Maintaining Two Homes: Practical Advice And Financial Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Maintaining Two Homes: Practical Advice and Financial Strategies

Juggling two homes – whether it's a primary residence and a vacation property, or managing separate homes for family members – presents unique challenges. This isn't just about double the cleaning; it's a significant undertaking requiring careful planning and robust financial strategies. This article delves into the practical advice and financial considerations needed to successfully maintain two homes.

The Allure and the Burden of Dual Homeownership

The appeal is obvious: a cozy city apartment for work and a sprawling country house for weekends. Or perhaps a family home and a separate property for aging parents. The reality, however, involves navigating complexities in maintenance, insurance, taxes, and finances. Before diving in, honestly assess your motivations and resources. Are you prepared for the increased responsibilities and financial commitment?

Financial Strategies for Managing Two Homes:

-

Budgeting is Key: Create a detailed budget that accounts for all expenses related to both properties. This includes mortgage payments (if applicable), property taxes, insurance, utilities, maintenance, repairs, and potential travel costs. Don't forget to factor in potential rental income if one property is rented out. Tools like personal finance apps can significantly help in tracking and managing your dual-home budget.

-

Mortgage Management: If you have mortgages on both properties, explore refinancing options to potentially lower your interest rates or consolidate loans. Consult with a mortgage professional to determine the best strategy for your specific financial situation.

-

Tax Implications: Understand the tax implications of owning two homes. You might be able to deduct mortgage interest and property taxes on both properties, but the rules can be complex. Consulting a tax advisor is highly recommended to ensure you're maximizing deductions and minimizing your tax liability. The rules around capital gains tax if you decide to sell one property are also crucial to understand.

-

Rental Income Strategy: If one property is rented out, factor in the potential rental income to offset expenses. However, be prepared for periods of vacancy and necessary repairs. Consider a property management company to alleviate some of the administrative burden. Learn about landlord-tenant laws in your area to protect yourself legally.

-

Emergency Fund: Having a robust emergency fund is crucial when managing two homes. Unexpected repairs, maintenance issues, or even temporary rental income loss can significantly impact your finances. Aim for an emergency fund covering several months' worth of expenses for both properties.

Practical Advice for Maintaining Two Homes:

-

Prioritize Maintenance: Establish a regular maintenance schedule for both properties. This includes tasks like landscaping, cleaning gutters, and addressing minor repairs promptly to prevent larger, more costly issues down the line. Consider hiring local handymen or contractors for routine maintenance tasks if your time is limited.

-

Insurance Coverage: Ensure you have adequate insurance coverage for both homes. This should include homeowner's insurance, liability insurance, and potentially flood insurance, depending on the location of each property.

-

Security Measures: Implement robust security measures at both properties, including alarm systems, security cameras, and regular security checks.

-

Smart Home Technology: Consider incorporating smart home technology to monitor and control aspects like security, lighting, and temperature remotely. This can enhance convenience and security, especially for a vacation home.

Conclusion:

Maintaining two homes presents both exciting opportunities and significant responsibilities. With careful planning, robust financial strategies, and a practical approach to maintenance, the dual-home dream can become a reality. Remember, seeking professional advice from financial advisors, tax professionals, and real estate agents can significantly ease the complexities involved. Don't hesitate to reach out for expert help to make this a successful and enjoyable endeavor. Remember to thoroughly research local regulations and laws pertaining to property ownership and rental agreements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Maintaining Two Homes: Practical Advice And Financial Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Coaching Change Shakes Up Dallas Stars

Jun 06, 2025

Coaching Change Shakes Up Dallas Stars

Jun 06, 2025 -

Controversy Erupts Marvel Unveils The Next Black Panther Spoilers Inside

Jun 06, 2025

Controversy Erupts Marvel Unveils The Next Black Panther Spoilers Inside

Jun 06, 2025 -

Pittsburgh Penguins Coaching Staff Bolstered By Addition Of David Quinn

Jun 06, 2025

Pittsburgh Penguins Coaching Staff Bolstered By Addition Of David Quinn

Jun 06, 2025 -

Investigation Underway Police Examine Heart Surgery Deaths At Uk Nhs Hospital

Jun 06, 2025

Investigation Underway Police Examine Heart Surgery Deaths At Uk Nhs Hospital

Jun 06, 2025 -

From Police Academy To Kidnapping Steve Guttenbergs Latest Role Explored

Jun 06, 2025

From Police Academy To Kidnapping Steve Guttenbergs Latest Role Explored

Jun 06, 2025

Latest Posts

-

Watch Taylor Lewans Off Target First Pitch Goes Viral

Jun 07, 2025

Watch Taylor Lewans Off Target First Pitch Goes Viral

Jun 07, 2025 -

The Dual Household Struggle How I Managed And Almost Didn T

Jun 07, 2025

The Dual Household Struggle How I Managed And Almost Didn T

Jun 07, 2025 -

First Trump Scholz Meeting What To Expect From Germanys Pragmatic Leader

Jun 07, 2025

First Trump Scholz Meeting What To Expect From Germanys Pragmatic Leader

Jun 07, 2025 -

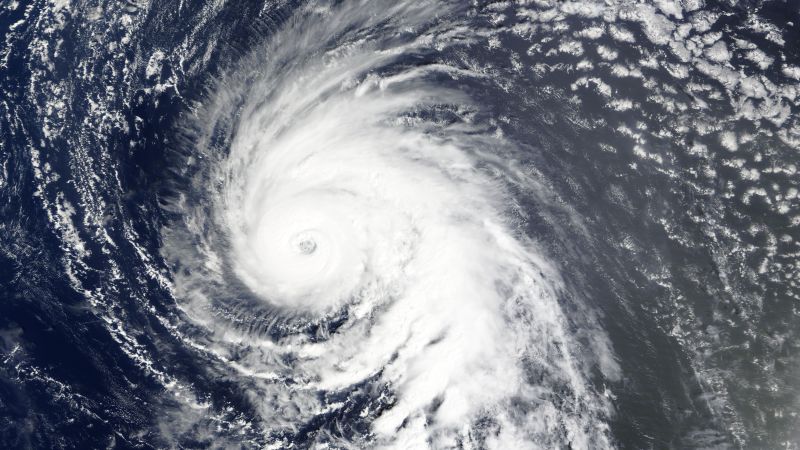

Atmospheric Disturbances Utilizing Ghost Hurricanes For Enhanced Hurricane Prediction

Jun 07, 2025

Atmospheric Disturbances Utilizing Ghost Hurricanes For Enhanced Hurricane Prediction

Jun 07, 2025 -

Reform Mps Burka Ban Idea Criticized As Dumb By Party Leader

Jun 07, 2025

Reform Mps Burka Ban Idea Criticized As Dumb By Party Leader

Jun 07, 2025