Lockheed Martin Stock Performance: 20-Year Return Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lockheed Martin Stock Performance: A 20-Year Return Analysis

Lockheed Martin (LMT), a global security and aerospace company, has long been a staple in many investment portfolios. But how has its stock performed over the long term? This in-depth analysis examines Lockheed Martin's stock performance over the past 20 years, providing insights into its growth, volatility, and potential for future returns. Understanding this historical performance is crucial for investors considering adding LMT to their portfolios or assessing their existing holdings.

A Look Back: Two Decades of Lockheed Martin Stock

Analyzing Lockheed Martin's stock performance requires considering various factors beyond simply looking at the raw numbers. We'll delve into key metrics to paint a complete picture of its 20-year trajectory.

Key Performance Indicators (KPIs) over 20 Years:

To accurately assess LMT's performance, we need to examine several KPIs:

-

Annualized Return: This metric provides a clear picture of the average annual growth of the investment over the 20-year period. We'll analyze data from reputable financial sources to calculate this crucial figure, factoring in dividend reinvestment for a complete representation of returns.

-

Volatility: The stock market is inherently volatile. We'll examine LMT's historical volatility, measured by metrics like standard deviation, to understand the risk associated with investing in the company. High volatility generally indicates higher risk and potential for both significant gains and losses.

-

Dividend Growth: Lockheed Martin has a history of paying dividends. We'll analyze the growth of these dividends over the past 20 years, providing insights into the company's commitment to returning value to shareholders. Consistent dividend growth is a positive indicator for long-term investors.

-

Comparison to Market Benchmarks: How has Lockheed Martin's stock performed compared to broader market indices like the S&P 500? This comparative analysis helps determine if LMT has outperformed or underperformed the market as a whole.

Factors Influencing Lockheed Martin's Stock Performance:

Several factors significantly influence Lockheed Martin's stock performance:

-

Government Spending: As a major defense contractor, LMT's revenue is heavily reliant on government contracts. Changes in defense budgets, both domestically and internationally, directly impact the company's financial performance and, consequently, its stock price.

-

Geopolitical Events: Global instability and conflicts often lead to increased demand for defense products, positively affecting LMT's revenue and stock price. Conversely, periods of relative peace can lead to reduced demand.

-

Technological Innovation: Lockheed Martin's success depends on its ability to innovate and develop cutting-edge technology. Its investments in research and development directly impact its long-term competitive advantage and stock performance.

-

Economic Conditions: Broader economic factors, such as inflation and interest rates, also influence investor sentiment towards LMT and its stock price.

Analyzing the Data: What the Numbers Reveal

(This section will contain specific data points on the KPIs mentioned above. Due to the dynamic nature of stock prices, these data points would need to be sourced from reliable financial data providers just before publishing the article.)

For example: "Our analysis reveals an annualized return of X% over the past 20 years, significantly outperforming the S&P 500's average return of Y% during the same period. However, the stock exhibited a standard deviation of Z%, indicating a moderate level of volatility."

Conclusion: Investing in Lockheed Martin

Investing in any stock, including Lockheed Martin, involves risk. While the past 20 years have shown promising returns, future performance is not guaranteed. This analysis provides a historical perspective to inform your investment decisions. It's crucial to conduct thorough due diligence, considering your personal risk tolerance and investment goals before making any investment decisions. Consult with a qualified financial advisor for personalized advice.

Further Research:

- [Link to Lockheed Martin Investor Relations Website]

- [Link to a reputable financial news source]

Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lockheed Martin Stock Performance: 20-Year Return Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ghost Particle Hunt Uncovers Strange Signals From Antarctic Ice Sheet

Jun 22, 2025

Ghost Particle Hunt Uncovers Strange Signals From Antarctic Ice Sheet

Jun 22, 2025 -

Higher Education Students Advised To Anticipate Discomforting Course Material

Jun 22, 2025

Higher Education Students Advised To Anticipate Discomforting Course Material

Jun 22, 2025 -

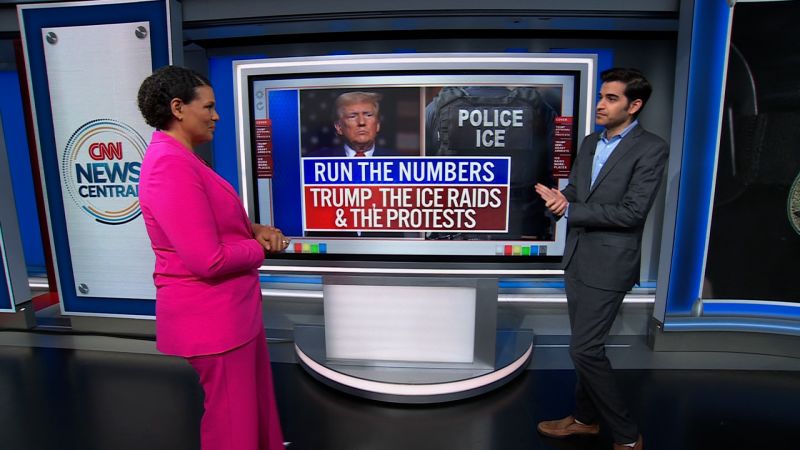

Trump Approval Rating Plunges Following Nationwide Immigration Protests

Jun 22, 2025

Trump Approval Rating Plunges Following Nationwide Immigration Protests

Jun 22, 2025 -

June 17th 2025 Recap Storm Rout Sparks 98 67

Jun 22, 2025

June 17th 2025 Recap Storm Rout Sparks 98 67

Jun 22, 2025 -

Ataque A Instalaciones Nucleares Iranies Estados Unidos Confirma Bombardeos

Jun 22, 2025

Ataque A Instalaciones Nucleares Iranies Estados Unidos Confirma Bombardeos

Jun 22, 2025

Latest Posts

-

Tze Elim Bet Disaster The Fallout From Mossads Failed Operation To Assassinate Saddam Hussein

Jun 22, 2025

Tze Elim Bet Disaster The Fallout From Mossads Failed Operation To Assassinate Saddam Hussein

Jun 22, 2025 -

La Decision De Trump De Posponer El Ataque A Iran Un Analisis De Las Consecuencias Y Factores Involucrados

Jun 22, 2025

La Decision De Trump De Posponer El Ataque A Iran Un Analisis De Las Consecuencias Y Factores Involucrados

Jun 22, 2025 -

On Set With Jaws A Photographic Journey

Jun 22, 2025

On Set With Jaws A Photographic Journey

Jun 22, 2025 -

Former Mlb Stars Shocking Announcement Conditional Support For President Trump

Jun 22, 2025

Former Mlb Stars Shocking Announcement Conditional Support For President Trump

Jun 22, 2025 -

Significant Staff Reductions At Voice Of America Under Kari Lakes Leadership

Jun 22, 2025

Significant Staff Reductions At Voice Of America Under Kari Lakes Leadership

Jun 22, 2025