Lockheed Martin Stock Performance: 20-Year Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lockheed Martin Stock Performance: A 20-Year Investment Analysis

Lockheed Martin (LMT), a titan in the aerospace and defense industry, has long been a consideration for long-term investors. But how has the company performed over the past two decades? This in-depth analysis examines Lockheed Martin's stock performance over the last 20 years, providing insights for potential investors considering a long-term position.

A Giant in Defense: Understanding Lockheed Martin's Position

Before diving into the numbers, it's crucial to understand Lockheed Martin's place in the global market. The company is a major player in the defense industry, providing a diverse range of products and services to both the U.S. government and international clients. This includes advanced fighter jets like the F-35, missile defense systems, and various space exploration technologies. This diversified portfolio contributes to its relative stability, even during periods of economic uncertainty. Understanding this underlying strength is key to interpreting its long-term stock performance.

20-Year Stock Performance: The Numbers Tell the Story

Analyzing Lockheed Martin's stock performance requires a multifaceted approach. Simply looking at the closing price isn't sufficient; we need to consider factors like dividends, stock splits, and the overall market performance during the same period.

-

Growth: While precise figures fluctuate based on the exact start and end dates chosen, Lockheed Martin's stock price has generally shown significant growth over the past 20 years. This growth hasn't been linear; there have been periods of stagnation and even decline, reflecting broader market trends and specific company challenges. Access to historical stock data through reputable financial websites like and allows for a more detailed personal analysis.

-

Dividends: Lockheed Martin has a history of paying consistent dividends to its shareholders. This regular dividend income adds another layer to the overall return on investment, making it a potentially attractive option for income-seeking investors. Analyzing the dividend payout history alongside price appreciation gives a more complete picture of total return.

-

Market Comparison: It's crucial to compare Lockheed Martin's performance against relevant market indices, such as the S&P 500. This comparison provides context, illustrating whether LMT outperformed or underperformed the broader market during the period. A superior performance relative to the market indicates a strong investment.

Factors Influencing Lockheed Martin's Stock Price:

Several key factors have influenced Lockheed Martin's stock price over the past two decades:

-

Government Spending: Changes in U.S. defense budgets have a direct impact on Lockheed Martin's revenue and profitability. Increased defense spending generally translates to higher stock prices, while budget cuts can have the opposite effect.

-

International Relations: Global geopolitical events and international relations significantly influence demand for Lockheed Martin's products. Periods of heightened global tensions often lead to increased demand and higher stock prices.

-

Technological Advancements: Lockheed Martin's ability to innovate and develop cutting-edge technologies is vital to its long-term success. Investments in research and development (R&D) are crucial to maintaining a competitive edge and driving future growth.

Is Lockheed Martin a Good Long-Term Investment?

Whether Lockheed Martin is a suitable long-term investment for you depends on your individual risk tolerance, investment goals, and financial situation. The historical data suggests significant potential for growth, particularly when factoring in dividend payouts. However, it's essential to remember that past performance is not indicative of future results. The defense industry is subject to cyclical trends and geopolitical uncertainties, introducing inherent risk.

Conclusion: Due Diligence is Key

This analysis provides a high-level overview of Lockheed Martin's 20-year stock performance. For a comprehensive investment decision, prospective investors should conduct thorough due diligence, including analyzing financial statements, reviewing industry reports, and consulting with a qualified financial advisor. Remember, responsible investing involves understanding the risks involved. Consider diversifying your portfolio to mitigate potential losses.

Disclaimer: This article provides informational purposes only and is not financial advice. Consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lockheed Martin Stock Performance: 20-Year Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Estados Unidos Bombardea Tres Sitios Nucleares En Iran Detalles Del Ataque

Jun 22, 2025

Estados Unidos Bombardea Tres Sitios Nucleares En Iran Detalles Del Ataque

Jun 22, 2025 -

Israel Iran Conflict How The War Impacts Qatars Foreign Policy

Jun 22, 2025

Israel Iran Conflict How The War Impacts Qatars Foreign Policy

Jun 22, 2025 -

Crackdown On Palestine Action Group To Be Banned Post Raf Base Infiltration

Jun 22, 2025

Crackdown On Palestine Action Group To Be Banned Post Raf Base Infiltration

Jun 22, 2025 -

Former Mlb Player To Withdraw Support For Trump Over Potential War

Jun 22, 2025

Former Mlb Player To Withdraw Support For Trump Over Potential War

Jun 22, 2025 -

Estados Unidos Ataca Iran Ultimas Noticias Y Desarrollo Del Conflicto En Oriente Medio

Jun 22, 2025

Estados Unidos Ataca Iran Ultimas Noticias Y Desarrollo Del Conflicto En Oriente Medio

Jun 22, 2025

Latest Posts

-

Unlocking Two Decades Of Lockheed Martin Stock Returns A Comprehensive Look

Jun 22, 2025

Unlocking Two Decades Of Lockheed Martin Stock Returns A Comprehensive Look

Jun 22, 2025 -

Exploring The Subgenres Of Romantasy From Paranormal To Mythical

Jun 22, 2025

Exploring The Subgenres Of Romantasy From Paranormal To Mythical

Jun 22, 2025 -

Romantasys Growing Popularity A Look At The Current Market

Jun 22, 2025

Romantasys Growing Popularity A Look At The Current Market

Jun 22, 2025 -

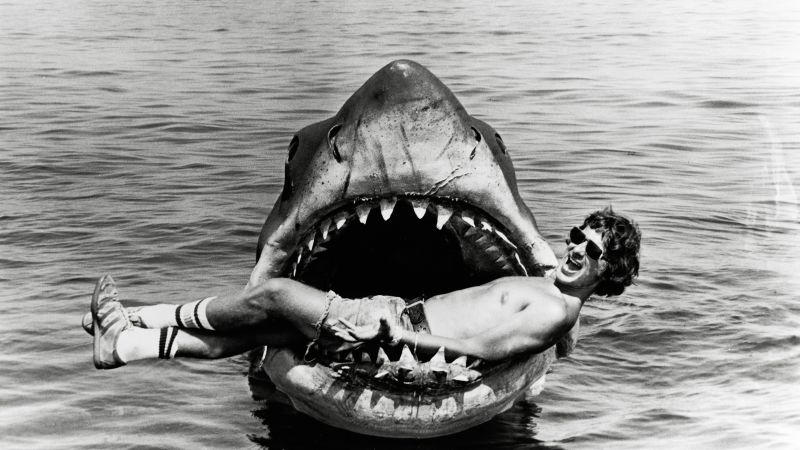

Jaws Unseen Photos From The Set Reveal Production Challenges

Jun 22, 2025

Jaws Unseen Photos From The Set Reveal Production Challenges

Jun 22, 2025 -

Meaning Behind Machine Gun Kellys Daughters Name An Exclusive Look

Jun 22, 2025

Meaning Behind Machine Gun Kellys Daughters Name An Exclusive Look

Jun 22, 2025