Moody's Downgrade Impact: Stock Market Shows Resilience, S&P 500 Leads Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Moody's Downgrade Impact: Stock Market Shows Resilience, S&P 500 Leads Gains

Moody's Investors Service's recent downgrade of several US banking institutions sent ripples through the financial world, raising concerns about the potential impact on the broader economy. However, initial market reactions have been surprisingly resilient, with the S&P 500 leading the gains, showcasing a level of strength that has surprised many analysts. This article delves into the details of the downgrade, its perceived impact, and the unexpected market response.

Moody's Downgrade: A Closer Look

Moody's decision to downgrade the credit ratings of 10 mid-sized banks and place others on review for downgrade reflects growing concerns about the banking sector's vulnerability to rising interest rates and potential economic slowdown. The agency cited weakening profitability and asset quality as key factors behind its assessment. This action immediately sparked discussions about potential contagion and wider systemic risks within the US financial system. [Link to Moody's press release]

While the downgrade itself is significant, the market's response has been less dramatic than some predicted. This begs the question: why the resilience?

Market Resilience: A Complex Picture

Several factors may contribute to the relatively muted market reaction:

- Anticipation: The market may have already priced in some of the negative news, anticipating potential downgrades given the prevailing economic climate. News outlets had been reporting on the fragility of regional banks for some time.

- Strong Corporate Earnings: Positive corporate earnings reports from several major companies have helped offset the negative sentiment surrounding the Moody's downgrade. Strong Q2 earnings have boosted investor confidence. [Link to relevant earnings report articles]

- Federal Reserve Actions: The Federal Reserve's actions in supporting the banking system during past crises have provided a sense of stability and reassurance to investors. The Fed's recent pause on interest rate hikes also contributed to the calmer market.

- Selective Downgrades: The downgrades were targeted at smaller and mid-sized banks, limiting the widespread panic that might have occurred if larger institutions had been affected. This targeted approach minimized systemic risk.

S&P 500 Leads the Charge

Despite the Moody's downgrade, the S&P 500 has shown notable resilience, even posting gains in the days following the announcement. This indicates that investors, at least for now, remain relatively optimistic about the overall health of the US economy and corporate earnings. This counterintuitive market behavior suggests that the negative impact of the downgrade might be limited and potentially overshadowed by other positive economic indicators.

Looking Ahead: Uncertainty Remains

While the initial market response has been surprisingly positive, it’s crucial to remember that uncertainty remains. The long-term effects of the Moody's downgrade, and the broader economic landscape, remain to be seen. Further interest rate hikes, potential economic slowdowns, and the ongoing impact of geopolitical events could still significantly influence market sentiment.

Investors should carefully monitor developments in the banking sector and the overall economic climate. Diversification remains a key strategy for mitigating risk in uncertain times. Consult with a financial advisor to develop a personalized investment plan tailored to your risk tolerance and financial goals.

Keywords: Moody's downgrade, S&P 500, stock market, banking sector, credit rating, economic outlook, market resilience, interest rates, Federal Reserve, investment strategy, financial risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Moody's Downgrade Impact: Stock Market Shows Resilience, S&P 500 Leads Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Your Child Ready To Give Up Their Pacifier Or Thumb

