Lockheed Martin (LMT), a titan in the aerospace and defense industry, has captivated investors for decades with its consistent growth and robust dividend payouts. But how has a long-term investment in Lockheed Martin fared over the past two decades? This in-depth analysis examines the company's performance, considering factors that influenced its stock price and offering insights for potential investors.

Two Decades of Performance: A Rollercoaster Ride with Positive Returns

Investing in Lockheed Martin over the past 20 years hasn't been a smooth, straight line. Like any stock, LMT has experienced periods of significant growth alongside market corrections and economic downturns. However, the overall trend paints a picture of impressive long-term value creation.

To truly understand the scope of this growth, we need to look beyond simple percentage increases. We must consider factors like:

- Dividend Reinvestment: Lockheed Martin has a history of consistent dividend payments, allowing investors to reinvest their dividends and compound their returns over time. This compounding effect significantly boosts long-term returns. [Link to Lockheed Martin Investor Relations Dividend History]

- Stock Splits: Stock splits can impact the perceived price per share but don't inherently change the overall value of an investment. Understanding the historical split adjusted price is crucial for accurate assessment.

- Market Comparisons: Comparing Lockheed Martin's performance against relevant industry benchmarks and broader market indices (like the S&P 500) offers a clearer perspective on its relative success.

Key Factors Influencing Lockheed Martin's Growth:

Several factors have contributed to Lockheed Martin's long-term success:

- Government Contracts: A significant portion of Lockheed Martin's revenue stems from government contracts, primarily from the U.S. Department of Defense. This consistent stream of revenue provides a level of stability not found in many other sectors. However, it also makes the company susceptible to changes in government spending and defense budgets.

- Technological Innovation: Lockheed Martin's commitment to research and development (R&D) has positioned it at the forefront of aerospace and defense technology. This innovation drives new product development and secures future contracts.

- International Expansion: The company's global reach expands its market opportunities beyond the United States, mitigating reliance on a single market.

- Strategic Acquisitions: Strategic acquisitions have broadened Lockheed Martin's product portfolio and strengthened its market position.

H2: Risks to Consider

While the long-term outlook for Lockheed Martin is generally positive, investors should be aware of potential risks:

- Geopolitical Uncertainty: Global political instability and conflicts can impact defense spending and create uncertainty in the market.

- Competition: The aerospace and defense industry is competitive, with several major players vying for contracts and market share.

- Economic Downturns: Recessions can lead to reduced government spending on defense, impacting Lockheed Martin's revenue.

H2: Looking Ahead: Future Prospects for Lockheed Martin

Despite these risks, the long-term outlook for Lockheed Martin remains strong. The company's continued investment in R&D, its diverse portfolio of products and services, and its strong international presence position it for continued growth. The increasing global demand for advanced defense systems also bodes well for the company's future.

Conclusion: A Solid, Long-Term Investment?

Investing in Lockheed Martin over the past two decades would have yielded substantial returns, particularly when considering dividend reinvestment. However, past performance is not indicative of future results. Potential investors should conduct thorough due diligence, considering the inherent risks alongside the long-term growth potential before making any investment decisions. Consult with a financial advisor to determine if Lockheed Martin aligns with your individual investment strategy and risk tolerance.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lockheed Martin Stock Investment: Examining Two Decades Of Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Vote Uk Parliament Backs Assisted Dying Bill

