Massive Bitcoin ETF Investment: The Implications Of The $5 Billion Milestone

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Massive Bitcoin ETF Investment: The Implications of the $5 Billion Milestone

The world of finance is buzzing. Investment in Bitcoin exchange-traded funds (ETFs) has officially surpassed the staggering $5 billion mark, signaling a monumental shift in the perception and adoption of Bitcoin as a legitimate asset class. This landmark achievement carries significant implications for the cryptocurrency market, traditional finance, and the future of digital assets. But what does this truly mean, and what are the potential consequences?

A Watershed Moment for Bitcoin Adoption:

The $5 billion figure represents more than just a numerical milestone; it's a powerful testament to growing institutional confidence in Bitcoin. For years, Bitcoin's volatility and regulatory uncertainty deterred large-scale institutional investors. However, the recent surge in ETF investment highlights a significant change in sentiment. This influx of capital signifies a broader acceptance of Bitcoin's potential as a viable investment vehicle, moving beyond the realm of speculative trading into mainstream finance.

What Drove This Massive Investment?

Several factors contributed to this remarkable growth:

- Increased Regulatory Clarity: While regulatory landscapes vary globally, increased clarity and approval of Bitcoin ETFs in key markets like the United States have played a crucial role. The SEC's recent decisions, although not universally approving all applications, have paved the way for greater institutional participation.

- Inflation Hedge Appeal: With persistent inflationary pressures globally, Bitcoin's limited supply and decentralized nature continue to attract investors seeking to hedge against inflation and traditional financial instability.

- Institutional Investor Demand: Major financial institutions are increasingly allocating a portion of their portfolios to Bitcoin, driven by the potential for high returns and diversification. This institutional adoption is a key factor fueling the growth of Bitcoin ETF investments.

- Improved Infrastructure: The development of more robust and secure infrastructure for Bitcoin trading and custody has made it easier and safer for institutional investors to participate in the market.

Implications for the Future:

This $5 billion milestone has far-reaching implications:

- Increased Market Volatility (Short-Term): While long-term prospects remain positive for many, short-term volatility is possible as the market adjusts to this massive influx of capital.

- Price Appreciation Potential: The increased demand fueled by ETF investments could potentially drive Bitcoin's price higher, although market dynamics are complex and unpredictable.

- Further Institutional Adoption: This milestone is likely to encourage even more institutional investors to enter the market, further accelerating the growth of the Bitcoin ecosystem.

- Enhanced Liquidity: Increased trading volume through ETFs will enhance market liquidity, making it easier for investors to buy and sell Bitcoin.

- Regulatory Scrutiny: The growing popularity and influence of Bitcoin ETFs may lead to increased regulatory scrutiny and the potential for stricter regulations in the future.

Looking Ahead:

The $5 billion milestone in Bitcoin ETF investment marks a significant turning point. While uncertainty remains inherent in the cryptocurrency market, this surge in institutional capital injection signals a promising future for Bitcoin's integration into the mainstream financial landscape. It remains crucial to stay informed about market trends and regulatory developments to navigate this evolving investment landscape effectively. Further research into the potential benefits and risks associated with Bitcoin investments is highly recommended before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you could lose some or all of your invested capital. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Massive Bitcoin ETF Investment: The Implications Of The $5 Billion Milestone. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufc Fans React To Jon Jones Cryptic I M Done Tweet Aspinall Fight In Jeopardy

May 20, 2025

Ufc Fans React To Jon Jones Cryptic I M Done Tweet Aspinall Fight In Jeopardy

May 20, 2025 -

Stock Market Today Six Day Winning Streak For S And P 500 Amidst Moodys Downgrade

May 20, 2025

Stock Market Today Six Day Winning Streak For S And P 500 Amidst Moodys Downgrade

May 20, 2025 -

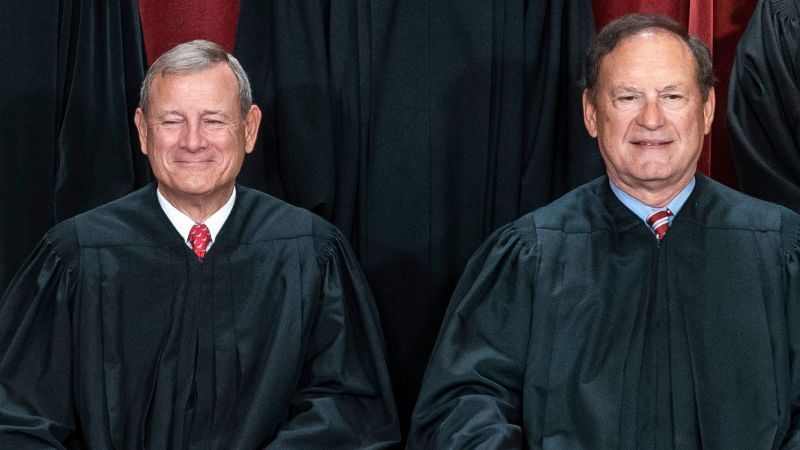

Alito And Roberts Supreme Court Impact A Look Back At Two Decades

May 20, 2025

Alito And Roberts Supreme Court Impact A Look Back At Two Decades

May 20, 2025 -

Fan Frenzy Jon Jones Future In Jeopardy Amidst Aspinall Contract Talks

May 20, 2025

Fan Frenzy Jon Jones Future In Jeopardy Amidst Aspinall Contract Talks

May 20, 2025 -

Jon Jones Calls For Aspinall Stripping Mma Community Responds

May 20, 2025

Jon Jones Calls For Aspinall Stripping Mma Community Responds

May 20, 2025

Latest Posts

-

Olympic Gold The Hidden Price Of A Coachs Ruthless Training

May 21, 2025

Olympic Gold The Hidden Price Of A Coachs Ruthless Training

May 21, 2025 -

Brexit Negotiations Eu And Uk On The Brink

May 21, 2025

Brexit Negotiations Eu And Uk On The Brink

May 21, 2025 -

5 Billion Poured Into Bitcoin Etfs Understanding The Risks And Rewards

May 21, 2025

5 Billion Poured Into Bitcoin Etfs Understanding The Risks And Rewards

May 21, 2025 -

Fallout After Lineker Tweet Hosts Future At Bbc Uncertain

May 21, 2025

Fallout After Lineker Tweet Hosts Future At Bbc Uncertain

May 21, 2025 -

Solving The Puzzle A Pachyrhinosaurus Mass Grave In Canada

May 21, 2025

Solving The Puzzle A Pachyrhinosaurus Mass Grave In Canada

May 21, 2025