Moody's Downgrade Ignored: Wall Street Celebrates As S&P 500, Dow, And Nasdaq Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Ignored: Wall Street Celebrates a Bullish Day

Wall Street shrugged off Moody's downgrade of US government debt, with major indices enjoying a robust rally. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed higher on Tuesday, defying predictions of a market downturn following the credit rating agency's action. This unexpected surge highlights the complex interplay of factors influencing market sentiment and raises questions about the long-term impact of Moody's decision.

The news from Moody's, which lowered the US government's credit rating from Aaa to Aa1, citing concerns about fiscal policy and the rising national debt, was initially met with some apprehension. However, the market’s response quickly shifted to optimism, driven by several key factors.

Why Did the Market Ignore the Downgrade?

Several contributing factors explain the market's seemingly nonchalant reaction to the Moody's downgrade:

-

Resilient Economic Data: Recent economic data, including strong job growth and consumer spending figures, continue to paint a picture of a robust US economy. This positive economic outlook seemingly outweighs concerns about the nation's debt ceiling crisis and the downgrade itself. Analysts point to these positive indicators as a major driver of investor confidence.

-

Anticipation of Future Rate Hikes: While some analysts predicted a sell-off, many investors had already factored a potential downgrade into their investment strategies. The anticipation of further interest rate hikes by the Federal Reserve, although potentially slowing economic growth, is also seen by some as a positive step in controlling inflation. This proactive approach by the Fed might, in the long run, limit further damage to the economy.

-

Strong Corporate Earnings: Stronger-than-expected corporate earnings reports from several major companies have boosted investor confidence and contributed to the positive market sentiment. These positive earnings provide a counterbalance to the concerns raised by Moody's.

-

Technical Factors: Some analysts believe the market's rise is partially due to technical factors, such as short-covering and bargain hunting. After a period of relative weakness, investors may have seen the dip as an opportunity to buy at lower prices.

Long-Term Implications Remain Uncertain

While Tuesday's market rally was impressive, it's crucial to remember that the long-term implications of Moody's downgrade remain uncertain. The increased cost of borrowing for the US government could have far-reaching consequences for the economy. This includes potential effects on:

- Interest Rates: Higher borrowing costs could lead to higher interest rates across the board, impacting everything from mortgages to business loans.

- Inflation: Increased borrowing costs could also fuel inflation, further complicating the Federal Reserve's efforts to control price increases.

- Global Market Confidence: The downgrade could also impact global market confidence in the US dollar and the overall stability of the US economy.

Conclusion: Tuesday's market reaction to Moody's downgrade was a surprising display of resilience. While the positive economic data and strong corporate earnings played a significant role, the long-term impact of the downgrade remains to be seen. Investors should remain vigilant and monitor economic indicators closely to assess the full implications of this significant development. Further analysis is needed to fully understand the interplay of these factors and predict the trajectory of the market in the coming weeks and months. Stay tuned for further updates.

Keywords: Moody's, Downgrade, US Government Debt, S&P 500, Dow Jones, Nasdaq, Wall Street, Stock Market, Credit Rating, Fiscal Policy, Economic Data, Interest Rates, Inflation, Global Markets, Investment Strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Ignored: Wall Street Celebrates As S&P 500, Dow, And Nasdaq Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025

Former Olympic Swimmer Speaks Out The Price Of Gold Harsh Coaching And Weight Issues

May 21, 2025 -

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025

Controversy Erupts Family Challenges New Law Affecting Paedophiles Parental Rights

May 21, 2025 -

2025s Safest Sunscreens Protecting Your Familys Skin

May 21, 2025

2025s Safest Sunscreens Protecting Your Familys Skin

May 21, 2025 -

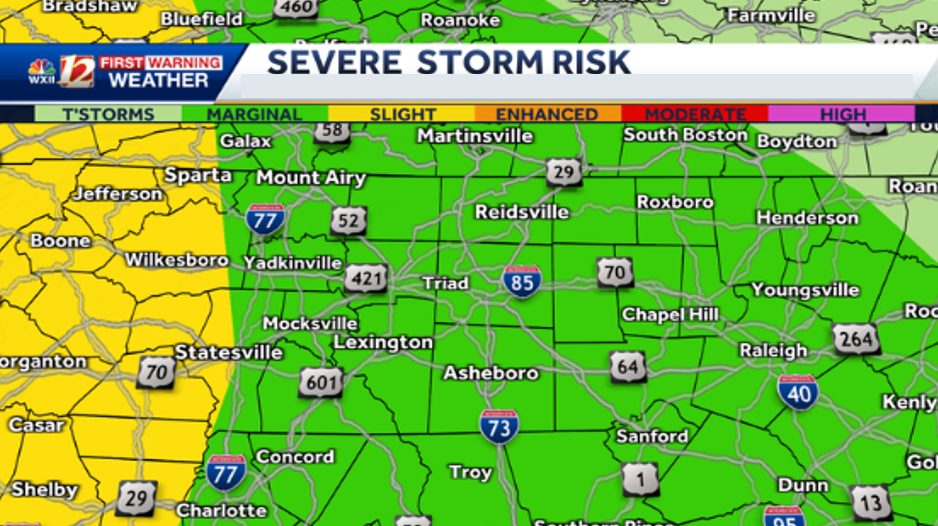

Overnight Rain And Storms High Risk Of Severe Weather In North Carolina

May 21, 2025

Overnight Rain And Storms High Risk Of Severe Weather In North Carolina

May 21, 2025 -

Best Sunscreen Choices For 2025 Family Friendly And Effective

May 21, 2025

Best Sunscreen Choices For 2025 Family Friendly And Effective

May 21, 2025

Latest Posts

-

Rain And Cooler Temperatures Predicted Weekly Weather Outlook

May 21, 2025

Rain And Cooler Temperatures Predicted Weekly Weather Outlook

May 21, 2025 -

Cross Species Abductions Monkey Behavior Baffles Scientists In Panama

May 21, 2025

Cross Species Abductions Monkey Behavior Baffles Scientists In Panama

May 21, 2025 -

William Goodge Fastest Run Across Australia A New Record

May 21, 2025

William Goodge Fastest Run Across Australia A New Record

May 21, 2025 -

Ellen De Generes Emotional Return To Social Media A Fans Perspective

May 21, 2025

Ellen De Generes Emotional Return To Social Media A Fans Perspective

May 21, 2025 -

Ubisoft Milans Aaa Rayman Game Job Openings Now Available

May 21, 2025

Ubisoft Milans Aaa Rayman Game Job Openings Now Available

May 21, 2025