Market Reaction: Treasury Yields Slip After Fed's Rate Cut Prediction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Reaction: Treasury Yields Slip After Fed's Rate Cut Prediction

Treasury yields experienced a downturn following the Federal Reserve's hinted prediction of potential interest rate cuts later this year. This unexpected shift in the market reflects growing concerns about the economy's resilience and the potential impact of inflation. The move sent ripples through the financial world, prompting investors to reassess their strategies.

The Federal Open Market Committee (FOMC) meeting concluded without a rate change this time, holding the benchmark federal funds rate steady at a range of 5% to 5.25%. However, the accompanying statement subtly shifted the narrative, acknowledging the recent banking turmoil and suggesting that future rate decisions will depend heavily on incoming economic data. This subtle change in tone was enough to trigger significant market movement.

<br>

Understanding the Market Response

The decrease in Treasury yields indicates a flight to safety. Investors, anticipating potential economic slowdown or even recession, are flocking to the perceived safety of government bonds. This increased demand for these bonds pushes their prices up, inversely resulting in lower yields. The market is essentially pricing in a higher probability of rate cuts by the Fed in the coming months.

-

Lower Yields, Higher Bond Prices: The inverse relationship between bond prices and yields is crucial to understanding the market reaction. When demand for bonds increases, their prices rise, and consequently, their yields fall.

-

Inflation Concerns Ease (Slightly): While inflation remains a concern, the market's response suggests a belief that the Fed's potential rate cuts might help mitigate inflationary pressures without triggering a significant economic downturn. This is a delicate balancing act for the central bank.

-

Banking Sector Instability: The recent instability in the banking sector played a significant role in influencing the Fed's stance and the subsequent market reaction. The fear of contagion and further financial stress contributed to the risk-off sentiment, driving investors towards safer assets.

<br>

What This Means for Investors

The shift in Treasury yields presents both opportunities and challenges for investors. Those holding bonds are likely to see increased value, while those invested in riskier assets might experience losses.

-

Bondholders: The drop in yields is positive news for current bondholders, as their investments have appreciated in value.

-

Stock Market: The uncertainty surrounding future rate cuts could create volatility in the stock market. Investors will need to carefully analyze company fundamentals and macroeconomic indicators before making investment decisions.

-

Currency Markets: The dollar's strength could be affected, as lower US interest rates may make it less attractive to foreign investors.

<br>

Looking Ahead: Uncertainty Remains

While the market reacted swiftly to the Fed's hint of potential rate cuts, significant uncertainty remains. The economic outlook is still clouded by various factors, including persistent inflation, geopolitical risks, and the ongoing recovery from the pandemic.

The next few months will be critical in observing how economic data unfolds and how the Fed responds. This will be key in determining the future direction of Treasury yields and the overall market sentiment. Keep an eye on key economic indicators like the Consumer Price Index (CPI) and employment data for clues about the future trajectory of interest rates.

Further Reading: (Replace with actual link).

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Reaction: Treasury Yields Slip After Fed's Rate Cut Prediction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Transparency Concerns Jon Jones On Ufcs Aspinall Injury Communication