May 20, 2025

Is Your Child Ready To Give Up Their Pacifier Or Thumb

May 20, 2025 -

Juego De Voces 2025 En Vivo El Esperado Dueto De Yahir Y Victor Garcia

May 20, 2025

Juego De Voces 2025 En Vivo El Esperado Dueto De Yahir Y Victor Garcia

May 20, 2025 -

Client Confidentiality Breached Legal Aid Data Hack Reveals Criminal Records

May 20, 2025

Client Confidentiality Breached Legal Aid Data Hack Reveals Criminal Records

May 20, 2025 -

Mixed Martial Arts Jon Jones Strip The Duck Comment Creates Uproar

May 20, 2025

Mixed Martial Arts Jon Jones Strip The Duck Comment Creates Uproar

May 20, 2025 -

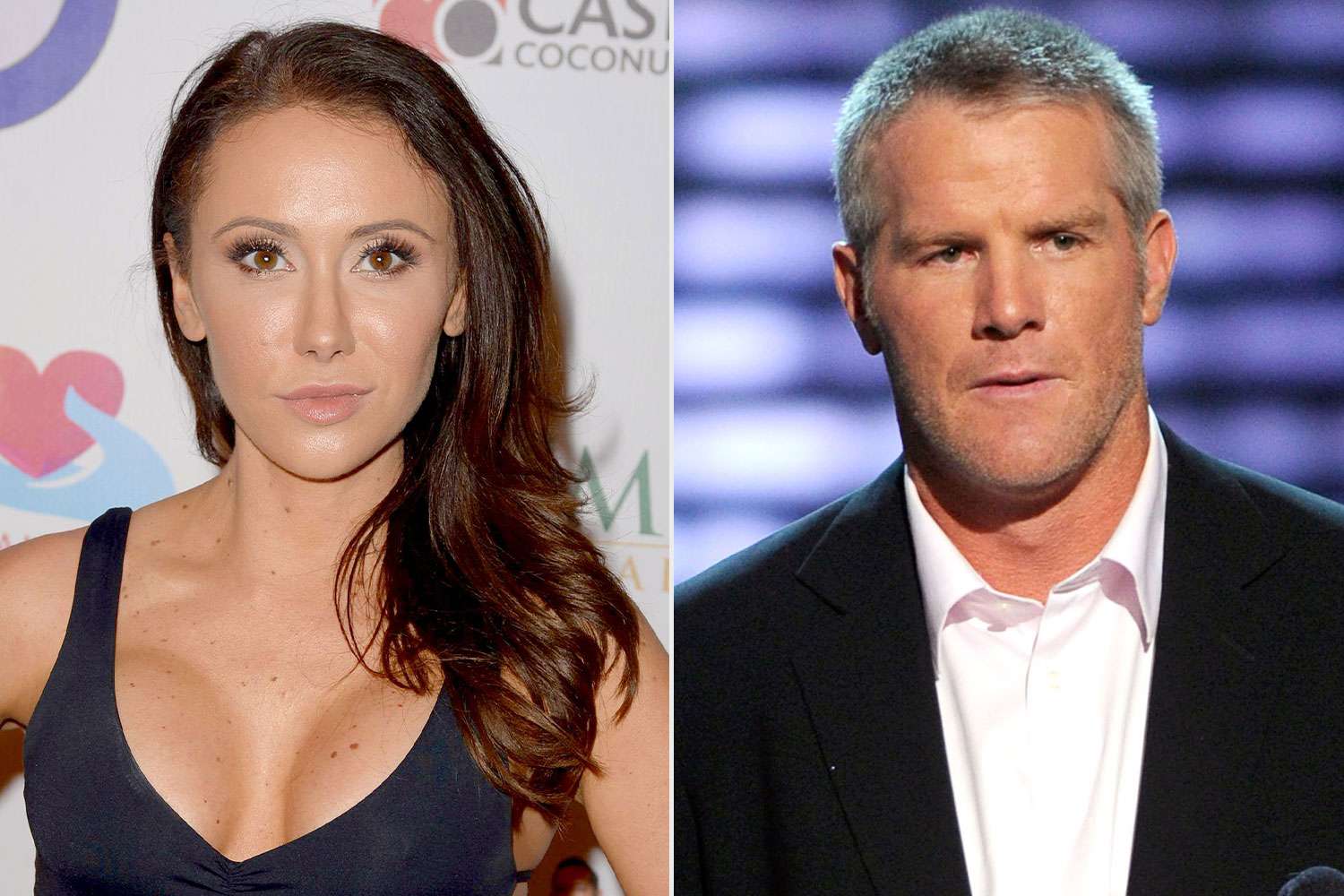

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Dehumanizing Treatment

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Speaks Out On Dehumanizing Treatment

May 20, 2025

Latest Posts

-

A J Perez On The Making Of Untold Brett Favre And The Subsequent Threats

May 20, 2025

A J Perez On The Making Of Untold Brett Favre And The Subsequent Threats

May 20, 2025 -

Jon Jones Calls For Aspinall Stripping Mma Fans React To Controversial Statement

May 20, 2025

Jon Jones Calls For Aspinall Stripping Mma Fans React To Controversial Statement

May 20, 2025 -

Mixed Martial Arts Jon Jones Strip The Duck Comment Creates Uproar

May 20, 2025

Mixed Martial Arts Jon Jones Strip The Duck Comment Creates Uproar

May 20, 2025 -

Balis New Rules For Tourists Cracking Down On Bad Behavior

May 20, 2025

Balis New Rules For Tourists Cracking Down On Bad Behavior

May 20, 2025 -

Data Security Failure At Legal Aid Thousands Of Private And Criminal Records Stolen

May 20, 2025

Data Security Failure At Legal Aid Thousands Of Private And Criminal Records Stolen

May 20, 2025