My 560% Amazon Profit—Why I'm Staying Invested

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

My 560% Amazon Profit—Why I'm Staying Invested

Headline: Amazon Stock Soared: My 560% Profit & Why I'm Doubling Down

Introduction: The whispers on Wall Street were hushed, the predictions cautious. Yet, my investment in Amazon has yielded a staggering 560% return. While some investors are cashing out after such a windfall, I'm not. This article details my journey, the reasons behind my continued investment, and why I believe Amazon's growth story is far from over. This isn't financial advice, but a personal account offering insights into a potentially lucrative long-term investment.

Keywords: Amazon stock, Amazon investment, Amazon profit, stock market, long-term investment, Amazon growth, investing strategy, e-commerce, tech stocks, market analysis.

H2: The Amazon Journey: From Initial Investment to 560% Growth

My investment in Amazon began several years ago, a time when many were skeptical about its long-term prospects. I saw beyond the immediate challenges and focused on the company's disruptive potential within the e-commerce and cloud computing sectors. My initial investment, while modest, was based on a thorough analysis of Amazon's financials, market position, and innovative spirit. This meticulous research is crucial before investing in any stock. I tracked Amazon's performance diligently, weathering market fluctuations with a long-term perspective. The gradual growth was initially rewarding, but the recent surge has been truly remarkable, pushing my returns to an impressive 560%.

H2: Why I'm Staying Invested: A Look at Amazon's Future

Despite the significant profits, I'm not selling. My decision is rooted in several key factors:

- Dominant Market Position: Amazon reigns supreme in online retail, with a vast customer base and unparalleled logistical capabilities. This market dominance is hard to challenge.

- AWS: The Cloud Computing Giant: Amazon Web Services (AWS) is a powerhouse, generating substantial revenue and fueling further growth across various sectors. This diversification reduces investment risk.

- Innovation and Expansion: Amazon consistently innovates, expanding into new markets such as grocery (Whole Foods), healthcare, and entertainment (Prime Video). This continuous evolution keeps it ahead of the curve.

- Long-Term Growth Potential: E-commerce continues to expand globally, offering immense potential for future growth. Amazon is uniquely positioned to capitalize on this trend.

- Resilience in Economic Downturns: While the market fluctuates, Amazon demonstrates a remarkable capacity to withstand economic downturns, highlighting its strong fundamental position.

H2: Risk Management and Diversification: A Crucial Aspect

It's crucial to note that even with Amazon's impressive performance, no investment is without risk. I've always adhered to a diversified investment portfolio, minimizing my exposure to any single stock. Diversification is key to mitigating potential losses. Consider consulting a financial advisor before making any investment decisions.

H3: Resources for Further Research

To conduct your own in-depth research, consider exploring these reputable sources:

- [Link to Amazon Investor Relations website]

- [Link to a reputable financial news source like the Wall Street Journal or Bloomberg]

- [Link to a financial analysis website like Yahoo Finance]

H2: Conclusion: A Long-Term Play

My 560% profit from Amazon isn't just about the numbers; it's about identifying a company with exceptional long-term growth potential. While past performance doesn't guarantee future success, I remain confident in Amazon's ability to deliver substantial returns. This article is intended to share my personal experience and perspective, not financial advice. Always conduct thorough research and consider professional guidance before making investment decisions. Remember, investing involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on My 560% Amazon Profit—Why I'm Staying Invested. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investment Giant Two Sigma Takes Large Position In Bank Of America Stock Bac

