National School Vouchers: Understanding Trump's Proposed Tax Credit Mechanism

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

National School Vouchers: Decoding Trump's Proposed Tax Credit Mechanism

The debate surrounding school choice in America is a complex and often contentious one. A key element of this debate centers around national school vouchers, and a particularly impactful proposal emerged during the Trump administration: a significant tax credit mechanism aimed at funding private school education. This article delves into the intricacies of this proposed system, exploring its potential benefits, drawbacks, and lasting impact on the educational landscape.

Understanding the Proposed Tax Credit System:

Unlike direct government funding of school vouchers, Trump's proposal focused on a tax credit system. This meant families choosing private schools would receive a federal tax credit, effectively reducing their tax burden by an amount equivalent to a portion of their private school tuition. This approach differed significantly from existing voucher programs, many of which are state-funded and often subject to specific eligibility requirements. The exact details of the proposed credit amount and eligibility criteria varied across different iterations of the proposal, making a precise analysis challenging. However, the core concept remained consistent: incentivizing private school enrollment through a tax-based mechanism.

Potential Benefits:

Proponents argued the tax credit system offered several advantages. These included:

- Increased school choice: Families, particularly those in underperforming public school districts, would have greater autonomy in selecting educational environments for their children.

- Competition and innovation: Increased competition between public and private schools could potentially drive innovation and improvement within the overall educational system.

- Empowerment of parents: Parents would have a more direct influence over their children's education, aligning with the broader philosophy of parental choice in education.

- Economic impact: The redirection of funds towards private schools could stimulate the private education sector, potentially creating jobs and boosting local economies.

Potential Drawbacks and Concerns:

Critics of the proposal raised numerous concerns, including:

- Equity and access: The tax credit system could exacerbate existing inequalities, benefiting primarily higher-income families who are already more likely to afford private school tuition. Lower-income families might not see a significant impact, potentially widening the achievement gap.

- Accountability and transparency: Private schools are often less subject to public accountability measures than public schools. Concerns arose regarding the lack of oversight and potential for misuse of funds.

- Separation of church and state: A significant proportion of private schools are religiously affiliated. The proposal raised concerns about the potential for public funds indirectly supporting religious institutions, violating the principle of separation of church and state.

- Funding for public schools: Critics argued that diverting funds towards private education, even indirectly through tax credits, would ultimately reduce funding available for public schools, potentially harming the education of children remaining in the public system.

Long-Term Implications and the Current Landscape:

While Trump's specific proposal for a national school voucher tax credit system didn't gain traction to become law, the debate continues. The discussion highlights the ongoing tension between public and private education, the role of government funding in education, and the pursuit of equitable access to quality education for all children. Understanding the nuances of such proposals is crucial for informed participation in the ongoing national conversation about school choice and educational reform.

Further Research:

For a more in-depth understanding of the ongoing debate around school choice and voucher programs, consider exploring resources from organizations like the and the . These resources offer diverse perspectives on the complexities of this vital issue.

Call to Action: Stay informed about evolving education policies and participate in discussions to shape the future of education in America.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on National School Vouchers: Understanding Trump's Proposed Tax Credit Mechanism. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Jobe Bellingham Completes Borussia Dortmund Transfer From Sunderland

