META Stock Post US-China Trade Agreement: Investment Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

META Stock Post US-China Trade Agreement: Investment Analysis

The recent US-China trade agreement has sent ripples through global markets, leaving investors wondering about the implications for various sectors. One company attracting significant attention is Meta Platforms (META), formerly Facebook. While not directly involved in the immediate trade disputes, the agreement's broader economic consequences could significantly impact META's performance. This analysis delves into the potential effects of the US-China trade agreement on META stock and offers insights for investors.

Understanding the US-China Trade Agreement's Impact:

The US-China trade agreement, while complex, aims to reduce trade tensions and foster economic cooperation. However, the long-term effects remain uncertain. For META, the key areas of concern include:

- Global Economic Growth: A stable trade relationship between the world's two largest economies generally supports global economic growth. Stronger global growth usually translates to increased advertising spending, a vital revenue stream for META. Conversely, a downturn in global economic activity could negatively impact advertising budgets.

- Access to the Chinese Market: While META's core services like Facebook are blocked in mainland China, the agreement's broader implications for technology companies could indirectly influence META's future strategies. Any easing of restrictions on technology companies could open new opportunities, albeit potentially with significant regulatory hurdles.

- Supply Chain Impacts: The agreement could impact global supply chains, potentially affecting META's infrastructure and operations. While META's primary operations are not heavily reliant on manufacturing in China, disruptions to global supply chains could still indirectly influence costs and efficiency.

- Regulatory Uncertainty: The ongoing regulatory scrutiny facing large tech companies worldwide remains a significant risk factor for META. The US-China trade agreement, while not directly addressing this issue, could influence the broader regulatory environment, adding to the uncertainty surrounding META's long-term prospects.

META's Strengths and Vulnerabilities:

META possesses several inherent strengths, including:

- Dominant Market Position: META maintains a dominant position in social media and digital advertising, giving it significant pricing power and resilience against minor economic fluctuations.

- Diversification Efforts: META's ongoing diversification into areas like the metaverse (Metaverse projects, Horizon Worlds) and virtual reality (VR) headsets could mitigate risks associated with reliance on a single revenue stream.

- Strong User Base: META boasts a massive and engaged user base globally, providing a strong foundation for continued advertising revenue growth.

However, META also faces vulnerabilities:

- Regulatory Risks: Stringent data privacy regulations and antitrust concerns in various jurisdictions pose a continuous threat to META's operations and profitability.

- Competition: Increasing competition from other tech giants, particularly in the digital advertising space, presents a challenge to META's market dominance.

- Economic Downturn: A significant global economic downturn could severely impact advertising spending, directly impacting META's revenue.

Investment Implications:

The US-China trade agreement's impact on META stock is difficult to predict with certainty. However, investors should consider:

- Long-term perspective: Investing in META requires a long-term outlook, recognizing the inherent uncertainties associated with the global economy and regulatory landscape.

- Diversification: A diversified investment portfolio can help mitigate risks associated with any single stock, including META.

- Fundamental analysis: Thorough fundamental analysis, considering both META's strengths and vulnerabilities, is crucial before making any investment decisions. Examine factors like revenue growth, profit margins, and debt levels. Consider consulting with a financial advisor before making any significant investment.

Conclusion:

The US-China trade agreement presents both opportunities and challenges for META. While the agreement's direct impact on META might be limited, its broader economic and regulatory implications will play a crucial role in shaping the company's future performance. Investors should carefully analyze these factors, along with META's fundamental strengths and weaknesses, before making any investment decisions. Remember to conduct your own thorough research and consult with a financial professional before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on META Stock Post US-China Trade Agreement: Investment Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

President Bidens Health Under Scrutiny Aide Denies Cover Up Allegations In New Book

May 15, 2025

President Bidens Health Under Scrutiny Aide Denies Cover Up Allegations In New Book

