Mom's Credit Card Charged $4,200 For Lollipops: A Son's Expensive Mistake

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mom's Credit Card Charged $4,200 for Lollipops: A Son's Expensive Mistake

A mother's credit card statement revealed a shocking $4,200 charge – all for lollipops. This isn't a sweet story; it's a cautionary tale about the potential pitfalls of unsupervised online shopping and the importance of parental controls. The incident highlights the growing concern of children making unauthorized purchases online and the financial burden it can place on families.

The incident, which quickly went viral on social media, involved a young boy who, while playing a mobile game, accidentally racked up a massive lollipop bill. While the specific details of the game and the purchasing mechanism remain unclear, the story underscores the ease with which children can make significant purchases without parental knowledge or consent. This raises serious questions about the responsibility of game developers, app stores, and parents in preventing similar situations.

How Could This Happen?

Several factors likely contributed to this expensive mistake:

- In-App Purchases: Many mobile games incorporate in-app purchases, often disguised within gameplay. These purchases can be made with a single tap, bypassing multiple confirmation screens that adults might expect.

- Lack of Parental Controls: The mother likely had not enabled sufficient parental controls on her devices or within the app store, allowing her son easy access to her payment information.

- Engaging Gameplay: The game likely employed engaging gameplay mechanics, potentially leading to impulsive purchases without the child fully understanding the financial consequences.

The Aftermath and Lessons Learned:

The mother, understandably upset, is currently working with her credit card company to dispute the charges. While the outcome remains uncertain, the incident serves as a harsh lesson for many parents. This situation isn't unique; similar stories of children making large unauthorized purchases on their parents' accounts are increasingly common.

Protecting Yourself from Similar Situations:

Preventing similar incidents requires a multi-pronged approach:

- Enable Parental Controls: Actively use parental controls on all devices used by children. These controls can limit in-app purchases, restrict access to certain apps, and require passwords for online transactions. Learn how to utilize parental controls offered by your mobile operating system (iOS, Android) and app stores (Google Play, Apple App Store).

- Open Communication: Talk to your children about online safety and the importance of responsible spending. Explain the concept of money and the consequences of making unauthorized purchases.

- Regularly Monitor Statements: Regularly review your credit card and bank statements for any unusual activity. Early detection can significantly reduce the financial impact of unauthorized purchases.

- Consider Using Separate Accounts: For children who engage with in-app purchases, consider creating a separate, limited-funds account for their use. This can help control spending and reduce the risk of significant financial losses.

Conclusion:

This "lollipop incident" serves as a stark reminder of the hidden costs of mobile gaming and the need for increased parental vigilance in the digital age. By implementing the preventative measures outlined above, parents can significantly reduce the risk of similar costly mistakes. This story should not only serve as a warning but also as a call to action for greater transparency and stronger safety protocols within the mobile gaming industry. What steps do you take to protect your finances from unauthorized online purchases? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mom's Credit Card Charged $4,200 For Lollipops: A Son's Expensive Mistake. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Clarke Schmidts Monday Start Analysis And Prediction

May 13, 2025

Clarke Schmidts Monday Start Analysis And Prediction

May 13, 2025 -

Katherine Schwarzenegger Celebrates First Mothers Day With Sweet Message From Chris Pratt

May 13, 2025

Katherine Schwarzenegger Celebrates First Mothers Day With Sweet Message From Chris Pratt

May 13, 2025 -

Investigating The Prevalence Of Spoan Disease A Focus On A Brazilian Town Practicing Cousin Marriage

May 13, 2025

Investigating The Prevalence Of Spoan Disease A Focus On A Brazilian Town Practicing Cousin Marriage

