Market Awaits PDD Holdings Q1 2025 Earnings Report: Financial Performance Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Awaits PDD Holdings Q1 2025 Earnings Report: A Financial Performance Analysis

Introduction: The market is holding its breath as the release date for PDD Holdings' Q1 2025 earnings report approaches. This leading e-commerce giant in China, known for its Pinduoduo platform, has consistently delivered impressive results, but the current economic climate presents unique challenges. This article will delve into a pre-earnings analysis, examining key performance indicators (KPIs) and exploring potential scenarios for the upcoming report. Understanding PDD Holdings' financial health is crucial for investors and industry analysts alike.

PDD Holdings: A Quick Overview

PDD Holdings (PDD), parent company of the popular Pinduoduo app, has disrupted the Chinese e-commerce landscape with its unique group-buying model. This approach has attracted a massive user base, particularly in lower-tier cities, fueling its phenomenal growth in recent years. However, increasing competition from established players like Alibaba and JD.com, coupled with macroeconomic headwinds, necessitates a close examination of its financial performance.

Key Performance Indicators (KPIs) to Watch:

Several key metrics will dictate the market's reaction to PDD Holdings' Q1 2025 report. Investors and analysts will scrutinize:

- Revenue Growth: Maintaining robust revenue growth is paramount. Any slowdown could indicate weakening consumer demand or intensified competition. A comparison with Q1 2024's figures and industry benchmarks will be critical.

- Annual Active Buyers: Pinduoduo's massive user base is its greatest asset. A decline in annual active buyers would signal serious concerns about market share erosion.

- Average Revenue Per User (ARPU): Growth in ARPU indicates success in increasing the spending per user. This metric reflects the effectiveness of PDD's marketing strategies and product offerings.

- Marketing Expenses: PDD Holdings has historically invested heavily in marketing. The balance between marketing spend and return on investment (ROI) will be a key focus. Any significant changes in marketing strategy will be closely analyzed.

- Profitability: While rapid growth is important, sustained profitability is equally crucial for long-term investor confidence. Metrics like net income and operating margin will be closely scrutinized.

Potential Scenarios and Market Implications:

Several scenarios could unfold based on the Q1 2025 earnings report:

- Scenario 1: Exceeding Expectations: Strong revenue growth, increased ARPU, and healthy profitability could send PDD Holdings' stock price soaring. This would signal resilience in the face of economic challenges and competitive pressures.

- Scenario 2: Meeting Expectations: Meeting analysts' projections would likely result in a muted market reaction. While not negative, it may not provide the significant boost investors are hoping for.

- Scenario 3: Falling Short of Expectations: Disappointing results could trigger a significant sell-off. This would necessitate a reevaluation of PDD Holdings' long-term growth potential.

Conclusion:

The PDD Holdings Q1 2025 earnings report is a significant event for the e-commerce sector and the broader Chinese economy. The market's reaction will largely depend on the company's ability to demonstrate continued growth and profitability in a challenging environment. By closely monitoring the key KPIs discussed above, investors can better understand the implications of the report and adjust their strategies accordingly. Stay tuned for updates as the release date approaches. We will provide further analysis once the report is published.

Further Reading:

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Awaits PDD Holdings Q1 2025 Earnings Report: Financial Performance Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Round 1 Expert Predictions For Zverev Mensik And More

