Moody's Downgrade Fails To Dent Market: S&P 500, Dow, And Nasdaq Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Fails to Dent Market: S&P 500, Dow, and Nasdaq Rise

A surprising resilience: Major US stock indices defied expectations on Tuesday, surging despite Moody's Investors Service downgrading the credit ratings of 10 small and mid-sized US banking institutions. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posted impressive gains, showcasing a market seemingly unfazed by the negative credit news. This unexpected market reaction raises questions about investor sentiment and the overall health of the financial sector.

Moody's downgrade and its limited impact: The downgrade, affecting banks deemed vulnerable to potential economic slowdown, was anticipated by some analysts. However, the muted market response suggests investors may be focusing on other economic indicators, potentially viewing the downgrade as a contained issue rather than a systemic threat. The affected banks are relatively small, and the overall impact on the broader financial system is considered to be limited. This contrasts with the more significant market reactions seen following previous credit rating downgrades, hinting at a shift in investor confidence or risk tolerance.

Analyzing the market surge: Several factors could explain the market's resilience. The recent release of positive economic data, including better-than-expected inflation figures, may be bolstering investor confidence. Furthermore, the ongoing earnings season, with several major corporations reporting strong results, is likely contributing to the positive sentiment. The Federal Reserve's recent pause in interest rate hikes also played a role, reducing concerns about aggressive monetary policy impacting economic growth.

<h3>What does this mean for investors?</h3>

The market's response to the Moody's downgrade presents a complex picture for investors. While the immediate reaction has been positive, the longer-term implications remain uncertain. It's crucial to monitor the following:

- Further economic data releases: Upcoming economic indicators will be key in determining the continued market trajectory. Pay close attention to inflation reports, employment numbers, and consumer spending data.

- Federal Reserve policy: The Fed's future actions regarding interest rates will continue to heavily influence market sentiment. Any shift towards further tightening or easing could significantly impact stock prices.

- Earnings reports: The ongoing earnings season will provide further insights into the financial health of corporations and the broader economy. Strong earnings could support continued market growth, while disappointing results could trigger a downturn.

<h3>The bigger picture: Assessing systemic risk</h3>

While the immediate impact of the Moody's downgrade seems limited, it’s important not to dismiss the underlying concerns. The downgrade highlights the ongoing vulnerabilities within the US banking sector, particularly the potential impact of rising interest rates and a possible economic slowdown. Investors should remain vigilant and diversify their portfolios to mitigate potential risks. This unexpected market behavior highlights the complexities of financial markets and the need for a nuanced approach to investment strategies.

Looking ahead: The market's surprising resilience offers a short-term positive outlook, but it's crucial for investors to maintain a long-term perspective. Continuous monitoring of economic indicators and corporate performance is paramount for navigating the complexities of the current market environment. Consult with a financial advisor to tailor your investment strategy to your individual risk tolerance and financial goals. Stay informed and adapt your approach accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Fails To Dent Market: S&P 500, Dow, And Nasdaq Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

