Navigating Broadcom's Earnings Report: A Practical Options Trading Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating Broadcom's Earnings Report: A Practical Options Trading Approach

Broadcom (AVGO) earnings reports are major market events. The semiconductor giant's performance significantly impacts the tech sector and the broader market, making it a prime target for options traders seeking both profit and risk management. But navigating the volatility surrounding these releases requires a strategic approach. This article provides a practical guide to options trading strategies around Broadcom's earnings announcements.

Understanding the Risks and Rewards

Trading options around earnings announcements offers substantial potential rewards but also carries heightened risk. The implied volatility (IV) of Broadcom options typically spikes before the report, creating opportunities for significant gains. However, unexpected results can lead to substantial losses if your position isn't managed effectively. Therefore, thorough research and a well-defined trading plan are paramount.

Pre-Earnings Analysis: Key Factors to Consider

Before employing any options strategy, conduct comprehensive due diligence. Analyze Broadcom's recent performance, considering factors like:

- Revenue Growth: Examine the company's revenue trends and projections for the current quarter. Are analysts' expectations realistic?

- Earnings per Share (EPS): Focus on the anticipated EPS and compare it to previous quarters and analyst consensus estimates. Significant deviations can heavily impact the stock price.

- Guidance: Pay close attention to Broadcom's forward-looking guidance. Positive guidance often boosts investor confidence, while negative guidance can trigger sell-offs.

- Industry Trends: Analyze broader semiconductor industry trends and their potential impact on Broadcom's performance. Geopolitical factors and supply chain issues are crucial considerations.

- Analyst Ratings: Review analyst ratings and price targets for AVGO to gauge market sentiment. A consensus of positive ratings often suggests bullish expectations.

Options Strategies for Broadcom Earnings

Several options strategies can be employed, each with its own risk-reward profile:

1. Long Straddle/Strangle: This strategy benefits from significant price movements in either direction. A straddle involves buying both a call and a put option with the same strike price and expiration date. A strangle is similar but uses different strike prices (one call and one put with different strike prices, but same expiration). This strategy profits if the price moves significantly, regardless of direction, but loses money if the price remains within the range of the strike prices.

2. Short Strangle/Iron Condor: These strategies are designed for periods of low volatility. A short strangle involves selling a call and a put option, while an iron condor adds extra protection by buying further out-of-the-money options. These strategies profit if the underlying stock's price stays within a defined range, making them appropriate if you anticipate limited price movement after earnings are released.

3. Calendar Spreads: These strategies take advantage of time decay. It involves selling near-term options and buying far-term options with the same strike price. This profit if volatility decreases before expiration. Useful for less volatile, anticipated earnings.

Post-Earnings Analysis and Reaction

After the earnings announcement, monitor the market's reaction closely. Price movements can be rapid and unpredictable. Consider adjusting your position based on the actual results and market sentiment. Remember that your pre-earnings analysis might be invalidated by unexpected news.

Disclaimer: Options trading involves substantial risk and is not suitable for all investors. This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Further Resources:

- [Link to reputable options trading education resource]

- [Link to Broadcom investor relations page]

Call to Action: Ready to refine your options trading strategy? Consider exploring [link to relevant educational resource or trading platform]. Remember to always prioritize risk management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating Broadcom's Earnings Report: A Practical Options Trading Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Alcaraz Vs Sinner Roddick Offers Insight Into Their Long Term Prospects