May 28, 2025

French Open Round 1 Expert Predictions For Zverev Mensik And More

May 28, 2025 -

Bbc Documents Impact Of Israeli Blockade Hungry Baby In Gaza

May 28, 2025

Bbc Documents Impact Of Israeli Blockade Hungry Baby In Gaza

May 28, 2025 -

Stellantis Appoints Antonio Filosa As Its New Ceo What To Expect

May 28, 2025

Stellantis Appoints Antonio Filosa As Its New Ceo What To Expect

May 28, 2025 -

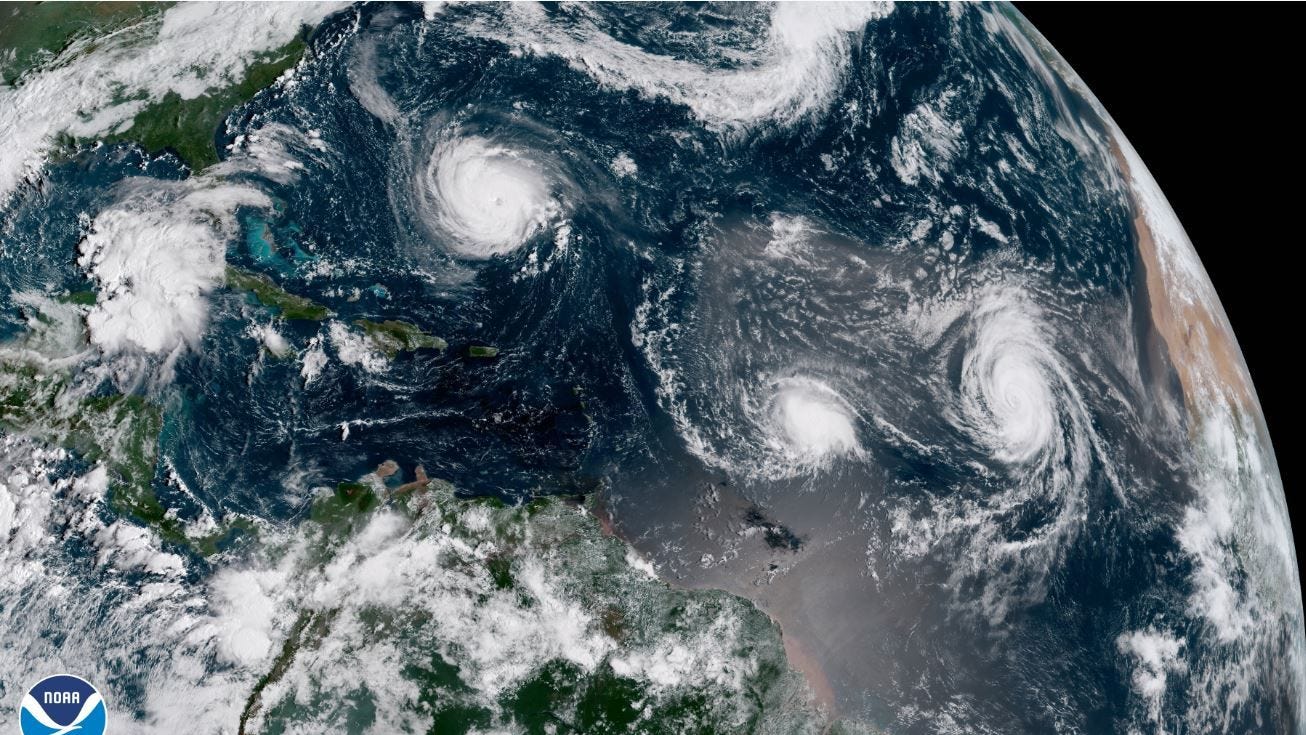

Hurricane Season 2025 Predictions Preparedness And Protection

May 28, 2025

Hurricane Season 2025 Predictions Preparedness And Protection

May 28, 2025 -

Jrue Holiday La Melo Ball Trade Speculation Impact On Dallas Mavericks And Nba Landscape

May 28, 2025

Jrue Holiday La Melo Ball Trade Speculation Impact On Dallas Mavericks And Nba Landscape

May 28, 2025

Latest Posts

-

Sbet Stock Price Explosion Causes And Implications Of The 1000 Growth

May 31, 2025

Sbet Stock Price Explosion Causes And Implications Of The 1000 Growth

May 31, 2025 -

Athletic Performance And Gender Identity Examining The Science

May 31, 2025

Athletic Performance And Gender Identity Examining The Science

May 31, 2025 -

California Track And Field Rule Review After Transgender Athletes State Championship Win

May 31, 2025

California Track And Field Rule Review After Transgender Athletes State Championship Win

May 31, 2025 -

Un Hearing Palestinian Ambassadors Heartbreaking Testimony On Gaza Children

May 31, 2025

Un Hearing Palestinian Ambassadors Heartbreaking Testimony On Gaza Children

May 31, 2025 -

Competitive Edge Or Myth Examining The Athletic Performance Of Transgender Women

May 31, 2025

Competitive Edge Or Myth Examining The Athletic Performance Of Transgender Women

May 31, 2025