Market Rally Continues: Six-Day Win Streak For S&P 500 Amidst Moody's Rating Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Rally Continues: Six-Day Win Streak for S&P 500 Amidst Moody's Rating Action

The S&P 500 has notched an impressive six-day winning streak, defying expectations and continuing a remarkable market rally. This surge comes despite a recent credit rating downgrade from Moody's, highlighting the complex interplay of factors currently shaping the financial landscape. What's driving this unexpected bullish trend, and what does it mean for investors?

Moody's Downgrade and Market Resilience:

Moody's Investors Service recently downgraded the credit ratings of several small and mid-sized US banks, citing concerns about the banking sector's vulnerability to potential economic slowdowns. This action typically sends shockwaves through the market, leading to increased volatility and potential sell-offs. However, the S&P 500's continued upward trajectory suggests a level of market resilience, perhaps indicating a belief that the banking sector's issues are contained or manageable. Analysts are closely examining whether this resilience is a temporary blip or a sign of broader market confidence.

Factors Fueling the Rally:

Several factors could be contributing to this unexpected rally:

- Stronger-than-Expected Earnings Reports: Recent earnings reports from major corporations have exceeded analysts' expectations in many sectors, boosting investor sentiment and fueling buying activity. Positive corporate news often acts as a significant catalyst for market growth.

- Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential slowing of price increases, leading to speculation that the Federal Reserve might moderate its aggressive interest rate hiking cycle. This prospect offers a glimmer of hope for economic stability and fuels market optimism.

- Technological Advancements: Continued innovation and advancements in sectors like artificial intelligence (AI) are driving investor interest and fueling investment in technology companies, contributing significantly to the market's positive momentum. Learn more about the impact of AI on the stock market [link to relevant article/resource].

- Resilient Consumer Spending: Despite economic uncertainties, consumer spending remains relatively robust, supporting economic growth and providing a foundation for corporate profitability. This positive indicator helps offset concerns about potential recessionary pressures.

What Lies Ahead?

While the six-day winning streak is undeniably impressive, it's crucial to approach the situation with measured optimism. The market remains susceptible to various external factors, including geopolitical instability and further economic data releases. The long-term impact of Moody's downgrade also remains to be seen.

Investor Strategies:

Investors should maintain a diversified portfolio and carefully consider their risk tolerance. While the current rally is encouraging, it's essential to avoid making impulsive decisions based solely on short-term market movements. Consult with a financial advisor before making significant investment changes.

Conclusion:

The S&P 500's six-day winning streak amidst Moody's rating action presents a fascinating case study in market resilience. While the underlying factors are complex and warrant further analysis, the rally underscores the dynamic and unpredictable nature of the stock market. Staying informed about economic indicators, corporate performance, and geopolitical events remains crucial for navigating the current market climate. Keep an eye on future economic releases for further insights into the trajectory of this market rally. Remember to always conduct thorough research and seek professional advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Rally Continues: Six-Day Win Streak For S&P 500 Amidst Moody's Rating Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Death Of The Dinosaurs New Discoveries At A Canadian Pachyrhinosaurus Site

May 21, 2025

Death Of The Dinosaurs New Discoveries At A Canadian Pachyrhinosaurus Site

May 21, 2025 -

Big Changes Ahead Creator Announces New Season Of Peaky Blinders

May 21, 2025

Big Changes Ahead Creator Announces New Season Of Peaky Blinders

May 21, 2025 -

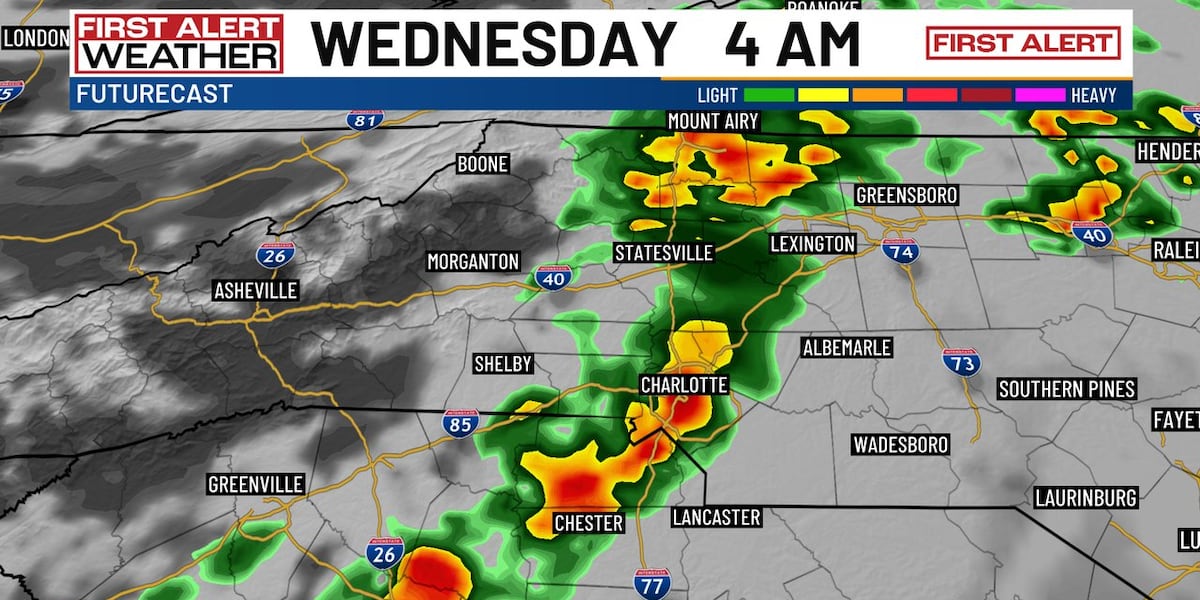

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025

Charlotte Storm Forecast Overnight Showers And Significant Cooldown

May 21, 2025 -

Analyzing The Impact Of Intolerable Suffering In Gaza

May 21, 2025

Analyzing The Impact Of Intolerable Suffering In Gaza

May 21, 2025 -

New Rules For Bali Tourists Curbing Misconduct And Protecting The Island

May 21, 2025

New Rules For Bali Tourists Curbing Misconduct And Protecting The Island

May 21, 2025

Latest Posts

-

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025

The Photographer Of Napalm Girl World Press Photos Review Of A Historic Vietnam War Photograph

May 21, 2025 -

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025

Charlotte Weather Alert Overnight Storms And Temperature Drop Incoming

May 21, 2025 -

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025

Parental Rights For Paedophiles Familys Scathing Critique Of Legal Changes

May 21, 2025 -

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025

The Loss That Broke Ellen De Generes Heart Family Tragedy Revealed

May 21, 2025 -

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025

Emotional Return Ellen De Generes Addresses Fans After Personal Loss

May 21, 2025