National School Vouchers: Understanding The Tax Credit In Trump's Latest Proposal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

National School Vouchers: Deciphering Trump's Proposed Tax Credit

The education landscape is once again facing a potential shakeup with Donald Trump's latest proposal focusing on national school vouchers. This isn't just another policy suggestion; it's a significant shift potentially impacting millions of families and the future of American education. The core of the proposal rests on a substantial tax credit, but understanding its intricacies is crucial to grasping its potential impact. This article delves into the details, exploring the benefits, drawbacks, and the broader implications of this ambitious plan.

What are National School Vouchers?

National school vouchers are government-funded programs that provide families with financial assistance to send their children to private schools, including religious schools. Unlike state-level voucher programs that vary widely in their scope and funding, a national program aims for uniform application across the country. Trump's proposal differs from previous iterations by focusing on a tax credit mechanism rather than direct government funding.

The Tax Credit Mechanism: How it Works

Instead of direct government disbursement, Trump's plan proposes a significant tax credit for families who choose to utilize private school options. This essentially means families would receive a reduction in their overall tax liability, effectively providing them with the funds to pay for private school tuition. The exact amount of the tax credit remains unclear, but its scale will determine the plan's overall accessibility and effectiveness. This approach offers a different dynamic compared to direct voucher programs, relying on individual tax filings rather than dedicated government spending.

Potential Benefits of the Tax Credit Approach

- Increased Parental Choice: Proponents argue the tax credit expands parental choice, allowing families to select schools best suited to their children's needs and educational philosophies. This is a key argument consistently advanced by school choice advocates.

- Competition and School Improvement: Increased competition among schools, both public and private, is another anticipated outcome. The theory suggests that public schools will strive to improve to remain competitive with private alternatives.

- Economic Stimulus: The tax credit could indirectly boost the economy by channeling funds into the private education sector, potentially creating jobs and stimulating economic activity within those communities.

Potential Drawbacks and Concerns

- Equity and Access: Critics raise concerns about equity and access. The tax credit's effectiveness depends on the size of the credit and could disproportionately benefit wealthier families, potentially exacerbating existing educational inequalities. Lower-income families may still struggle to afford private school tuition, even with the tax credit.

- Accountability and Oversight: Ensuring accountability and appropriate oversight of private schools receiving indirect funding through the tax credit system poses a significant challenge. Without stringent regulations, the quality of education within these schools could remain inconsistent.

- Church-State Separation: The inclusion of religious schools within the voucher system raises concerns about the separation of church and state. Public funding for religious education remains a contentious issue in American politics.

Comparison with Other Voucher Programs

Existing state-level voucher programs provide a valuable context for assessing the potential impact of a national program. A study of [link to relevant study on state voucher programs] suggests [brief summary of findings regarding effectiveness and equity]. However, a national program’s scale and uniform application would create a vastly different scenario, requiring careful consideration.

The Road Ahead: Political and Practical Challenges

The proposal faces significant political hurdles. Securing Congressional approval for such a sweeping change will require navigating complex political landscapes and addressing concerns from various stakeholders. Furthermore, logistical challenges related to implementation, oversight, and equitable distribution of the tax credit will necessitate careful planning and resource allocation.

Conclusion: A Pivotal Moment for Education

Trump's proposed national school voucher system, implemented through a tax credit, represents a potentially transformative moment for American education. While offering the promise of increased parental choice and school competition, it also raises significant concerns about equity, accountability, and the separation of church and state. The debate surrounding this proposal is far from over, and its ultimate impact will depend on the specifics of its implementation and the political will to address the inherent challenges. Further analysis and public discussion are crucial to ensure a fair and effective solution for all students.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on National School Vouchers: Understanding The Tax Credit In Trump's Latest Proposal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Holiday Costs Prohibiting Cancer Patients From Breaks Charity Warns

Jun 08, 2025

Holiday Costs Prohibiting Cancer Patients From Breaks Charity Warns

Jun 08, 2025 -

French Open Upset Swiateks No 1 Ranking Falls After Unexpected Loss

Jun 08, 2025

French Open Upset Swiateks No 1 Ranking Falls After Unexpected Loss

Jun 08, 2025 -

The Hamilton By Election A Victory For Reform And What It Signifies

Jun 08, 2025

The Hamilton By Election A Victory For Reform And What It Signifies

Jun 08, 2025 -

Clay Court King Swiateks Disregard For Ranking Projections

Jun 08, 2025

Clay Court King Swiateks Disregard For Ranking Projections

Jun 08, 2025 -

Deadly Dinner How Death Cap Mushrooms Caused A Family Crisis In Australia

Jun 08, 2025

Deadly Dinner How Death Cap Mushrooms Caused A Family Crisis In Australia

Jun 08, 2025

Latest Posts

-

Too Much Protein Heres What Happens To Your Body

Sep 14, 2025

Too Much Protein Heres What Happens To Your Body

Sep 14, 2025 -

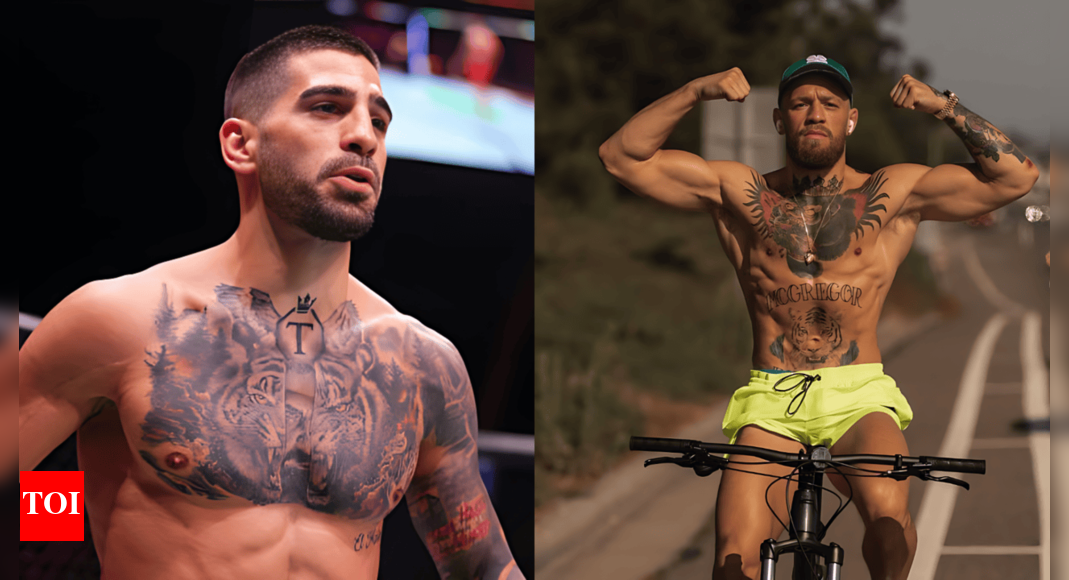

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025 -

Allegiant Air Adds Bellingham To Burbank With New Non Stop Flights

Sep 14, 2025

Allegiant Air Adds Bellingham To Burbank With New Non Stop Flights

Sep 14, 2025 -

Legal Battle Ends Tribe Ordered To Leave Scottish Woods

Sep 14, 2025

Legal Battle Ends Tribe Ordered To Leave Scottish Woods

Sep 14, 2025 -

Starmers Defence Of Mandelson Amidst Epstein Email Controversy

Sep 14, 2025

Starmers Defence Of Mandelson Amidst Epstein Email Controversy

Sep 14, 2025