Millions At Risk? Understanding The Implications Of The New Car Finance Ruling

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Millions at Risk? Understanding the Implications of the New Car Finance Ruling

The recent ruling on car finance practices has sent shockwaves through the industry, leaving millions of drivers potentially vulnerable to significant financial repercussions. This article breaks down the key implications of this landmark decision and offers advice on how to protect yourself.

The automotive industry is facing a seismic shift following a groundbreaking legal ruling that impacts millions of car finance agreements. The ruling, which challenges [mention specific aspect of finance practices challenged, e.g., the use of add-on insurance products, or specific clauses in contracts], has cast a long shadow over the sector, raising concerns about potential widespread financial distress among borrowers. Experts predict a potential wave of legal challenges and renegotiations, leaving many consumers uncertain about their future payments.

What Does the Ruling Mean for Consumers?

The implications of this ruling are far-reaching and potentially devastating for numerous individuals. Here's a breakdown of the key consequences:

- Increased Scrutiny of Existing Contracts: Millions of car finance agreements are now under a microscope. Borrowers might find clauses in their contracts deemed unfair or unenforceable, leading to potential repayments reductions or even contract cancellations.

- Potential for Repayment Reductions: The ruling could lead to significantly lower monthly payments for many affected consumers. This is particularly good news for those struggling to meet their current obligations.

- Legal Challenges and Recourse: Individuals with potentially unfair contracts now have stronger legal grounds to challenge their agreements and seek compensation. This means navigating the legal system, potentially incurring costs.

- Impact on Future Finance Agreements: The ruling will likely force lenders to revise their contracts and practices, potentially leading to stricter lending criteria and higher interest rates for future borrowers.

Understanding Your Rights and Taking Action

If you're concerned about the impact of this ruling on your car finance agreement, here's what you should do:

- Review Your Contract Carefully: Examine your contract for any clauses that might be deemed unfair or misleading under the new ruling. Look for terms related to [mention specific terms like hidden fees, excessive interest rates, or unfair penalty clauses].

- Seek Independent Legal Advice: If you suspect your contract is problematic, consult with a solicitor or consumer rights organization specializing in finance disputes. They can advise you on your options and the best course of action.

- Contact Your Lender: Communicate with your lender and inquire about the implications of the ruling on your specific agreement. Be prepared to provide documentation and be persistent in seeking clarity.

- Monitor for Updates: Keep abreast of developments by following reputable financial news sources and consumer protection organizations. Legislation might change, and further clarifications on the ruling are likely.

The Road Ahead: Changes in the Car Finance Landscape

This landmark ruling signifies a significant shift in the car finance industry. Expect increased regulation and greater consumer protection measures in the coming months and years. Lenders are likely to adjust their practices to comply with the new legal landscape, potentially leading to changes in interest rates, contract terms, and lending criteria.

What are your thoughts on this crucial development? Share your experiences and concerns in the comments below. [This acts as a subtle CTA encouraging engagement.]

Related Resources:

- [Link to a relevant government website offering consumer protection advice]

- [Link to a reputable consumer rights organization]

Keywords: Car finance ruling, car finance implications, car loan, auto loan, consumer rights, legal action, financial repercussions, unfair contracts, repayment reduction, [add other relevant keywords].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Millions At Risk? Understanding The Implications Of The New Car Finance Ruling. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kai Cenat And X Qc Comparing The Net Worth Of Streaming Giants

Aug 03, 2025

Kai Cenat And X Qc Comparing The Net Worth Of Streaming Giants

Aug 03, 2025 -

Analyzing The Allegations Investigating Claims Of Israeli Actions Leading To Famine And Summer Camp Poisoning

Aug 03, 2025

Analyzing The Allegations Investigating Claims Of Israeli Actions Leading To Famine And Summer Camp Poisoning

