Mastering Options Trading For Broadcom's Upcoming Earnings Announcement

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mastering Options Trading for Broadcom's Upcoming Earnings Announcement

Broadcom (AVGO) is gearing up for its next earnings announcement, sending ripples of anticipation – and opportunity – through the options market. For seasoned traders and newcomers alike, this presents a chance to potentially profit, but navigating the complexities of options trading requires careful planning and understanding. This article will guide you through strategies for leveraging Broadcom's earnings announcement, focusing on risk management and maximizing potential returns.

Understanding the Volatility Ahead

Broadcom, a leading semiconductor company, is known for its volatile stock price. Earnings announcements often amplify this volatility, creating a potentially lucrative environment for options traders. However, high volatility also means higher risk. Before diving in, it's crucial to understand the factors influencing AVGO's price:

- Market Sentiment: The overall market climate significantly impacts Broadcom's stock. A bearish market could dampen even positive earnings news. Stay informed about broader economic trends and market indices like the S&P 500.

- Guidance: Broadcom's earnings announcement will include forward-looking guidance. This guidance, more than the current quarter's results, can significantly impact the stock price. Pay close attention to management's commentary.

- Industry Trends: The semiconductor industry is dynamic and susceptible to supply chain disruptions and geopolitical events. Understanding these trends is crucial for predicting AVGO's performance.

- Competition: Broadcom operates in a competitive market. News about competitors' performance or product launches can influence investor sentiment and AVGO's stock price.

Options Strategies for Broadcom's Earnings

Several options strategies can be employed, each carrying its own level of risk and reward:

1. Straddles and Strangles: These strategies profit from significant price movement in either direction. A straddle involves buying both a call and a put option with the same strike price and expiration date. A strangle offers a similar strategy but with different strike prices (out-of-the-money options). These are suitable if you anticipate a large price swing but are unsure of the direction.

2. Bullish/Bearish Spreads: If you have a strong directional view, spreads offer a more defined risk profile than outright option purchases. A bullish call spread involves buying a call option and simultaneously selling a higher-strike call option. A bearish put spread mirrors this, but with put options. These reduce the initial investment but limit potential profit.

3. Iron Condors/Iron Butterflies: These strategies are neutral, profiting from low volatility. They involve buying and selling multiple options at various strike prices. These are more complex strategies suitable for experienced traders comfortable with defined risk profiles.

Risk Management: The Cornerstone of Options Trading

Regardless of the strategy, effective risk management is paramount:

- Define your risk tolerance: Before trading, determine how much you're willing to lose. Options trading can lead to significant losses if not managed carefully.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across various assets to mitigate risk.

- Use stop-loss orders: These orders automatically sell your options if the price falls below a certain level, limiting potential losses.

- Don't overleverage: Avoid using excessive margin, as this can amplify both profits and losses.

Where to Find More Information

For comprehensive education on options trading, consider reputable resources such as the Options Industry Council website ([link to OIC website]). Always conduct thorough research and seek professional financial advice if needed.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Options trading involves significant risk, and you could lose your entire investment. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mastering Options Trading For Broadcom's Upcoming Earnings Announcement. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

