Major Subprime Auto Lender Failure: What You Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Major Subprime Auto Lender Failure: What You Need to Know

The subprime auto lending industry is facing a major shakeup. Recent headlines have announced the failure of a significant player, sending shockwaves through the financial sector and raising serious concerns for borrowers and investors alike. This isn't just another financial hiccup; it's a critical event with potentially far-reaching consequences. Understanding the implications is crucial, whether you're a borrower, an investor, or simply concerned about the broader economic landscape.

What Happened?

While specific details may vary depending on the lender in question, the general pattern involves unsustainable lending practices, rising interest rates, and a subsequent inability to manage loan defaults. This specific lender, [Insert Lender Name Here – replace with actual name if known, otherwise remove this sentence], reportedly faced a surge in delinquencies, ultimately leading to insolvency. This isn't an isolated incident; other subprime lenders are facing similar challenges, highlighting the fragility of this sector.

The Ripple Effect: Understanding the Broader Implications

The failure of a major subprime auto lender doesn't exist in a vacuum. Its impact ripples outwards, affecting several key areas:

-

Borrowers: Many borrowers, often those with less-than-perfect credit, are now facing uncertainty regarding their auto loans. Repossessions might increase, and securing future financing could become significantly more difficult. Understanding your rights and exploring options for debt consolidation or refinancing is paramount. Resources like the [link to a relevant consumer protection agency or credit counseling organization] can provide valuable assistance.

-

Investors: Those who invested in the lender's securities or bonds are likely to experience significant losses. The failure underscores the inherent risks associated with investing in the subprime auto lending market, particularly in a rising interest rate environment. Diversification and careful due diligence are crucial for mitigating such risks. Consult with a financial advisor to assess your investment portfolio and adjust accordingly.

-

The Economy: The failure can contribute to broader economic instability. Increased repossessions can negatively impact the used car market, potentially triggering further price drops. The wider financial system might also feel the strain, depending on the extent of the lender's interconnectedness with other financial institutions.

What to Do If You're a Subprime Auto Borrower:

- Review your loan agreement: Understand the terms and conditions, including your rights and responsibilities.

- Contact your lender: If you're experiencing financial difficulties, reach out to your lender immediately to explore options like forbearance or modification.

- Seek professional advice: A credit counselor can help you navigate your options and create a plan to manage your debt.

- Monitor your credit report: Keep a close eye on your credit score, as any defaults will negatively impact your financial standing.

Looking Ahead: Lessons Learned and Future Outlook

This event serves as a stark reminder of the risks inherent in the subprime auto lending market. The industry needs to adopt more responsible lending practices, and regulators need to enhance oversight to prevent similar failures in the future. Increased transparency and stricter regulations could help stabilize the market and protect both borrowers and investors.

Keywords: Subprime auto loan, auto loan crisis, lender failure, financial crisis, credit score, debt, repossession, investment risk, economic impact, consumer protection, credit counseling, financial advice, rising interest rates, used car market.

(Note: Remember to replace "[Insert Lender Name Here]" with the actual name of the lender if known. Also, ensure all links are functional and relevant.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Major Subprime Auto Lender Failure: What You Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Coldplay Sets New Wembley Stadium Attendance Record A Night To Remember

Sep 14, 2025

Coldplay Sets New Wembley Stadium Attendance Record A Night To Remember

Sep 14, 2025 -

Anniversary Tribute Malcolm Jamal Warners Widow Reveals Exciting Update

Sep 14, 2025

Anniversary Tribute Malcolm Jamal Warners Widow Reveals Exciting Update

Sep 14, 2025 -

Millie Bobby Browns Pregnancy Noah Schnapp Weighs In

Sep 14, 2025

Millie Bobby Browns Pregnancy Noah Schnapp Weighs In

Sep 14, 2025 -

2025 Emmy Awards Your Complete Guide To Watching And Whos Presenting

Sep 14, 2025

2025 Emmy Awards Your Complete Guide To Watching And Whos Presenting

Sep 14, 2025 -

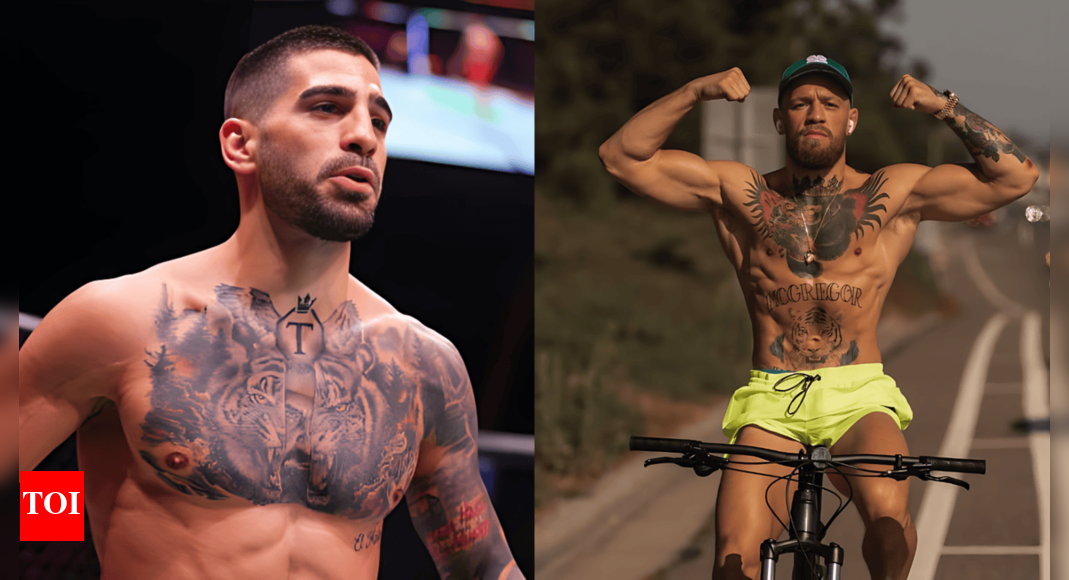

Ilia Topuria Presidential Run Inspired By Conor Mc Gregor

Sep 14, 2025

Ilia Topuria Presidential Run Inspired By Conor Mc Gregor

Sep 14, 2025

Latest Posts

-

How To Watch The 2025 Emmy Awards Date Time And Presenter Lineup

Sep 14, 2025

How To Watch The 2025 Emmy Awards Date Time And Presenter Lineup

Sep 14, 2025 -

Watch The 2025 Emmy Awards The Ultimate Viewers Guide

Sep 14, 2025

Watch The 2025 Emmy Awards The Ultimate Viewers Guide

Sep 14, 2025 -

Scottish Court Orders Eviction Of Woodland Tribe

Sep 14, 2025

Scottish Court Orders Eviction Of Woodland Tribe

Sep 14, 2025 -

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025

Epstein Emails Bbc Report Sheds Light On Starmers Defence Of Mandelson

Sep 14, 2025 -

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025

Public Anniversary Tribute Malcolm Jamal Warners Wife Shares Important News

Sep 14, 2025