Millions Of Homeowners To Experience Mortgage Payment Hikes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Millions of Homeowners Brace for Mortgage Payment Hikes: What You Need to Know

Millions of homeowners across the nation are bracing for a significant increase in their mortgage payments as fixed-rate mortgages mature and refinance options dwindle. This looming financial challenge is a direct consequence of the Federal Reserve's aggressive interest rate hikes aimed at combating inflation. The impact is widespread, affecting both recent homebuyers and those who have held their mortgages for years. Understanding the implications and exploring available options is crucial for navigating this turbulent financial landscape.

The Perfect Storm: Rising Rates and Maturing Mortgages

The current situation is a confluence of several factors. Firstly, the Federal Reserve's consistent interest rate increases have drastically altered the mortgage market. What was once a period of historically low interest rates has given way to a new reality of significantly higher borrowing costs. This directly translates to larger monthly payments for new mortgages and those being refinanced.

Secondly, millions of homeowners locked into low-rate mortgages taken out during the period of historically low interest rates are now seeing their fixed-term periods expire. As these mortgages mature, they are forced to refinance at the current, considerably higher rates, leading to a substantial jump in their monthly payments. This shock to household budgets can have far-reaching consequences.

How Much Will Payments Increase?

The magnitude of the increase varies depending on several factors, including the original loan amount, the original interest rate, the term of the loan, and the new interest rate. However, many homeowners are facing increases of hundreds of dollars per month. For some, this could mean the difference between financial stability and serious hardship.

- Example: A homeowner with a $300,000 mortgage at a 3% interest rate might see their monthly payment increase by $500 or more if they refinance at a 7% interest rate. This substantial increase underscores the severity of the situation.

Coping Mechanisms and Available Options:

Facing such a significant increase in monthly expenses can be daunting, but several options exist to mitigate the impact:

- Budget Review: A thorough review of your monthly budget is the first crucial step. Identifying areas where expenses can be reduced can free up funds to cover the increased mortgage payment.

- Refinance Strategically: While current rates are high, refinancing might still be an option depending on your financial situation and credit score. Shop around for the best rates and compare options carefully. [Link to a reputable mortgage comparison website]

- Contact Your Lender: Don't hesitate to reach out to your lender to explore possible options, such as forbearance or loan modification programs, though these might have implications on your credit score.

- Seek Financial Advice: Consulting a financial advisor can provide personalized guidance tailored to your specific circumstances. They can help you develop a financial plan to navigate this challenging period.

Looking Ahead: Navigating the Mortgage Market in Uncertain Times

The current mortgage market presents significant challenges for homeowners. Staying informed about market trends, understanding your financial options, and proactively managing your finances are crucial steps in navigating this period of uncertainty. The coming months will undoubtedly require careful planning and resourcefulness for many homeowners facing these substantial mortgage payment hikes. Staying informed and seeking professional advice when needed can significantly improve the chances of navigating this difficult financial landscape successfully.

Keywords: Mortgage payment hikes, rising interest rates, mortgage refinance, homeowner, financial hardship, budget review, financial advisor, loan modification, forbearance, Federal Reserve, inflation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Millions Of Homeowners To Experience Mortgage Payment Hikes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arsenal And Chelsea In Final Stages Of Noni Madueke Deal

Jul 11, 2025

Arsenal And Chelsea In Final Stages Of Noni Madueke Deal

Jul 11, 2025 -

Brandon Waddell To Start Game 2 For Phillies Thursday

Jul 11, 2025

Brandon Waddell To Start Game 2 For Phillies Thursday

Jul 11, 2025 -

Gazas Healthcare System At Breaking Point Four Babies In One Icu Cot

Jul 11, 2025

Gazas Healthcare System At Breaking Point Four Babies In One Icu Cot

Jul 11, 2025 -

Controversy Erupts Trumps Claim Of Jewish Group Support For Nominee Challenged

Jul 11, 2025

Controversy Erupts Trumps Claim Of Jewish Group Support For Nominee Challenged

Jul 11, 2025 -

Familys Self Deportation From The Us A Story Of Unity And Sacrifice

Jul 11, 2025

Familys Self Deportation From The Us A Story Of Unity And Sacrifice

Jul 11, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

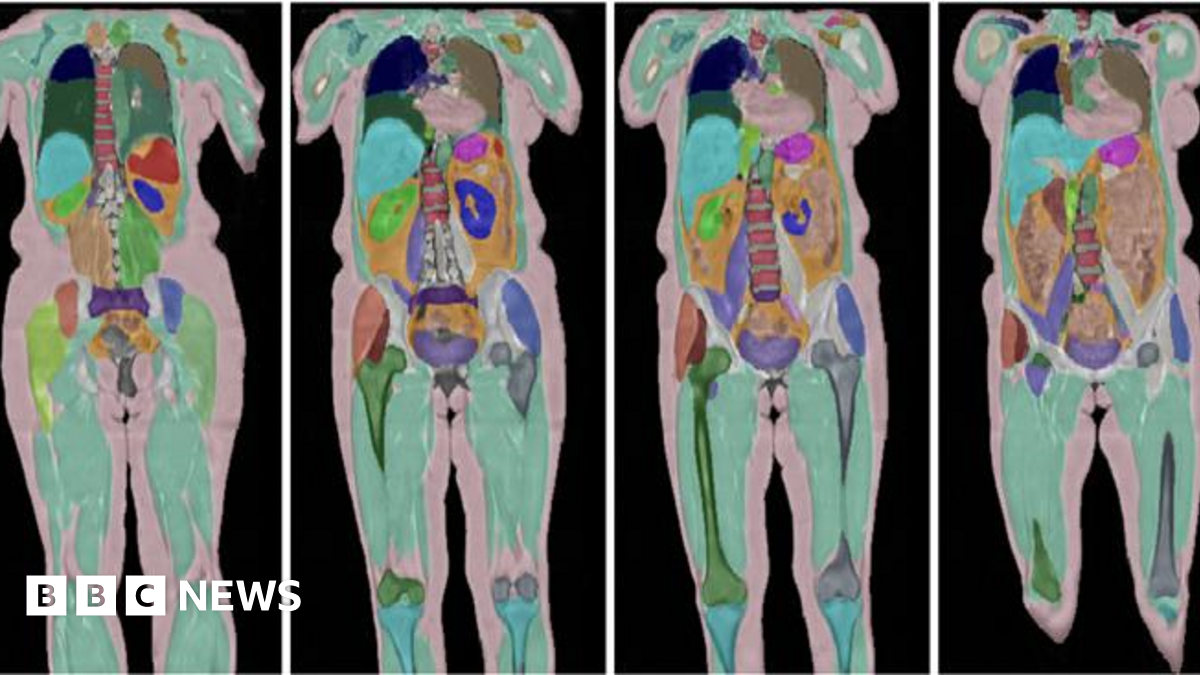

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025