Longest Losing Streak Since April 2024: Palantir Stock Continues To Fall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Longest Losing Streak Since April 2024: Palantir Stock Continues to Fall

Palantir Technologies (PLTR) stock has extended its losing streak, marking its longest period of decline since April 2024, leaving investors concerned about the future trajectory of the data analytics giant. This downturn raises questions about the company's growth prospects and the overall sentiment surrounding the tech sector. The recent drop follows a period of relative stability, highlighting the volatility inherent in the tech market.

The stock's persistent decline has prompted analysts to reassess their predictions for Palantir's performance. This article delves into the reasons behind this prolonged slump, examining both internal company factors and broader market trends influencing PLTR's stock price.

<h3>What's Driving Palantir's Stock Down?</h3>

Several factors contribute to Palantir's extended losing streak:

-

Concerns about Revenue Growth: While Palantir has consistently reported revenue growth, the rate of expansion has slowed in recent quarters, fueling concerns among investors. This deceleration, compared to previous periods of rapid growth, may be a significant factor in the current stock price decline. Analysts are scrutinizing the company's ability to maintain its momentum in a potentially slowing market.

-

Increased Competition: The data analytics sector is increasingly competitive. Palantir faces stiff competition from established players and agile newcomers, creating pressure to innovate and maintain its market share. This intensified competition could impact Palantir's ability to secure and retain lucrative contracts.

-

Broader Market Sentiment: The overall tech sector has experienced volatility recently, influenced by macroeconomic factors such as rising interest rates and inflation. This negative sentiment towards the tech sector has likely exacerbated Palantir's stock decline, impacting even companies with relatively strong fundamentals.

-

Lack of Significant New Product Announcements: The absence of major product announcements or significant partnerships could also be contributing to investor hesitancy. Investors often look for signs of innovation and expansion to bolster confidence in a company's future prospects.

<h3>Analyzing the April 2024 Comparison: A Look Back</h3>

The current losing streak is notably longer than the decline experienced in April 2024. Understanding the context of that previous downturn can provide valuable insight into the current situation. While the specific catalysts differed, both periods highlight the inherent risks associated with investing in a growth-oriented tech company. Analyzing the events of April 2024, including news cycles and market conditions, can help investors better assess the current challenges facing Palantir.

<h3>What's Next for Palantir Investors?</h3>

The prolonged decline raises crucial questions for Palantir investors. Should they hold, buy the dip, or consider selling? There's no easy answer, and individual investment decisions should always be based on careful research and consideration of personal risk tolerance. It's advisable to consult with a financial advisor before making any significant investment changes.

Key Considerations for Investors:

- Long-term Vision: Palantir operates in a growing market with significant long-term potential. Investors with a long-term outlook might view this dip as a buying opportunity.

- Risk Tolerance: Investing in Palantir carries inherent risk due to its growth-stage nature and the volatility of the tech sector.

- Diversification: It's crucial to diversify investments to mitigate risk and not over-concentrate in a single stock, especially one as volatile as Palantir.

This extended losing streak underscores the need for thorough due diligence before investing in any stock. While Palantir's future remains uncertain, careful analysis of the factors affecting its stock price can help investors make informed decisions. Stay tuned for further updates as the situation unfolds. For more in-depth market analysis, visit [link to reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Longest Losing Streak Since April 2024: Palantir Stock Continues To Fall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Powerball Jackpot Soars To 643 Million Are You Ready To Win

Aug 22, 2025

Powerball Jackpot Soars To 643 Million Are You Ready To Win

Aug 22, 2025 -

Empty Homes And Housing Shortages Exploring The Disconnect

Aug 22, 2025

Empty Homes And Housing Shortages Exploring The Disconnect

Aug 22, 2025 -

Mass Tourisms Dark Side Why Europe Is Pushing Back

Aug 22, 2025

Mass Tourisms Dark Side Why Europe Is Pushing Back

Aug 22, 2025 -

Aew Dynamite August 20 2025 Full Results Mjfs Stipulations Athenas Brutal Match

Aug 22, 2025

Aew Dynamite August 20 2025 Full Results Mjfs Stipulations Athenas Brutal Match

Aug 22, 2025 -

Gaza Children Orphaned By Conflict Graduate Amidst Emotional Ceremony

Aug 22, 2025

Gaza Children Orphaned By Conflict Graduate Amidst Emotional Ceremony

Aug 22, 2025

Latest Posts

-

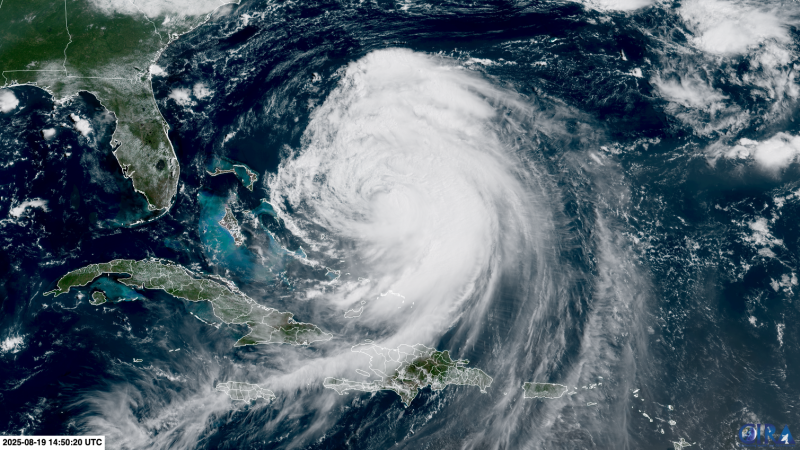

Hurricane Erins Impact Dangerous Rip Currents And Potential For Further Development

Aug 22, 2025

Hurricane Erins Impact Dangerous Rip Currents And Potential For Further Development

Aug 22, 2025 -

Gaza Graduation A Moving Ceremony For Children Who Lost Their Families

Aug 22, 2025

Gaza Graduation A Moving Ceremony For Children Who Lost Their Families

Aug 22, 2025 -

Netanyahu Call Trumps Controversial War Hero Remark Analyzed

Aug 22, 2025

Netanyahu Call Trumps Controversial War Hero Remark Analyzed

Aug 22, 2025 -

Mlb Alvarado Back With Phillies Misses Postseason

Aug 22, 2025

Mlb Alvarado Back With Phillies Misses Postseason

Aug 22, 2025 -

Minnesota Vikings Male Cheerleaders Spark Debate And Criticism

Aug 22, 2025

Minnesota Vikings Male Cheerleaders Spark Debate And Criticism

Aug 22, 2025