Aug 03, 2025 -

Is Dexters Comeback A Success Michael C Halls Performance Evaluated

Aug 03, 2025

Is Dexters Comeback A Success Michael C Halls Performance Evaluated

Aug 03, 2025 -

Elon Musks 15 Million Donation To Republicans A Precursor To His New Party

Aug 03, 2025

Elon Musks 15 Million Donation To Republicans A Precursor To His New Party

Aug 03, 2025 -

Team Water Mr Beast And You Tube Creators Tackle The Global Clean Water Crisis

Aug 03, 2025

Team Water Mr Beast And You Tube Creators Tackle The Global Clean Water Crisis

Aug 03, 2025

Latest Posts

-

Montana Business Shooting Multiple Victims Law Enforcement Investigating

Aug 03, 2025

Montana Business Shooting Multiple Victims Law Enforcement Investigating

Aug 03, 2025 -

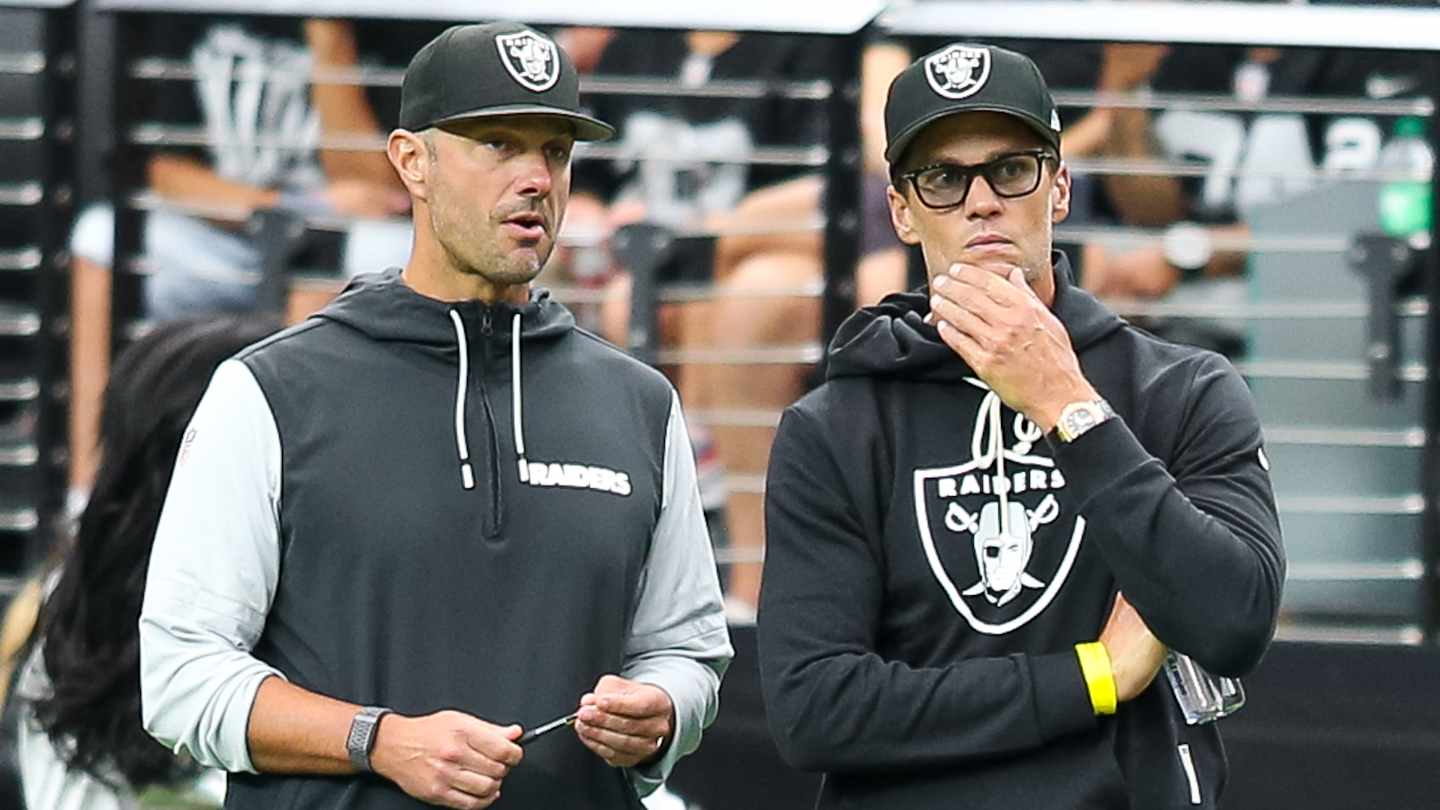

Raiders Training Camp Scrimmage Positive And Negative Observations

Aug 03, 2025

Raiders Training Camp Scrimmage Positive And Negative Observations

Aug 03, 2025 -

Henry Cavill On Superman Reboot All My Focus Confirms Dedication

Aug 03, 2025

Henry Cavill On Superman Reboot All My Focus Confirms Dedication

Aug 03, 2025 -

Fox News Flash Top Sports Headlines For August 2nd

Aug 03, 2025

Fox News Flash Top Sports Headlines For August 2nd

Aug 03, 2025 -

See The Photos Jennifer Lopezs Golden Hair Hidden Under A Turban In Egypt

Aug 03, 2025

See The Photos Jennifer Lopezs Golden Hair Hidden Under A Turban In Egypt

Aug 03, 2025