Jun 08, 2025

Official Jobe Bellingham Completes Borussia Dortmund Transfer From Sunderland

Jun 08, 2025 -

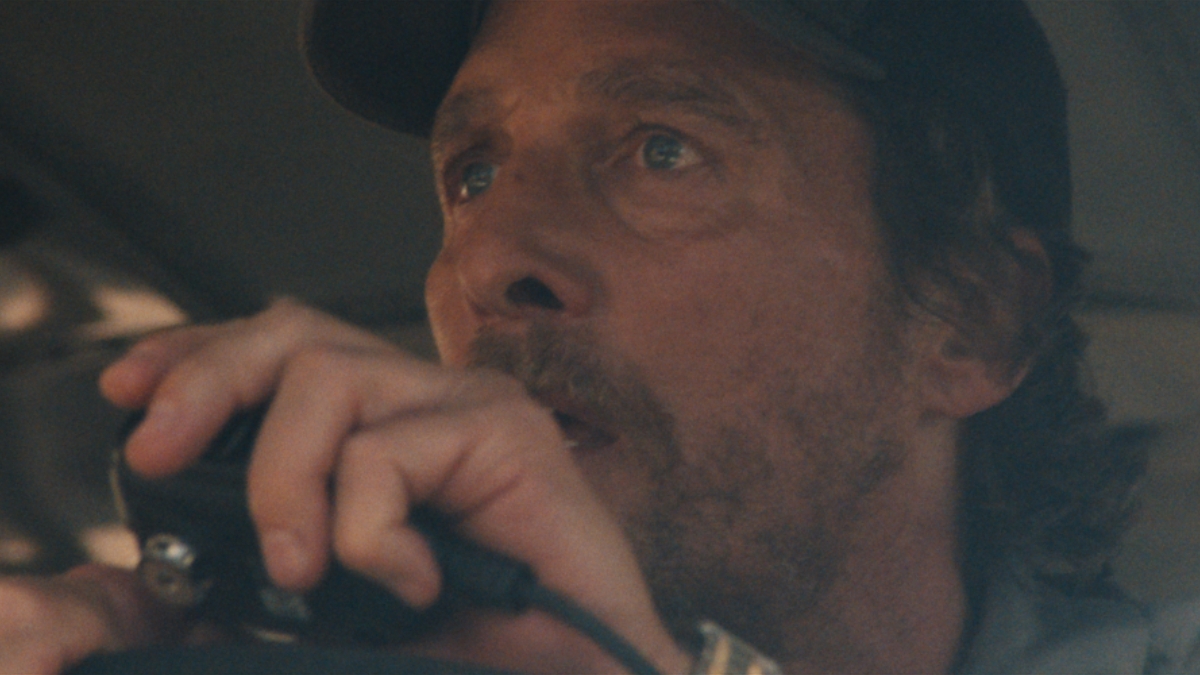

Apples New Teaser Mc Conaughey And Ferrera Star In The Lost Bus

Jun 08, 2025

Apples New Teaser Mc Conaughey And Ferrera Star In The Lost Bus

Jun 08, 2025 -

Gaza Aid Distribution Massacre Eyewitness Testimony And Video Footage

Jun 08, 2025

Gaza Aid Distribution Massacre Eyewitness Testimony And Video Footage

Jun 08, 2025 -

Sean Diddy Combs Criminal Trial Jane Doe Delivers Crucial Testimony

Jun 08, 2025

Sean Diddy Combs Criminal Trial Jane Doe Delivers Crucial Testimony

Jun 08, 2025 -

Super Regionals Your Guide To The Ncaa Baseball Tournaments Next Round

Jun 08, 2025

Super Regionals Your Guide To The Ncaa Baseball Tournaments Next Round

Jun 08, 2025

Latest Posts

-

The Charlie Kirk Debate Analyzing His Influence On Young Voters

Sep 14, 2025

The Charlie Kirk Debate Analyzing His Influence On Young Voters

Sep 14, 2025 -

Charlie Kirks Enduring Influence A Look At His Political Legacy And Future

Sep 14, 2025

Charlie Kirks Enduring Influence A Look At His Political Legacy And Future

Sep 14, 2025 -

Mealtime Mayhem Expert Guidance For Parents Of Fussy Eaters

Sep 14, 2025

Mealtime Mayhem Expert Guidance For Parents Of Fussy Eaters

Sep 14, 2025 -

Charlie Kirk Examining The Controversies And Achievements Of A Young Conservative Leader

Sep 14, 2025

Charlie Kirk Examining The Controversies And Achievements Of A Young Conservative Leader

Sep 14, 2025 -

Apple Tv Streams Fridays Mariners Game With Hometown Radio

Sep 14, 2025

Apple Tv Streams Fridays Mariners Game With Hometown Radio

Sep 14, 2025