Mortgage Trends: First-Timers Opting For Longer Loan Terms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Trends: First-Timers Opting for Longer Loan Terms

Record-low interest rates and soaring home prices are driving a shift in the mortgage market, with first-time homebuyers increasingly choosing longer loan terms. This trend, while offering immediate affordability, presents both opportunities and challenges for the future. Let's delve into the reasons behind this shift and explore its potential implications.

The Allure of Longer Loan Terms:

For many first-time homebuyers, entering the property market feels like scaling Mount Everest. The combination of historically high home prices and increasingly stringent lending requirements has made saving for a sufficient down payment a significant hurdle. Longer loan terms, such as 30-year mortgages instead of the more traditional 15-year options, offer a crucial advantage: lower monthly payments.

This lower monthly payment allows first-time buyers to afford homes that might otherwise be out of reach. The reduced financial strain can be particularly beneficial for those navigating other significant life expenses like student loan debt or childcare costs. This affordability is a major driver behind the surge in popularity of longer-term mortgages.

The Economics of Extended Payments:

While lower monthly payments are attractive, it's crucial to understand the long-term implications. A longer loan term translates to paying significantly more interest over the life of the loan. For example, a 30-year mortgage will accumulate far more interest than a 15-year mortgage, even with lower monthly payments.

This increased interest payment needs careful consideration. While it offers immediate affordability, it can impact long-term financial goals, potentially delaying other investments or savings plans.

Navigating the Shifting Landscape:

This shift in mortgage trends requires a nuanced approach from both homebuyers and lenders.

For first-time homebuyers:

- Understand the total cost: Don't just focus on the monthly payment; compare the total interest paid over the life of the loan for different term lengths. Use a mortgage calculator to visualize the long-term financial implications.

- Explore alternative options: Consider strategies like increasing your down payment, even if it means delaying your purchase slightly. This can significantly reduce the overall interest paid.

- Seek professional advice: Consult with a financial advisor to create a budget and ensure that a longer-term mortgage aligns with your overall financial goals.

For lenders:

- Offer diverse options: Providing a range of loan terms and flexible down payment options can cater to a wider range of buyers.

- Promote financial literacy: Educating prospective borrowers about the long-term implications of different loan terms is crucial for responsible homeownership.

The Future of Mortgage Lending:

The trend of first-time homebuyers opting for longer loan terms is likely to continue as long as home prices remain high and interest rates stay relatively low. However, it’s vital for both buyers and lenders to adopt a well-informed and responsible approach. This requires transparency, careful financial planning, and a commitment to long-term financial stability. The current mortgage market requires a careful balancing act between immediate affordability and long-term financial health. Are you prepared to navigate this complex landscape?

Keywords: Mortgage trends, first-time homebuyers, long-term mortgages, 30-year mortgage, 15-year mortgage, interest rates, home prices, affordability, financial planning, mortgage calculator, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Trends: First-Timers Opting For Longer Loan Terms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Spelling Bee Puzzle 457 June 3rd Complete Solution Guide

Jun 04, 2025

Nyt Spelling Bee Puzzle 457 June 3rd Complete Solution Guide

Jun 04, 2025 -

England West Indies Cricket Players Arrive By Bicycle After Traffic Delays

Jun 04, 2025

England West Indies Cricket Players Arrive By Bicycle After Traffic Delays

Jun 04, 2025 -

Us Labor Market Shows Resilience April Job Openings Surge Unexpectedly

Jun 04, 2025

Us Labor Market Shows Resilience April Job Openings Surge Unexpectedly

Jun 04, 2025 -

Alcaraz Sinners French Open Success A Driving Force

Jun 04, 2025

Alcaraz Sinners French Open Success A Driving Force

Jun 04, 2025 -

Tennis Showdown Roddick Weighs In On Sinner And Alcarazs Long Term Prospects

Jun 04, 2025

Tennis Showdown Roddick Weighs In On Sinner And Alcarazs Long Term Prospects

Jun 04, 2025

Latest Posts

-

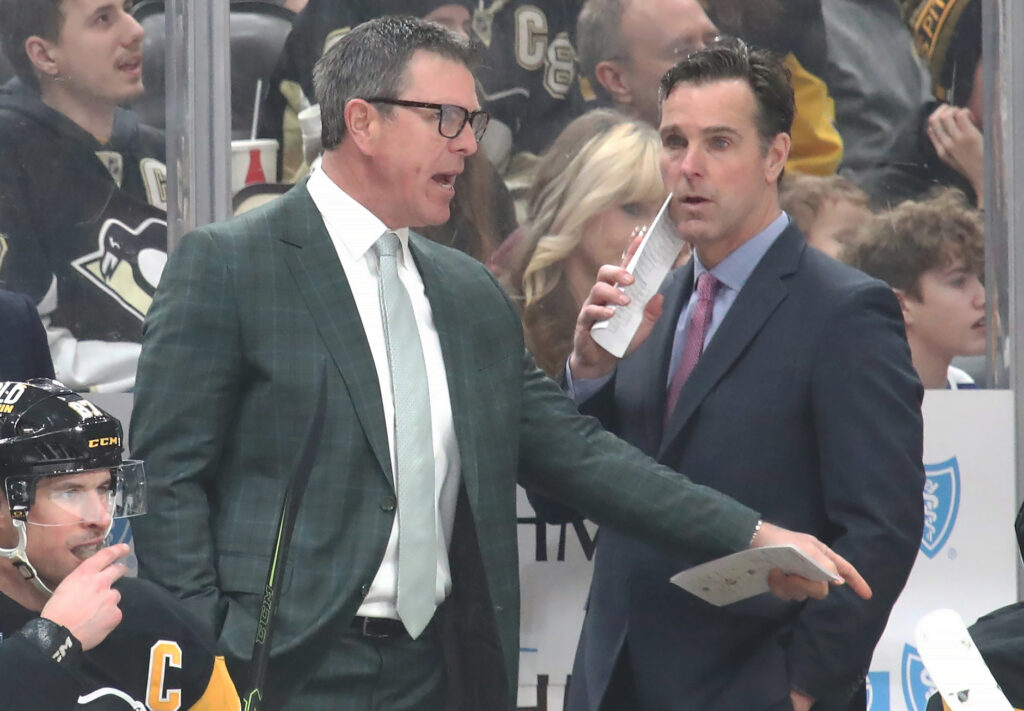

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025

David Quinn And Joe Sacco Join Rangers Coaching Team

Jun 06, 2025 -

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025

Harry Enten Deconstructs Mike Lindells Business And Political Career On Cnn

Jun 06, 2025 -

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025

The Unique Demands Of Clay Why Roland Garros Is Different

Jun 06, 2025 -

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025

Is Coca Cola Ko Stock A Buy Analyzing The Investment Potential

Jun 06, 2025 -

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025

Madeleine Mc Cann Case Still Unsolved After 18 Years

Jun 06, 2025