May 13, 2025 -

9 3 Victory For Rockies Over Padres Full Game Recap From May 11 2025

May 13, 2025

9 3 Victory For Rockies Over Padres Full Game Recap From May 11 2025

May 13, 2025 -

Unexpected Candy Chaos 4 200 Lollipop Order And The Lessons Learned

May 13, 2025

Unexpected Candy Chaos 4 200 Lollipop Order And The Lessons Learned

May 13, 2025

Latest Posts

-

Water Restrictions Force Ban On Tanker Deliveries To Us Billionaires Estate

Sep 13, 2025

Water Restrictions Force Ban On Tanker Deliveries To Us Billionaires Estate

Sep 13, 2025 -

Star Trek Strange New Worlds Season 3 Finale Showrunner Interview Breakdown

Sep 13, 2025

Star Trek Strange New Worlds Season 3 Finale Showrunner Interview Breakdown

Sep 13, 2025 -

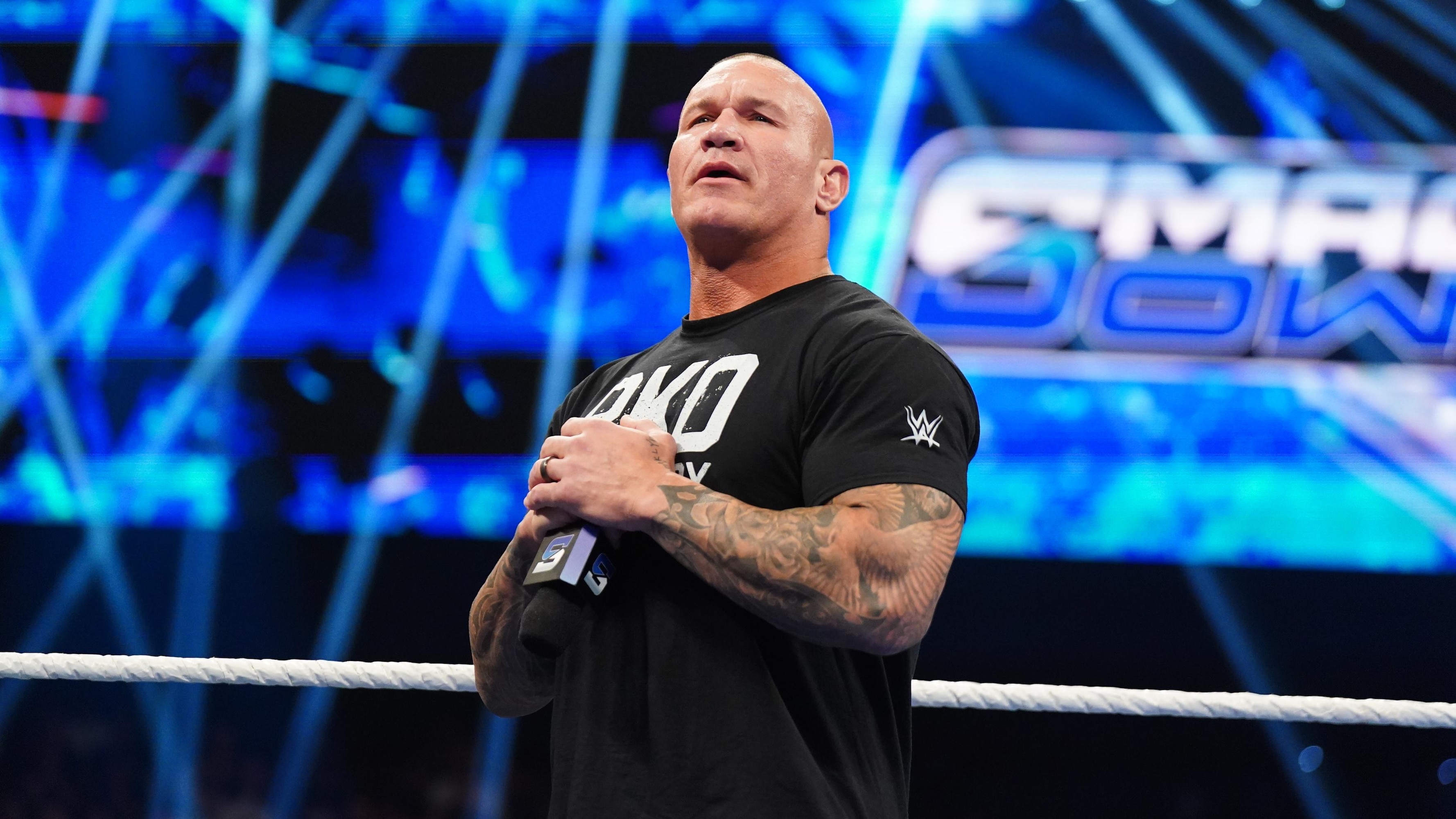

Where Does Randy Orton Go After Wwe Retirement Exploring His Next Chapter

Sep 13, 2025

Where Does Randy Orton Go After Wwe Retirement Exploring His Next Chapter

Sep 13, 2025 -

The End Of Restrictions How Wnba Players Won Style Autonomy

Sep 13, 2025

The End Of Restrictions How Wnba Players Won Style Autonomy

Sep 13, 2025 -

Simple Solutions For Fussy Eaters Expert Guidance For Peaceful Meals

Sep 13, 2025

Simple Solutions For Fussy Eaters Expert Guidance For Peaceful Meals

Sep 13, 2025