May 28, 2025

Investment Giant Two Sigma Takes Large Position In Bank Of America Stock Bac

May 28, 2025 -

Anson Mount On The Challenging Moments Filming Star Trek Strange New Worlds

May 28, 2025

Anson Mount On The Challenging Moments Filming Star Trek Strange New Worlds

May 28, 2025 -

Minke Whale Carcass Discovered On Portstewart Strand

May 28, 2025

Minke Whale Carcass Discovered On Portstewart Strand

May 28, 2025 -

Food Inflation At 1 Year High The Role Of Beef

May 28, 2025

Food Inflation At 1 Year High The Role Of Beef

May 28, 2025 -

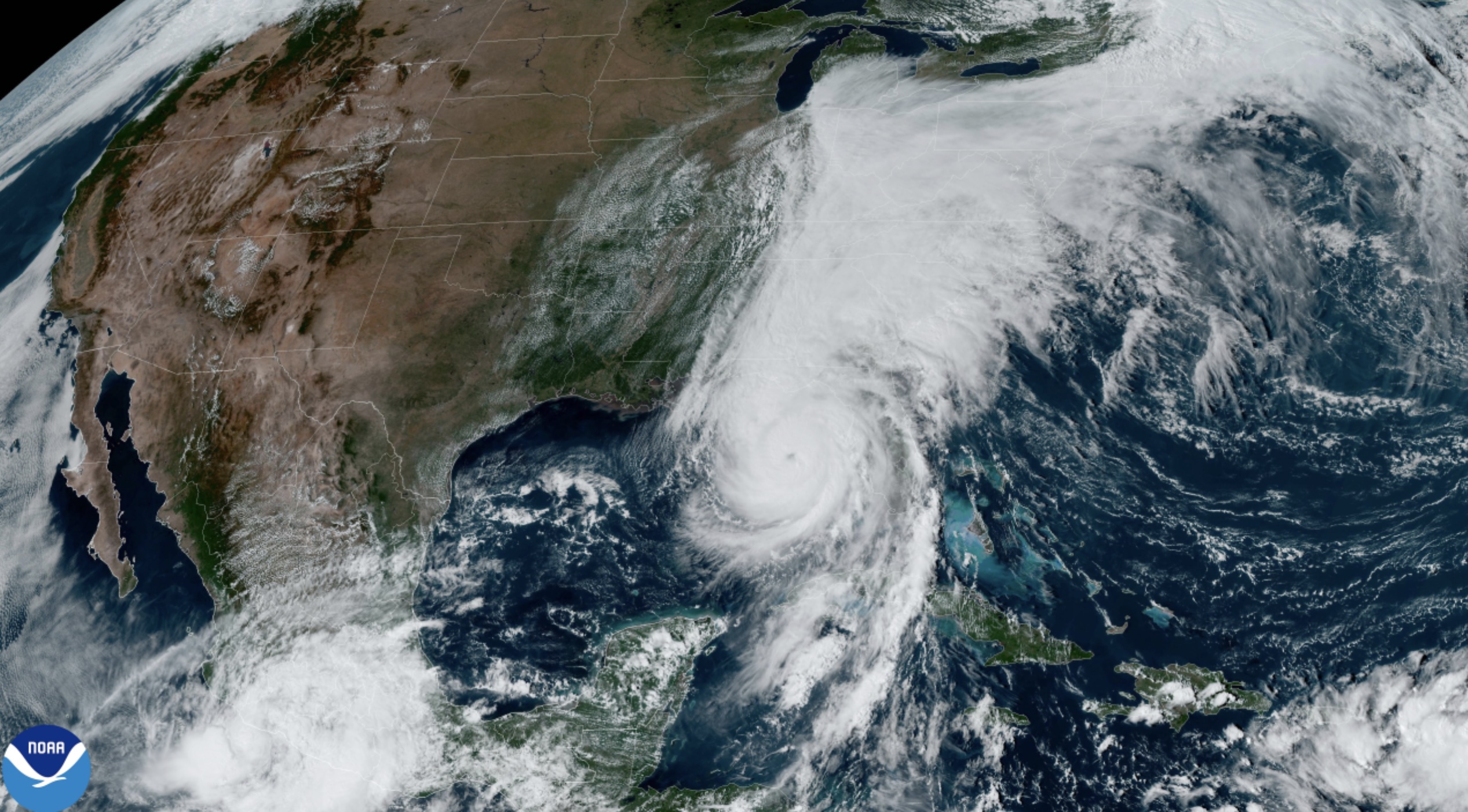

Above Normal Hurricane Season Forecast 10 Storms Could Hit The Us

May 28, 2025

Above Normal Hurricane Season Forecast 10 Storms Could Hit The Us

May 28, 2025

Latest Posts

-

Tennis Star Sloane Stephens On Arm Pain The Jell O Effect Of Burnout

Jun 01, 2025

Tennis Star Sloane Stephens On Arm Pain The Jell O Effect Of Burnout

Jun 01, 2025 -

Longtime Rivals Suge Knight Asks Diddy To Take The Stand To Humanize Himself

Jun 01, 2025

Longtime Rivals Suge Knight Asks Diddy To Take The Stand To Humanize Himself

Jun 01, 2025 -

Brazils Fonseca Eyes French Open 2025 Upset Against Jack Draper

Jun 01, 2025

Brazils Fonseca Eyes French Open 2025 Upset Against Jack Draper

Jun 01, 2025 -

Californias Budget Battle Examining The Role Of A Transgender High School Student

Jun 01, 2025

Californias Budget Battle Examining The Role Of A Transgender High School Student

Jun 01, 2025 -

Northern Arkansas Landscape A Convicts Haven

Jun 01, 2025

Northern Arkansas Landscape A Convicts Haven

Jun 01, 2025