Mike Lynch And Partner Ordered To Pay HP Enterprise £700 Million

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

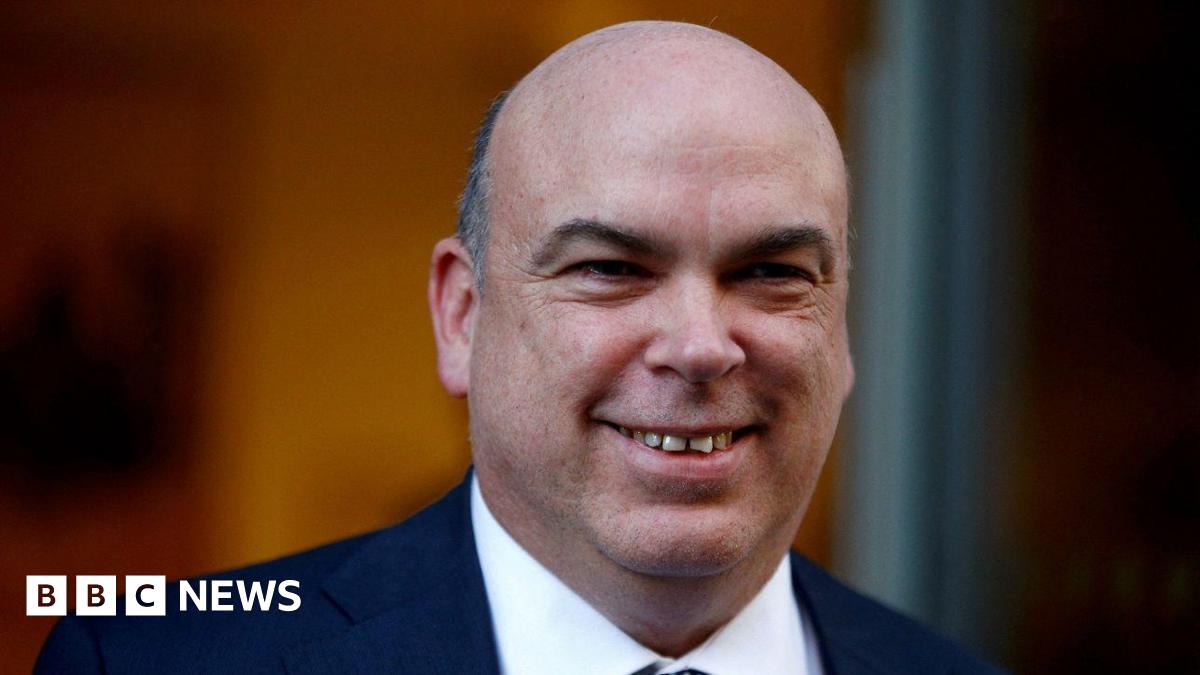

Mike Lynch and Partner Ordered to Pay HP Enterprise £700 Million in Landmark Case

A London court has delivered a resounding victory for HP Enterprise (HPE), ordering Autonomy founder Mike Lynch and his former partner, Sushovan Hussain, to pay a staggering £700 million in damages. This landmark ruling concludes a long-running and fiercely contested legal battle stemming from HPE's controversial $11 billion acquisition of Autonomy in 2011. The judgment represents a significant win for HPE, which had accused Lynch and Hussain of inflating Autonomy's value through accounting fraud before the sale.

The case, which has spanned years and involved complex forensic accounting and technical evidence, hinged on allegations of systematic misrepresentation of Autonomy's financial performance. HPE argued that Lynch and Hussain knowingly misled them about the true state of Autonomy's business, resulting in a substantial overpayment. This ultimately led to significant losses for HPE following the acquisition.

The Judge's Decision and its Implications

Following a lengthy trial, the judge ruled decisively in favor of HPE. The £700 million award covers damages and interest, reflecting the court's finding that Lynch and Hussain were responsible for the misrepresentations that led to HPE's losses. This decision has sent shockwaves through the business world, highlighting the significant legal and financial repercussions of corporate fraud. It also sets a crucial precedent for future cases involving similar allegations of accounting irregularities in mergers and acquisitions.

