Long-Term Mortgages: How 31-Year Loans Impact First-Time Buyers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Long-Term Mortgages: How 31-Year Loans Impact First-Time Buyers

Are 31-year mortgages the key to unlocking homeownership for first-time buyers, or a risky path to long-term debt? The dream of owning a home is a powerful one, especially for first-time buyers. But with rising interest rates and increasingly competitive markets, the traditional mortgage landscape can feel daunting. Enter the 31-year mortgage – a longer-term loan offering lower monthly payments, but with significant long-term implications. This article explores the advantages and disadvantages of these extended loan terms, focusing on their impact on first-time homebuyers.

Lower Monthly Payments: The Alluring Appeal of 31-Year Mortgages

One of the most significant draws of a 31-year mortgage for first-time buyers is the substantially reduced monthly payment compared to shorter-term loans like 15-year or even 20-year mortgages. This lower payment can make homeownership a more achievable reality for those with tighter budgets. By stretching the repayment period, the principal amount is divided over a longer time, resulting in more manageable monthly installments. This can be particularly beneficial in high-cost housing markets where even a modest home can command a significant price.

- Increased Affordability: Lower monthly payments free up more cash flow for other essential expenses, such as groceries, transportation, and savings.

- Easier Qualification: A smaller monthly payment can significantly improve a buyer's debt-to-income ratio (DTI), making it easier to qualify for a mortgage.

The Long-Term Cost: Weighing the Pros and Cons

While the lower monthly payments are undeniably attractive, it's crucial to understand the long-term financial consequences of a 31-year mortgage. The extended repayment period means you'll pay significantly more in interest over the life of the loan. This can amount to tens, even hundreds of thousands of dollars more than a shorter-term mortgage.

- Higher Total Interest Paid: This is the biggest drawback. The longer you borrow, the more interest accrues.

- Less Equity Buildup: You'll build equity more slowly with a 31-year mortgage, meaning it takes longer to own a significant portion of your home outright.

- Market Volatility: Over 31 years, there's a greater chance of experiencing significant market fluctuations that could impact your investment.

Strategic Considerations for First-Time Buyers

Choosing between a 31-year mortgage and a shorter-term loan requires careful consideration of your individual financial situation and long-term goals. First-time buyers should:

- Analyze Your Financial Situation: Create a realistic budget that accounts for all expenses, including potential interest rate increases. Use a to compare different loan terms.

- Explore Down Payment Assistance Programs: Several government and private programs offer down payment assistance to first-time homebuyers, potentially reducing the loan amount and monthly payments. Research options in your area.

- Consult with a Financial Advisor: A qualified financial advisor can provide personalized guidance, helping you weigh the risks and benefits of different mortgage options.

Conclusion: Making an Informed Decision

A 31-year mortgage can be a viable option for first-time homebuyers seeking more manageable monthly payments. However, it's essential to fully understand the long-term financial implications, including the increased total interest paid and slower equity buildup. By carefully analyzing your financial situation, exploring available assistance programs, and seeking professional advice, you can make an informed decision that aligns with your long-term financial goals and sets you on the path to successful homeownership. Remember, while the allure of lower monthly payments is strong, financial prudence should always be the guiding principle.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Long-Term Mortgages: How 31-Year Loans Impact First-Time Buyers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Day 24 Karen Read Trial Key Evidence Challenged By Defense Witness

Jun 03, 2025

Day 24 Karen Read Trial Key Evidence Challenged By Defense Witness

Jun 03, 2025 -

Keys Project Clears Second Hurdle Full Flow Ahead

Jun 03, 2025

Keys Project Clears Second Hurdle Full Flow Ahead

Jun 03, 2025 -

Debunking The Mc Migraine Does This Tik Tok Trend Work

Jun 03, 2025

Debunking The Mc Migraine Does This Tik Tok Trend Work

Jun 03, 2025 -

Us Open Tiafoe Joins Paul In Quarterfinals Securing American Representation

Jun 03, 2025

Us Open Tiafoe Joins Paul In Quarterfinals Securing American Representation

Jun 03, 2025 -

Frances Tiafoes Roland Garros Win A Historic Moment For Us Tennis

Jun 03, 2025

Frances Tiafoes Roland Garros Win A Historic Moment For Us Tennis

Jun 03, 2025

Latest Posts

-

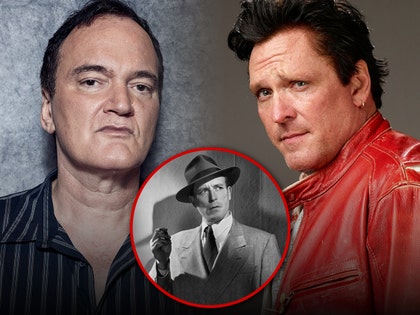

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025

Actor Michael Madsen On Lawrence Tierneys Dismissal From Tarantino Film

Aug 02, 2025 -

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025

Michael Madsen Remembered Tarantino Speaks Out At Star Studded Funeral

Aug 02, 2025 -

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025

Cornwall Mums Death Could Older Driver Rule Changes Have Saved Her Life

Aug 02, 2025 -

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025

Ukraine Zelensky Concedes To Youth Demands Averts Crisis

Aug 02, 2025 -

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025

Golden Dome Missile Defense First Major Pentagon Test Planned Before 2028

Aug 02, 2025