Maximize Retirement Savings: A Report On Self-Directed Gold & Precious Metal IRAs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Maximize Retirement Savings: A Report on Self-Directed Gold & Precious Metal IRAs

Retirement planning is a crucial aspect of financial security, and maximizing your savings is paramount. While traditional retirement accounts offer stability, many investors are exploring alternative options to diversify their portfolios and potentially enhance returns. One such option gaining popularity is the self-directed gold and precious metals IRA. This comprehensive report explores the benefits, risks, and considerations of using precious metals as part of your retirement strategy.

What is a Self-Directed IRA?

A self-directed IRA (SDIRA) gives you greater control over your investment choices compared to traditional or Roth IRAs. Unlike accounts restricted to stocks, bonds, and mutual funds, a SDIRA allows you to invest in a broader range of assets, including alternative investments like real estate, private equity, and – importantly for this discussion – precious metals such as gold, silver, platinum, and palladium.

Why Choose Gold and Precious Metals for Your Retirement?

Many investors see precious metals as a hedge against inflation and economic uncertainty. Historically, gold has performed well during times of economic instability, potentially preserving the value of your retirement savings. The reasons for incorporating precious metals into your retirement plan are numerous:

- Inflation Hedge: Precious metals are often considered a safeguard against inflation, as their value tends to rise when the purchasing power of fiat currencies decreases.

- Portfolio Diversification: Adding precious metals diversifies your retirement portfolio, reducing reliance on traditional assets and potentially mitigating risk.

- Tangible Asset: Unlike stocks or bonds, which are intangible assets, precious metals are physical assets you can own.

- Potential for Growth: While prices fluctuate, precious metals have historically shown long-term growth potential.

How to Invest in Gold and Precious Metals Through a Self-Directed IRA:

Investing in precious metals within an SDIRA requires careful planning and adherence to IRS regulations. You cannot simply purchase and store the metals yourself. Instead, you must work with a custodian approved by the IRS who will hold the physical metals on your behalf within your IRA account. The custodian will ensure compliance with all regulations and handle the storage and transfer of the precious metals.

Choosing the Right Custodian:

Selecting a reputable custodian is crucial. Look for a custodian with experience in handling precious metals IRAs, transparent fees, and strong security measures to protect your assets. Thorough research is recommended before making a decision. Consider factors like:

- Reputation and Experience: Look for a custodian with a proven track record and positive client reviews.

- Fees and Charges: Compare fees for storage, administration, and transactions.

- Security Measures: Ensure the custodian uses secure vaults and robust security protocols.

- IRS Compliance: Verify that the custodian is fully compliant with all relevant IRS regulations.

Risks Associated with Precious Metals IRAs:

While precious metals can offer diversification and potential benefits, it's essential to acknowledge the inherent risks:

- Price Volatility: Precious metal prices fluctuate significantly, leading to potential losses.

- Storage Costs: Storing physical metals incurs ongoing costs.

- Liquidity: Selling precious metals might take longer than selling stocks or bonds.

- Tax Implications: Consult with a qualified financial advisor and tax professional to understand the tax implications of investing in a precious metals IRA.

Conclusion:

A self-directed gold and precious metals IRA can be a valuable component of a diversified retirement strategy, offering potential protection against inflation and economic downturns. However, it is crucial to proceed with careful planning, understanding the risks involved, and selecting a reputable custodian. Remember to consult with a qualified financial advisor and tax professional before making any investment decisions. They can help you determine if this investment strategy aligns with your individual financial goals and risk tolerance. Don't hesitate to seek professional guidance to navigate the complexities of self-directed IRAs and maximize your retirement savings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Maximize Retirement Savings: A Report On Self-Directed Gold & Precious Metal IRAs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Trump To Departure The Stories Of Americans Leaving The Country

Jun 05, 2025

From Trump To Departure The Stories Of Americans Leaving The Country

Jun 05, 2025 -

Roland Garros 2024 Mastering The Demands Of Clay

Jun 05, 2025

Roland Garros 2024 Mastering The Demands Of Clay

Jun 05, 2025 -

Us Economy Defies Expectations Aprils Job Openings Report

Jun 05, 2025

Us Economy Defies Expectations Aprils Job Openings Report

Jun 05, 2025 -

Patriot League Expands Villanovas Football Future

Jun 05, 2025

Patriot League Expands Villanovas Football Future

Jun 05, 2025 -

Winter Fuel Payment Policy Change Chancellors Latest Statement Explained

Jun 05, 2025

Winter Fuel Payment Policy Change Chancellors Latest Statement Explained

Jun 05, 2025

Latest Posts

-

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025

Topshops Revival A High Street Return And The Challenge Of Cool

Aug 17, 2025 -

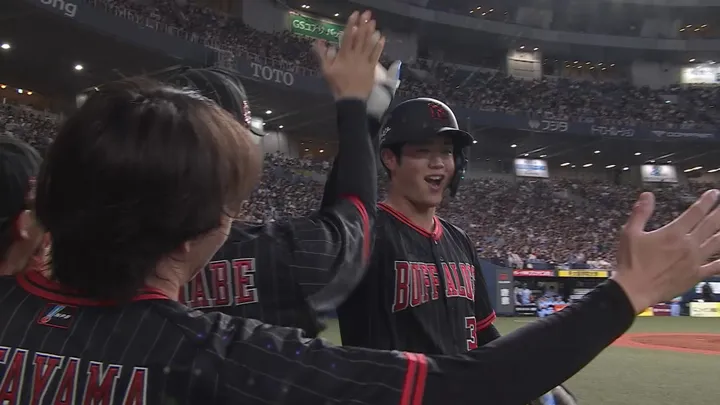

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025

Ryo Otas Grand Slam Two Run Deficit After Eighth Bases Loaded Blast

Aug 17, 2025 -

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025

Federal Grand Jury Charges New Orleans Mayor With Corruption Years Long Investigation Concludes

Aug 17, 2025 -

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025

Controversy Erupts Uk Trade Envoy Quits Over Northern Cyprus Visit

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyl Update Ps 5 Release Coming By End Of 2025

Aug 17, 2025