Key aspects of the ruling include:

- Confirmation of fraudulent activity: The judge's decision explicitly confirms the presence of accounting irregularities and misrepresentations within Autonomy's financial reporting.

- Significant financial penalty: The £700 million judgment is one of the largest ever awarded in a UK accounting fraud case, underscoring the severity of the misconduct.

- Impact on M&A due diligence: This case serves as a stark reminder of the importance of thorough due diligence in mergers and acquisitions, emphasizing the need for rigorous scrutiny of target companies' financial records.

The Ongoing Battle: Appeals and Future Prospects

While the ruling represents a significant win for HPE, the legal battle may not be entirely over. Both Lynch and Hussain have indicated their intention to appeal the decision. The appeals process could potentially take years and involve further legal complexities. The outcome of any appeal will have significant implications for all parties involved.

This case highlights the crucial role of robust corporate governance and transparency in preventing and addressing accounting fraud. For businesses involved in mergers and acquisitions, this ruling underscores the critical importance of thorough due diligence and careful scrutiny of financial information.

What This Means for Investors and Businesses

The outcome of this case has far-reaching implications for investors and businesses. It underlines the potential for significant financial consequences stemming from corporate fraud and the importance of robust internal controls and ethical business practices. Companies involved in high-value transactions should learn from this case and prioritize thorough due diligence to mitigate potential risks.

Further reading: You can find more information on similar high-profile cases of corporate fraud and accounting irregularities through resources like the and the . Staying informed about such developments is crucial for anyone involved in the business world. This case reinforces the need for robust legal protection and stringent oversight in mergers and acquisitions.

This article is for informational purposes only and does not constitute legal or financial advice. Always seek professional advice when making financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mike Lynch And Partner Ordered To Pay HP Enterprise £700 Million. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

