Navigating Broadcom's Earnings Announcement With Options

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating Broadcom's Earnings Announcement with Options: A Guide for Savvy Investors

Broadcom (AVGO), a semiconductor giant, is a company that consistently keeps investors on the edge of their seats. Its earnings announcements are major market events, often triggering significant price swings. For those comfortable with the added risk, options trading offers a powerful tool to navigate the volatility surrounding these announcements. This article will explore how to effectively utilize options strategies before, during, and after Broadcom's earnings releases.

Understanding the Risks and Rewards of Options Trading

Before diving into specific strategies, it's crucial to understand the inherent risks of options trading. Unlike simply buying or selling shares, options involve leverage, amplifying both potential profits and losses. A deep understanding of options contracts, including their expiration dates, strike prices, and the various types (calls and puts), is essential. Consider consulting a financial advisor before engaging in options trading if you're unfamiliar with the complexities.

Strategies Before the Earnings Announcement

Several options strategies can help position yourself ahead of Broadcom's earnings release. The optimal strategy depends on your outlook on the stock price movement:

-

Bullish Outlook (Expecting Price Increase): A long call option allows you to profit significantly if the price surges after the announcement. However, the premium paid for the option could be lost if the price remains flat or declines.

-

Bearish Outlook (Expecting Price Decrease): A long put option is the appropriate choice. This strategy profits from a price drop, but the premium is lost if the price rises or stays the same.

-

Neutral Outlook (Uncertainty about Price Movement): A long straddle (buying both a call and a put option with the same strike price and expiration date) or a strangle (buying a call and a put with different strike prices) can profit from significant price movements in either direction. However, these strategies require larger premiums and only profit if the price movement exceeds the premium cost.

Managing Risk During and After the Announcement

The period immediately surrounding the earnings announcement is often characterized by extreme volatility. Effective risk management is crucial:

-

Setting Stop-Loss Orders: Protecting your capital is paramount. Stop-loss orders automatically sell your options positions if the price falls below a predetermined level, limiting potential losses.

-

Monitoring Market Sentiment: Keeping an eye on news headlines, analyst ratings, and social media sentiment can provide insights into the market's reaction to the earnings report and inform your trading decisions.

-

Adjusting Positions: Don't be afraid to adjust your positions based on the evolving market conditions. If your initial prediction proves incorrect, consider exiting the trade to minimize losses.

Post-Earnings Analysis and Future Strategies

After the earnings announcement, analyze the results and your trading performance. This analysis helps refine your strategies for future earnings releases.

Resources for Further Learning

For a more comprehensive understanding of options trading, explore resources like:

- Investopedia: [Link to Investopedia's options trading section]

- The Options Industry Council: [Link to the Options Industry Council website]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market, particularly options trading, involves significant risk. Consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Always conduct thorough research before trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating Broadcom's Earnings Announcement With Options. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Inspiration Alcaraz On Sinners Strong Showing

Jun 05, 2025

French Open Inspiration Alcaraz On Sinners Strong Showing

Jun 05, 2025 -

Industry Challenges Contribute To Powins Significant Financial Strain

Jun 05, 2025

Industry Challenges Contribute To Powins Significant Financial Strain

Jun 05, 2025 -

Summer Houses Paige De Sorbo Announces Departure After Seven Seasons

Jun 05, 2025

Summer Houses Paige De Sorbo Announces Departure After Seven Seasons

Jun 05, 2025 -

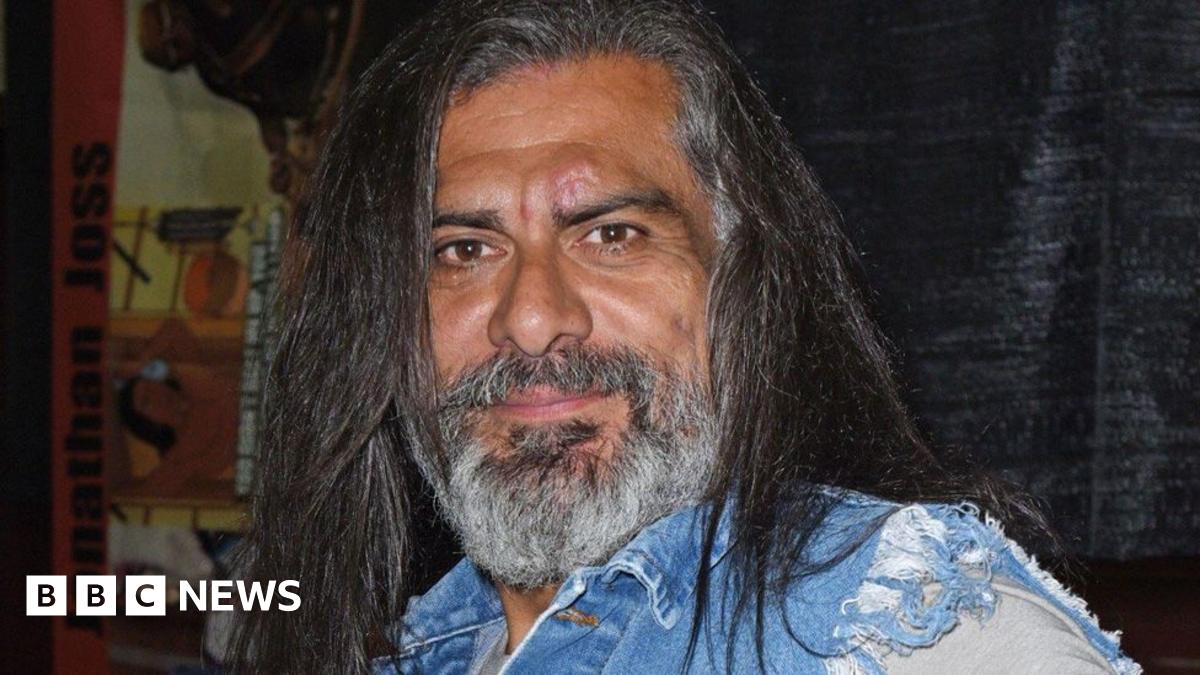

Confirmed Jonathan Joss Known For King Of The Hill Role Shot And Killed

Jun 05, 2025

Confirmed Jonathan Joss Known For King Of The Hill Role Shot And Killed

Jun 05, 2025 -

Ex Trump Voters Emigrating A Growing Trend In American Expatriation

Jun 05, 2025

Ex Trump Voters Emigrating A Growing Trend In American Expatriation

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025