22 Crew Rescued After Car Carrier Fire In North Pacific

Jun 05, 2025

22 Crew Rescued After Car Carrier Fire In North Pacific

Jun 05, 2025 -

Winter Fuel Payment U Turn Chancellor Confirms 2024 Payments

Jun 05, 2025

Winter Fuel Payment U Turn Chancellor Confirms 2024 Payments

Jun 05, 2025 -

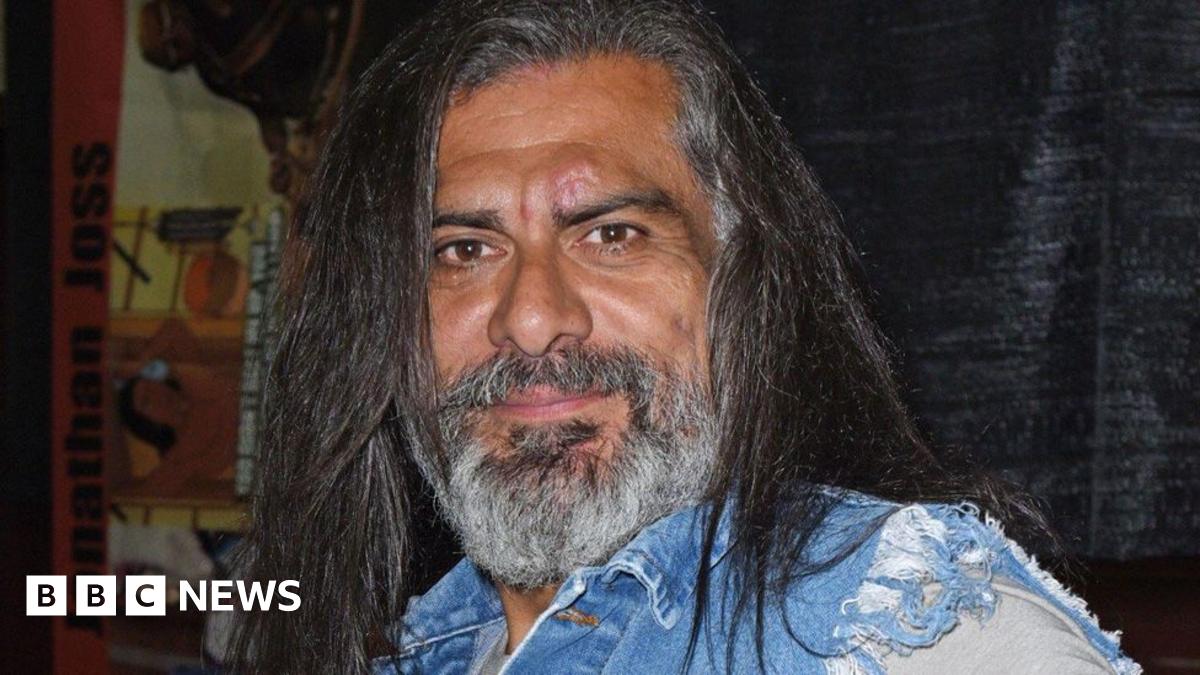

King Of The Hill Actor Jonathan Joss Fatally Shot Fans Mourn Loss Of John Redcorn

Jun 05, 2025

King Of The Hill Actor Jonathan Joss Fatally Shot Fans Mourn Loss Of John Redcorn

Jun 05, 2025 -

Us Supreme Court Decision Implications Of Reverse Discrimination Ruling

Jun 05, 2025

Us Supreme Court Decision Implications Of Reverse Discrimination Ruling

Jun 05, 2025 -

Alexander Bubliks View The Mental Landscape Of Professional Tennis

Jun 05, 2025

Alexander Bubliks View The Mental Landscape Of Professional Tennis

Jun 05, 2025

Latest Posts

-

Can Topshop Reclaim Its Place On The High Street

Aug 17, 2025

Can Topshop Reclaim Its Place On The High Street

Aug 17, 2025 -

Stalker 2 Development Roadmap Ps 5 And Ps 5 Pro Versions Confirmed

Aug 17, 2025

Stalker 2 Development Roadmap Ps 5 And Ps 5 Pro Versions Confirmed

Aug 17, 2025 -

Ukraine Conflict A Nations Fate And Global Prayers For Peace

Aug 17, 2025

Ukraine Conflict A Nations Fate And Global Prayers For Peace

Aug 17, 2025 -

Bidens Crime Concerns A 1992 Warning Resonates Today

Aug 17, 2025

Bidens Crime Concerns A 1992 Warning Resonates Today

Aug 17, 2025 -

Dev Combating Bots And Boosters In 2025 And Beyond

Aug 17, 2025

Dev Combating Bots And Boosters In 2025 And Beyond

Aug 17, 2025