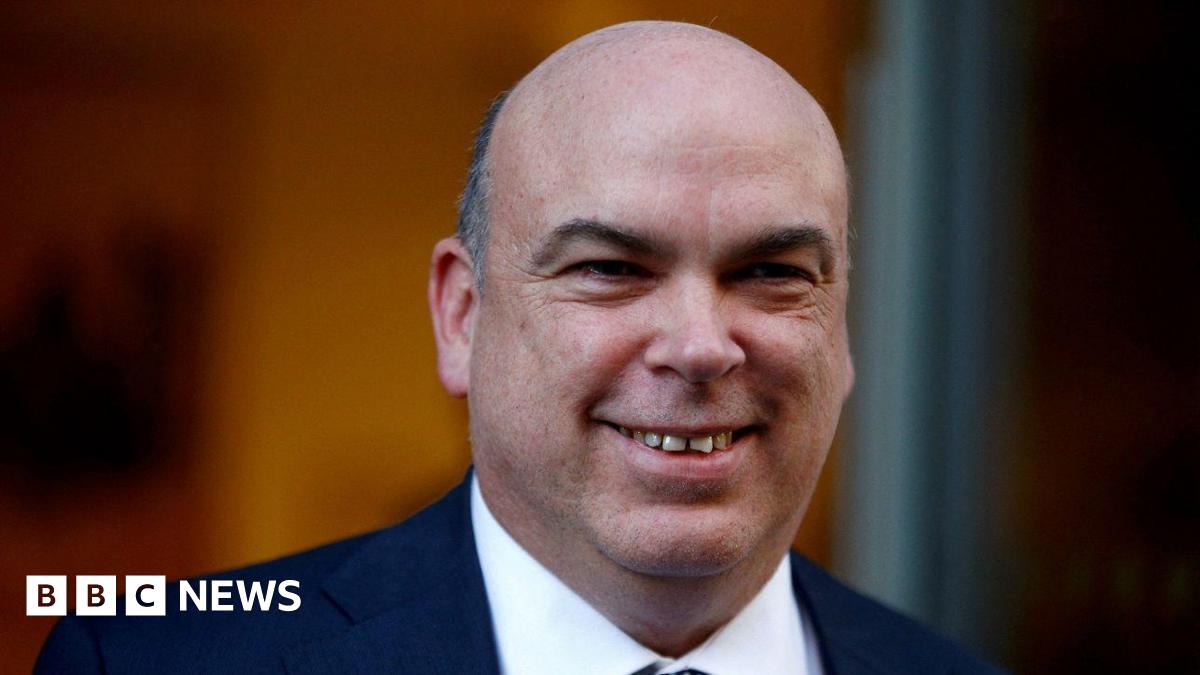

Lost Saga Found Researchers Crack Medieval Scribes Code

Jul 24, 2025

Lost Saga Found Researchers Crack Medieval Scribes Code

Jul 24, 2025 -

Mets Trade Deadline Rumors Cease To New York Padres Talks Confirmed

Jul 24, 2025

Mets Trade Deadline Rumors Cease To New York Padres Talks Confirmed

Jul 24, 2025 -

Investigation Uncovers Ex Union Boss Mc Cluskeys Use Of Private Jets Funded By Building Firm

Jul 24, 2025

Investigation Uncovers Ex Union Boss Mc Cluskeys Use Of Private Jets Funded By Building Firm

Jul 24, 2025 -

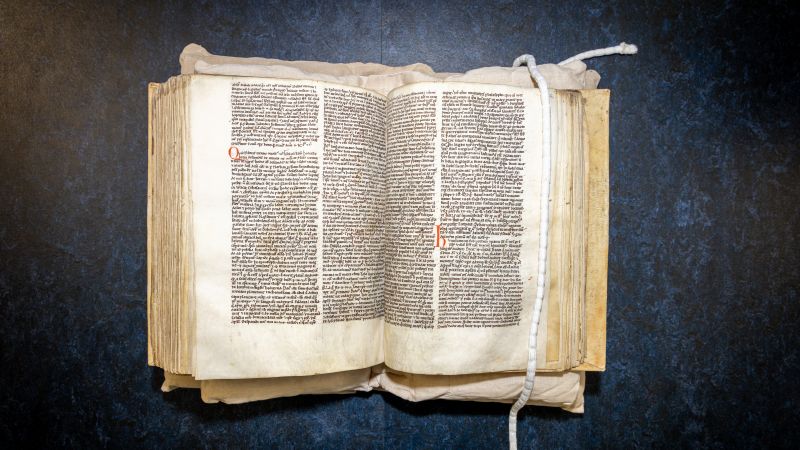

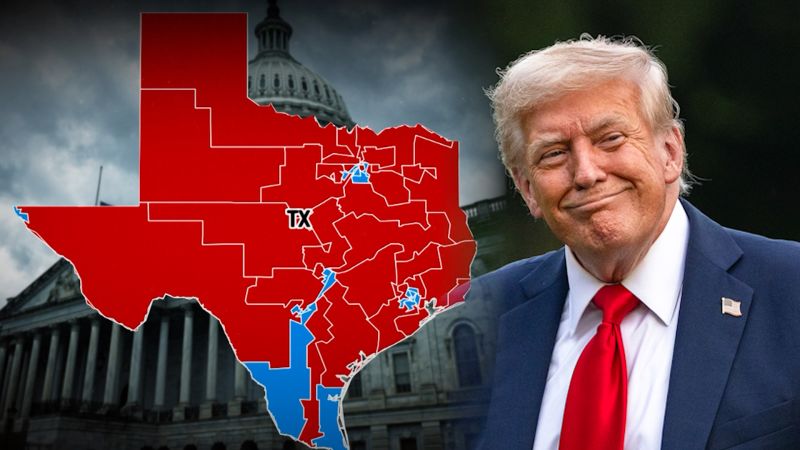

Trumps Texas Maneuver Democratic Party Strategizes A Counteroffensive

Jul 24, 2025

Trumps Texas Maneuver Democratic Party Strategizes A Counteroffensive

Jul 24, 2025 -

700 Million Debt Mike Lynch And Business Partner Face Hp Enterprise Judgment

Jul 24, 2025

700 Million Debt Mike Lynch And Business Partner Face Hp Enterprise Judgment

Jul 24, 2025

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win

Washington Open Update Raducanu Advances To Semifinals After Sakkari Win