Jun 22, 2025

Historic Vote Uk Parliament Backs Assisted Dying Bill

Jun 22, 2025 -

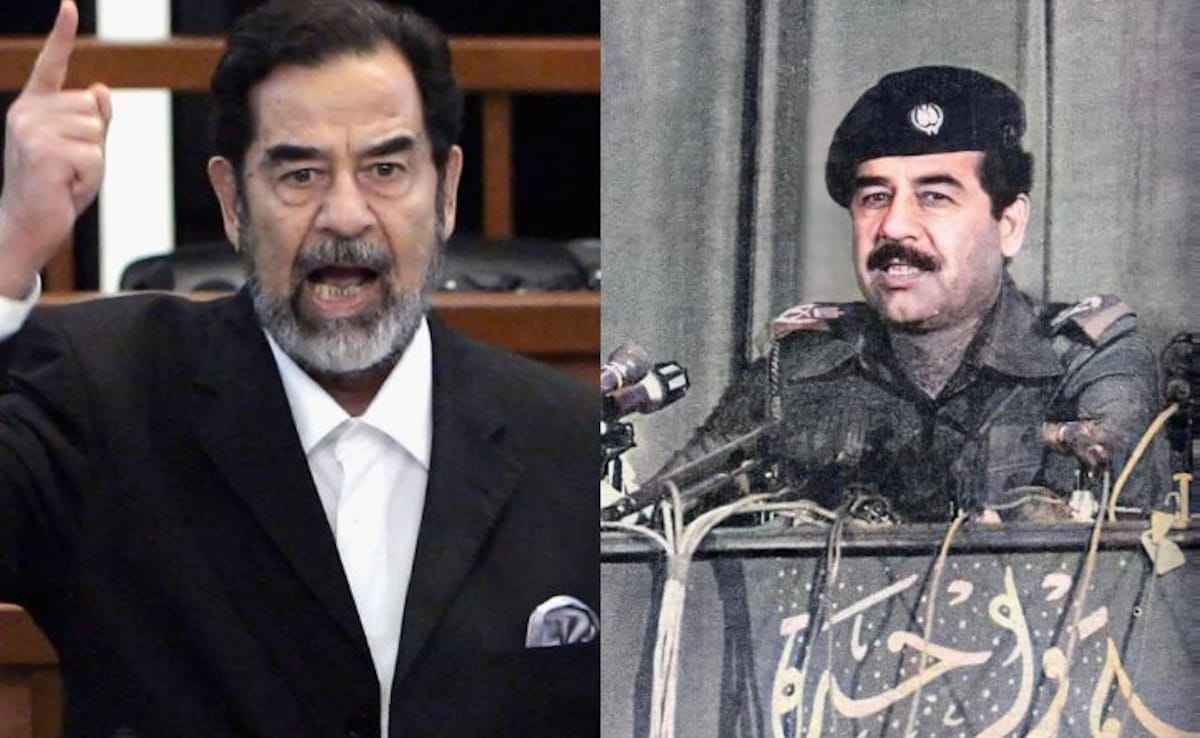

Bramble Bush Mossads Failed Attempt To Assassinate Saddam Hussein

Jun 22, 2025

Bramble Bush Mossads Failed Attempt To Assassinate Saddam Hussein

Jun 22, 2025 -

Assisted Dying A Look At Recent Legal Victories And Ongoing Challenges

Jun 22, 2025

Assisted Dying A Look At Recent Legal Victories And Ongoing Challenges

Jun 22, 2025 -

Orlando Pride Starting Lineup Road Trip To Face Racing Louisville

Jun 22, 2025

Orlando Pride Starting Lineup Road Trip To Face Racing Louisville

Jun 22, 2025 -

Storm Dominates Sparks In Blowout Victory Kelsey Plums Impact Missed

Jun 22, 2025

Storm Dominates Sparks In Blowout Victory Kelsey Plums Impact Missed

Jun 22, 2025

Latest Posts

-

Increased Radiation Monitoring In Qatar Response To Israeli Strikes On Irans Nuclear Program

Jun 22, 2025

Increased Radiation Monitoring In Qatar Response To Israeli Strikes On Irans Nuclear Program

Jun 22, 2025 -

Conflicto En Oriente Proximo Desarrollo Del Ataque De Eeuu A Las Instalaciones Nucleares De Iran

Jun 22, 2025

Conflicto En Oriente Proximo Desarrollo Del Ataque De Eeuu A Las Instalaciones Nucleares De Iran

Jun 22, 2025 -

From The Set Of Jaws A Photo Journey

Jun 22, 2025

From The Set Of Jaws A Photo Journey

Jun 22, 2025 -

Telegram Ceo Pavel Durov Will Divide Estate Among Over 100 Children

Jun 22, 2025

Telegram Ceo Pavel Durov Will Divide Estate Among Over 100 Children

Jun 22, 2025 -

50 Years Of Jaws The Enduring Legacy Of A Summer Blockbuster

Jun 22, 2025

50 Years Of Jaws The Enduring Legacy Of A Summer Blockbuster

Jun 22, 2025