Maximize Retirement Savings: Self-Directed Gold & Precious Metal IRAs Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Maximize Retirement Savings: Self-Directed Gold & Precious Metal IRAs Explained

Retirement planning is crucial, and diversifying your portfolio is key to securing your financial future. While traditional retirement accounts often focus on stocks and bonds, exploring alternative options like self-directed gold and precious metal IRAs can significantly enhance your savings strategy. This comprehensive guide will explain what they are, how they work, and why they might be right for you.

What is a Self-Directed IRA?

A Self-Directed IRA (SDIRA) offers investors greater control over their retirement investments compared to traditional IRAs. Instead of being limited to stocks, bonds, and mutual funds, a SDIRA allows you to invest in a wider range of assets, including real estate, private equity, and – importantly for this discussion – precious metals like gold, silver, platinum, and palladium. This expanded investment flexibility can be particularly appealing in times of economic uncertainty.

Why Choose a Gold IRA?

Gold and other precious metals have historically acted as a hedge against inflation and economic downturns. When the stock market fluctuates, precious metals can offer a degree of stability, helping to protect your retirement savings from significant losses. This diversification is a key benefit for many investors seeking to mitigate risk. Investing in a Gold IRA allows you to leverage the potential benefits of precious metals within the tax-advantaged environment of a retirement account.

How Does a Self-Directed Gold IRA Work?

Investing in precious metals through a self-directed IRA involves several steps:

-

Establish a Self-Directed IRA: You'll need to open a self-directed IRA account with a custodian specifically authorized to handle precious metals transactions. It's crucial to choose a reputable custodian with experience in this area.

-

Purchase Approved Precious Metals: You can then purchase gold, silver, platinum, or palladium bullion from an approved depository and IRA-eligible dealer. The metals must meet specific purity standards to qualify for IRA investment.

-

Transfer to Depository: The purchased precious metals are then transferred to a secure, IRS-approved depository that specializes in storing assets for IRAs. This ensures compliance with all regulations.

-

Custodian Oversight: Your custodian maintains oversight of the precious metals held in your IRA, ensuring compliance with IRS rules and regulations throughout the process.

Tax Advantages of a Gold IRA:

One of the major benefits of investing in precious metals through a self-directed IRA is the tax-deferred growth. This means you won't pay taxes on the investment gains until you begin withdrawing funds in retirement. This tax advantage can significantly boost your retirement savings over time. Consult with a tax professional to fully understand the implications for your specific situation.

Risks and Considerations:

While precious metals offer diversification benefits, it’s crucial to understand the potential risks:

- Market Volatility: Although generally considered a safe haven asset, the price of precious metals can fluctuate.

- Storage Costs: Storing precious metals in an IRS-approved depository incurs fees.

- Liquidity: Compared to stocks and bonds, precious metals can be less liquid.

Choosing the Right Custodian:

Selecting the right custodian is paramount. Look for a custodian with:

- Experience with Precious Metals: Ensure they have a proven track record in handling precious metal transactions within IRAs.

- Excellent Customer Service: A responsive and helpful custodian can make the process smoother.

- Transparency and Fees: Understand all fees associated with the account and the custodian's pricing structure.

Conclusion:

A self-directed gold and precious metal IRA offers a unique opportunity to diversify your retirement portfolio and potentially protect your savings from market volatility. However, thorough research and understanding of the associated risks and regulations are crucial before making any investment decisions. Consult with a qualified financial advisor to determine if this investment strategy aligns with your individual retirement goals and risk tolerance. Remember to always work with reputable custodians and dealers to ensure compliance with all IRS regulations. Proper planning and diligent research are key to maximizing your retirement savings.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Maximize Retirement Savings: Self-Directed Gold & Precious Metal IRAs Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

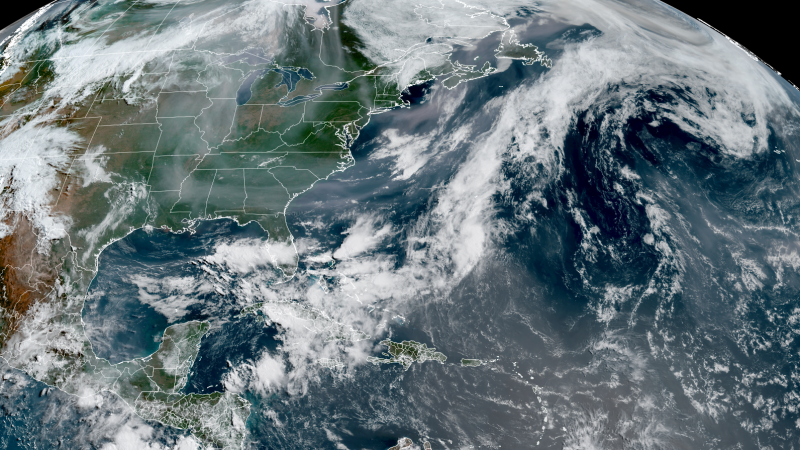

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025

Weather Forecast Imminent Collision Of Canadian Smoke And African Dust Over Southern Regions

Jun 05, 2025 -

From The Vault Grace Potters Collection Of Unreleased Recordings

Jun 05, 2025

From The Vault Grace Potters Collection Of Unreleased Recordings

Jun 05, 2025 -

Man Arrested In New York In Fbi Investigation Of California Fertility Clinic Bombing

Jun 05, 2025

Man Arrested In New York In Fbi Investigation Of California Fertility Clinic Bombing

Jun 05, 2025 -

Ryan Gosling A Contender For White Black Panther In The Mcu Post Ketema

Jun 05, 2025

Ryan Gosling A Contender For White Black Panther In The Mcu Post Ketema

Jun 05, 2025 -

Confirmed Body Discovered In Portugal Identifies Missing Stag Party Guest From Scotland

Jun 05, 2025

Confirmed Body Discovered In Portugal Identifies Missing Stag Party Guest From Scotland

Jun 05, 2025

Latest Posts

-

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025

Tristan Rogers Dead At 79 Remembering Robert Scorpio Of General Hospital

Aug 17, 2025 -

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025