May 21, 2025

Transparency Concerns Jon Jones On Ufcs Aspinall Injury Communication

May 21, 2025 -

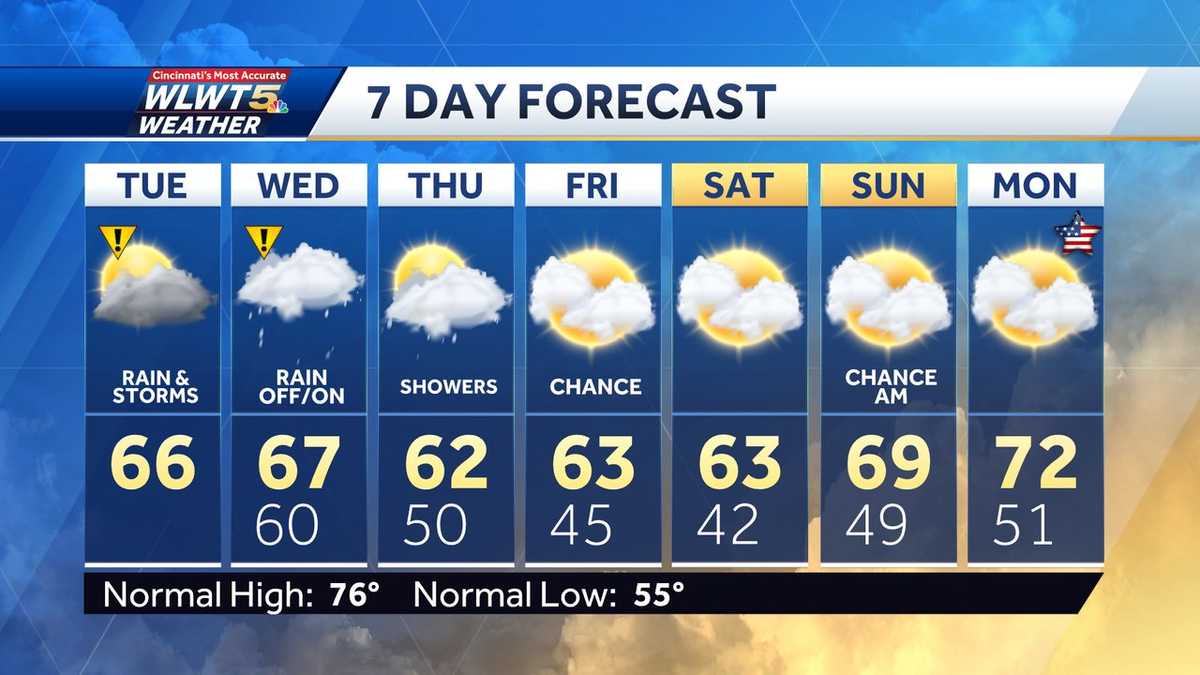

Chilly Week Ahead Prepare For Persistent Rain Showers

May 21, 2025

Chilly Week Ahead Prepare For Persistent Rain Showers

May 21, 2025 -

Lineker And The Bbc Is This The End Of An Era

May 21, 2025

Lineker And The Bbc Is This The End Of An Era

May 21, 2025 -

Beyond The Screen Jamie Lee Curtis Discusses Her Deep Connection With Lindsay Lohan

May 21, 2025

Beyond The Screen Jamie Lee Curtis Discusses Her Deep Connection With Lindsay Lohan

May 21, 2025 -

Ubisoft Milans Aaa Rayman Game Job Openings Now Available

May 21, 2025

Ubisoft Milans Aaa Rayman Game Job Openings Now Available

May 21, 2025

Latest Posts

-

Church Break In Two Juveniles Charged With Criminal Damage And Defecation

May 21, 2025

Church Break In Two Juveniles Charged With Criminal Damage And Defecation

May 21, 2025 -

Significant Changes To Law Governing Paedophiles Parental Rights Draw Sharp Criticism

May 21, 2025

Significant Changes To Law Governing Paedophiles Parental Rights Draw Sharp Criticism

May 21, 2025 -

After Trump Funding Cuts Sesame Street Signs With Netflix

May 21, 2025

After Trump Funding Cuts Sesame Street Signs With Netflix

May 21, 2025 -

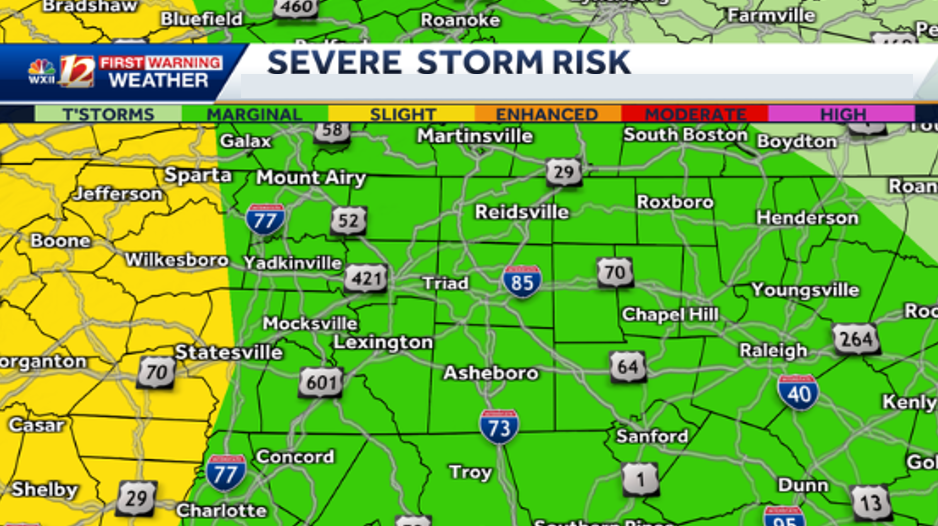

Overnight Storms And Heavy Rain Threaten North Carolina Severe Weather Risk High

May 21, 2025

Overnight Storms And Heavy Rain Threaten North Carolina Severe Weather Risk High

May 21, 2025 -

Cross Species Baby Abductions By Monkeys Baffle Scientists In Panama

May 21, 2025

Cross Species Baby Abductions By Monkeys Baffle Scientists In Panama

May 21, 2025