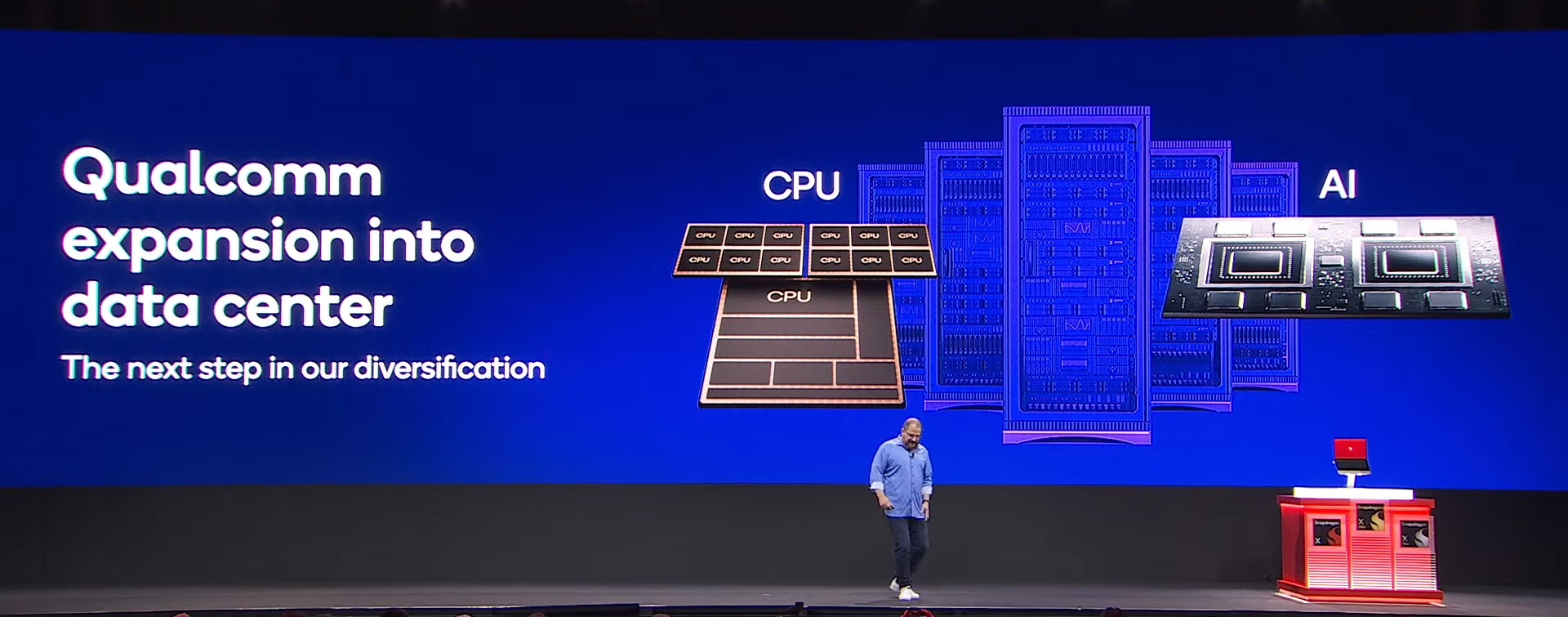

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025

Qualcomms Next Gen Data Center Cpus And Ai Accelerators What To Expect

May 20, 2025 -

Snl Season 50 Finale A Record Breaking Success For Nbc

May 20, 2025

Snl Season 50 Finale A Record Breaking Success For Nbc

May 20, 2025 -

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025

Beyond The Action The Emotional Core Of The Last Of Us

May 20, 2025 -

Death Toll Rises After Israeli Strikes On Last Hospital In North Gaza

May 20, 2025

Death Toll Rises After Israeli Strikes On Last Hospital In North Gaza

May 20, 2025 -

From Zero To Billions How This Visionary Generates Innovative Ideas

May 20, 2025

From Zero To Billions How This Visionary Generates Innovative Ideas

May 20, 2025

Latest Posts

-

Cybersecurity Failure At Legal Aid Thousands Of Sensitive Records Exposed

May 20, 2025

Cybersecurity Failure At Legal Aid Thousands Of Sensitive Records Exposed

May 20, 2025 -

Growing Ethereum Interest 200 Million Investment Following Pectra Upgrade

May 20, 2025

Growing Ethereum Interest 200 Million Investment Following Pectra Upgrade

May 20, 2025 -

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Backlash And Its Implications

May 20, 2025

Jon Jones And Tom Aspinall Analyzing The Strip The Duck Backlash And Its Implications

May 20, 2025 -

Jamie Lee Curtis Opens Up About Her Longstanding Friendship With Lindsay Lohan

May 20, 2025

Jamie Lee Curtis Opens Up About Her Longstanding Friendship With Lindsay Lohan

May 20, 2025 -

10 Minutes Of Unpiloted Flight Lufthansa Addresses Co Pilots Mid Flight Medical Emergency

May 20, 2025

10 Minutes Of Unpiloted Flight Lufthansa Addresses Co Pilots Mid Flight Medical Emergency

May 20, 2025