May 15, 2025 -

Lawsuit Alleges Sean Combs Drugged And Forced Ex Girlfriend Into Sex Acts

May 15, 2025

Lawsuit Alleges Sean Combs Drugged And Forced Ex Girlfriend Into Sex Acts

May 15, 2025 -

Taiwan Demonstrates New Himars Capabilities In Live Fire Exercise

May 15, 2025

Taiwan Demonstrates New Himars Capabilities In Live Fire Exercise

May 15, 2025 -

After Injury Kershaw Pitches In Season Debut For Dodgers Year 18

May 15, 2025

After Injury Kershaw Pitches In Season Debut For Dodgers Year 18

May 15, 2025 -

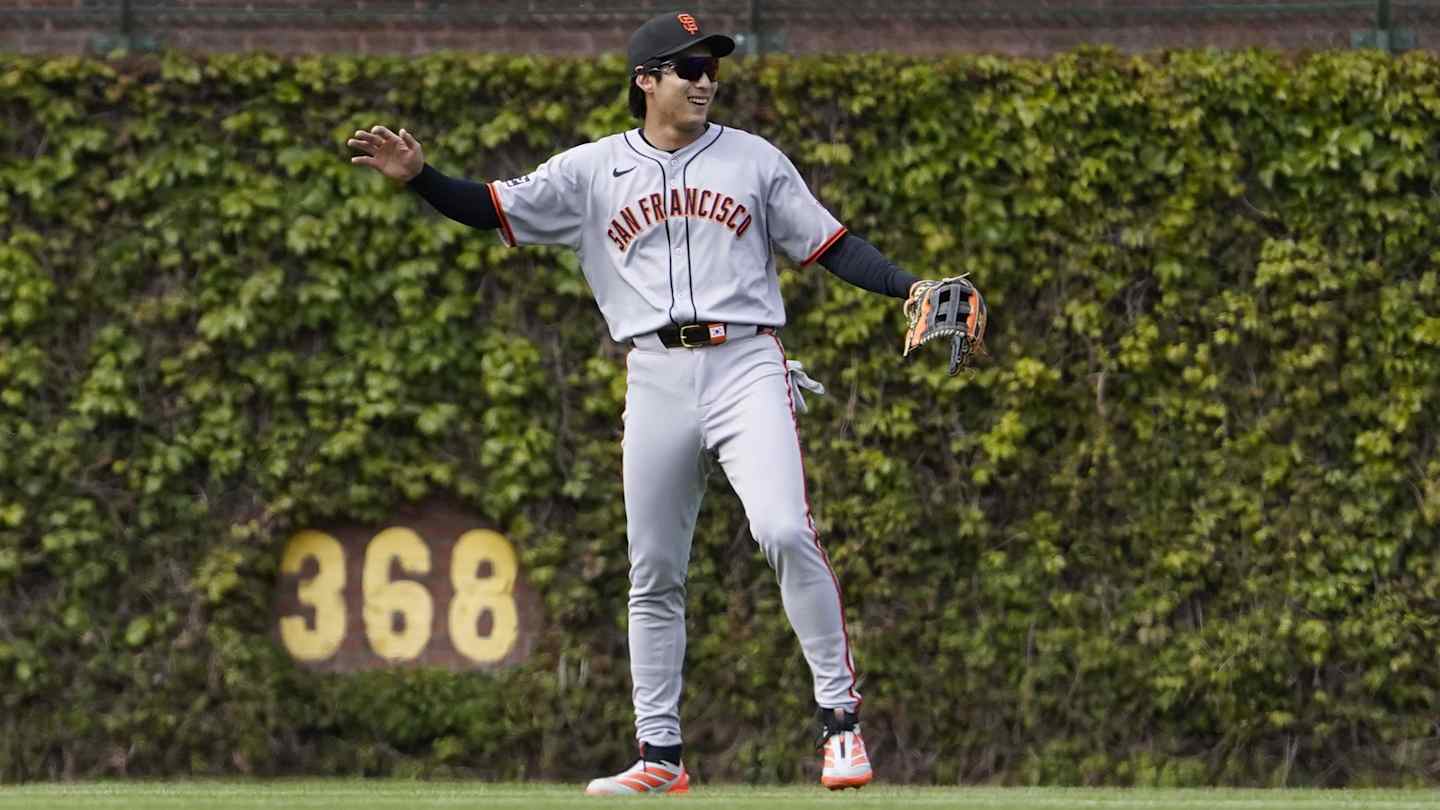

Giants Breakout Star A Turning Point In Their Season

May 15, 2025

Giants Breakout Star A Turning Point In Their Season

May 15, 2025