Major Subprime Auto Lender Fails: Assessing The Economic Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major Subprime Auto Lender Fails: Assessing the Economic Impact

The recent failure of [Name of Lender], a major player in the subprime auto lending market, has sent shockwaves through the financial industry and raised serious concerns about the potential economic fallout. This event underscores the fragility of the subprime auto loan sector and highlights the interconnectedness of the financial system. Experts warn that the consequences could ripple through various sectors, impacting consumers, dealerships, and the broader economy.

Understanding the Subprime Auto Loan Market

The subprime auto loan market caters to borrowers with poor credit scores, offering them access to vehicle financing that would otherwise be unavailable. While this provides crucial mobility for many, it also carries significant risk. These loans often come with higher interest rates and fees, making borrowers more vulnerable to financial hardship. The recent failures demonstrate the inherent volatility of this market segment, particularly during economic downturns or periods of rising interest rates. [Link to a relevant article on subprime auto loans].

The Immediate Impact of the Lender's Failure

The immediate impact of [Name of Lender]'s failure is multifaceted:

- Consumer hardship: Thousands of borrowers are now facing uncertainty regarding their auto loans. Repossessions are likely to increase, leading to further financial distress for affected individuals. Many may struggle to secure alternative financing options.

- Dealer distress: Dealerships that relied heavily on [Name of Lender] for financing are facing a significant reduction in sales and potential revenue loss. This could trigger a chain reaction, impacting employment within the automotive sector.

- Financial market instability: The failure raises questions about the overall health of the subprime auto loan market and the potential for further defaults. This uncertainty can negatively impact investor confidence and lead to tighter credit conditions across the board.

Long-Term Economic Consequences

The long-term economic consequences of this failure are still unfolding, but several key areas warrant close attention:

- Increased consumer debt: The rise in repossessions and subsequent difficulty securing new financing could lead to an increase in overall consumer debt, hindering economic growth.

- Reduced consumer spending: Financial instability among borrowers may translate into reduced consumer spending, impacting various sectors of the economy.

- Potential for systemic risk: While the failure of a single lender might seem isolated, it highlights the interconnectedness of the financial system. A cascade effect, impacting other lenders or financial institutions, cannot be ruled out.

What's Next?

Regulators and policymakers are now under pressure to assess the broader implications of this failure and implement measures to mitigate further risk within the subprime auto loan market. This may include stricter lending regulations, enhanced consumer protection measures, and greater oversight of the industry. The future stability of the subprime auto loan market will heavily depend on these actions.

Call to Action: Stay informed about developments in the subprime auto loan market. Understand your own financial situation and seek professional advice if you are struggling with auto loan repayments. [Link to a reputable financial advice website]. The economic impact of this failure is significant, and awareness is key to navigating the challenges ahead.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Subprime Auto Lender Fails: Assessing The Economic Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Apple Tv Streams Fridays Mariners Game With Hometown Radio

Sep 14, 2025

Apple Tv Streams Fridays Mariners Game With Hometown Radio

Sep 14, 2025 -

Bowen Yang Chloe Fineman And More Meet The Snl Season 51 Cast

Sep 14, 2025

Bowen Yang Chloe Fineman And More Meet The Snl Season 51 Cast

Sep 14, 2025 -

Got Him And The Clock Is Ticking Pressure Mounts On Keir Starmer

Sep 14, 2025

Got Him And The Clock Is Ticking Pressure Mounts On Keir Starmer

Sep 14, 2025 -

Erika Kirks Heartfelt Tribute Keeping Charlie Kirks Legacy Alive

Sep 14, 2025

Erika Kirks Heartfelt Tribute Keeping Charlie Kirks Legacy Alive

Sep 14, 2025 -

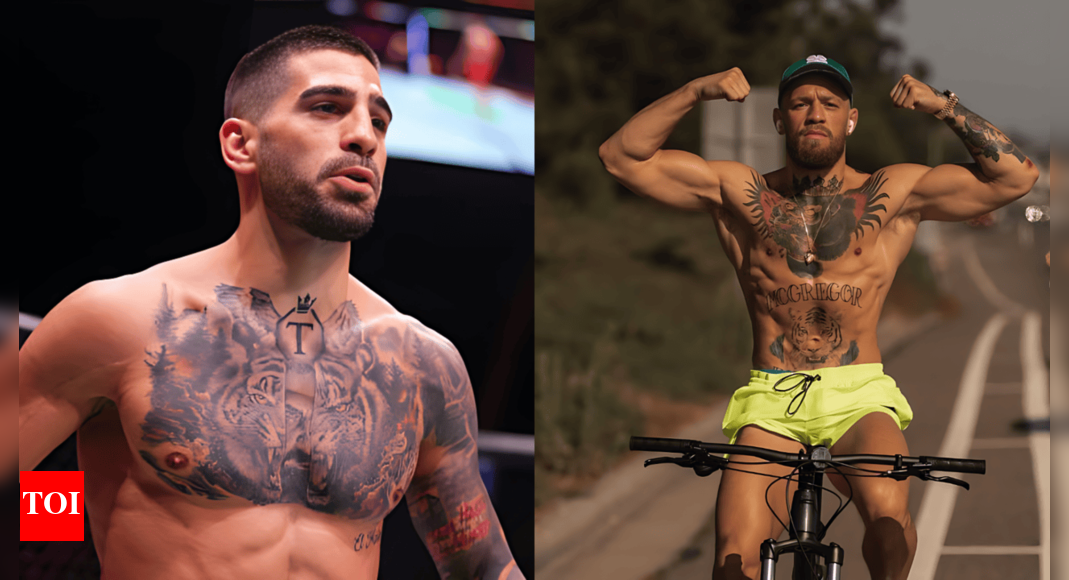

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025

Latest Posts

-

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025 -

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025 -

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025

Erika Kirk Honors Charlie Kirks Memory And Work

Sep 14, 2025 -

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025

Pregnancy Childhood Covid 19 Vaccine Risks Under Scrutiny

Sep 14, 2025 -

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025

Subprime Auto Loan Defaults Rise Is Another Financial Crisis Brewing

Sep 14, 2025