Jun 05, 2025

Alcaraz Vs Sinner Roddick Offers Insight Into Their Long Term Prospects

Jun 05, 2025 -

Dramatic Rescue In North Pacific 22 Sailors Saved After Car Carrier Fire

Jun 05, 2025

Dramatic Rescue In North Pacific 22 Sailors Saved After Car Carrier Fire

Jun 05, 2025 -

Jannik Sinner On His Alcaraz Hurdle Ahead Of Potential Roland Garros Matchup

Jun 05, 2025

Jannik Sinner On His Alcaraz Hurdle Ahead Of Potential Roland Garros Matchup

Jun 05, 2025 -

Grooming And Abuse Survivors Recount Their Experiences

Jun 05, 2025

Grooming And Abuse Survivors Recount Their Experiences

Jun 05, 2025 -

Why Is A Former Penn State And Nfl Stars Jersey In The Smithsonian

Jun 05, 2025

Why Is A Former Penn State And Nfl Stars Jersey In The Smithsonian

Jun 05, 2025

Latest Posts

-

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025

Keita Nakagawas Game Tying Home Run Fuels Orix Comeback

Aug 17, 2025 -

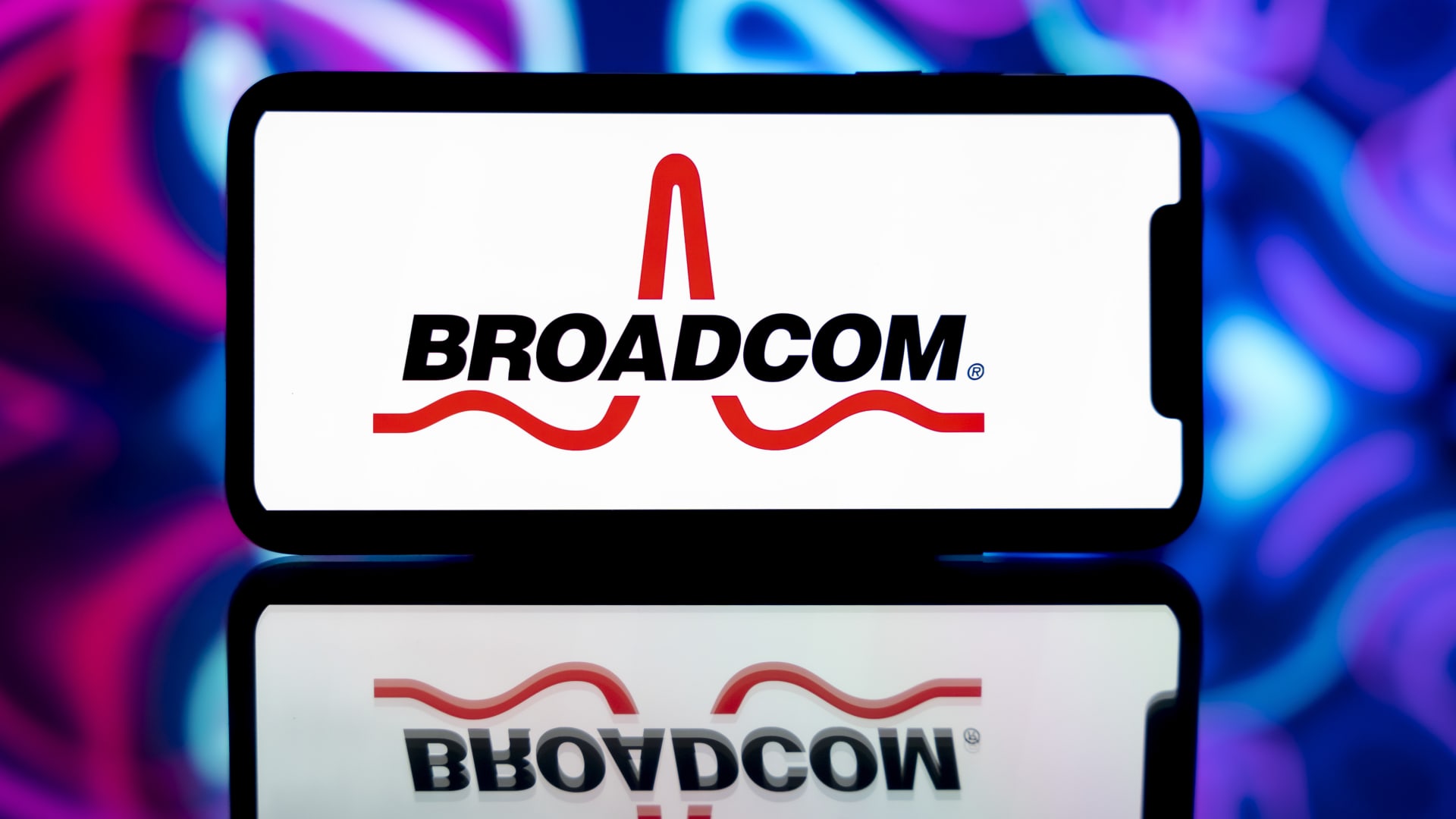

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

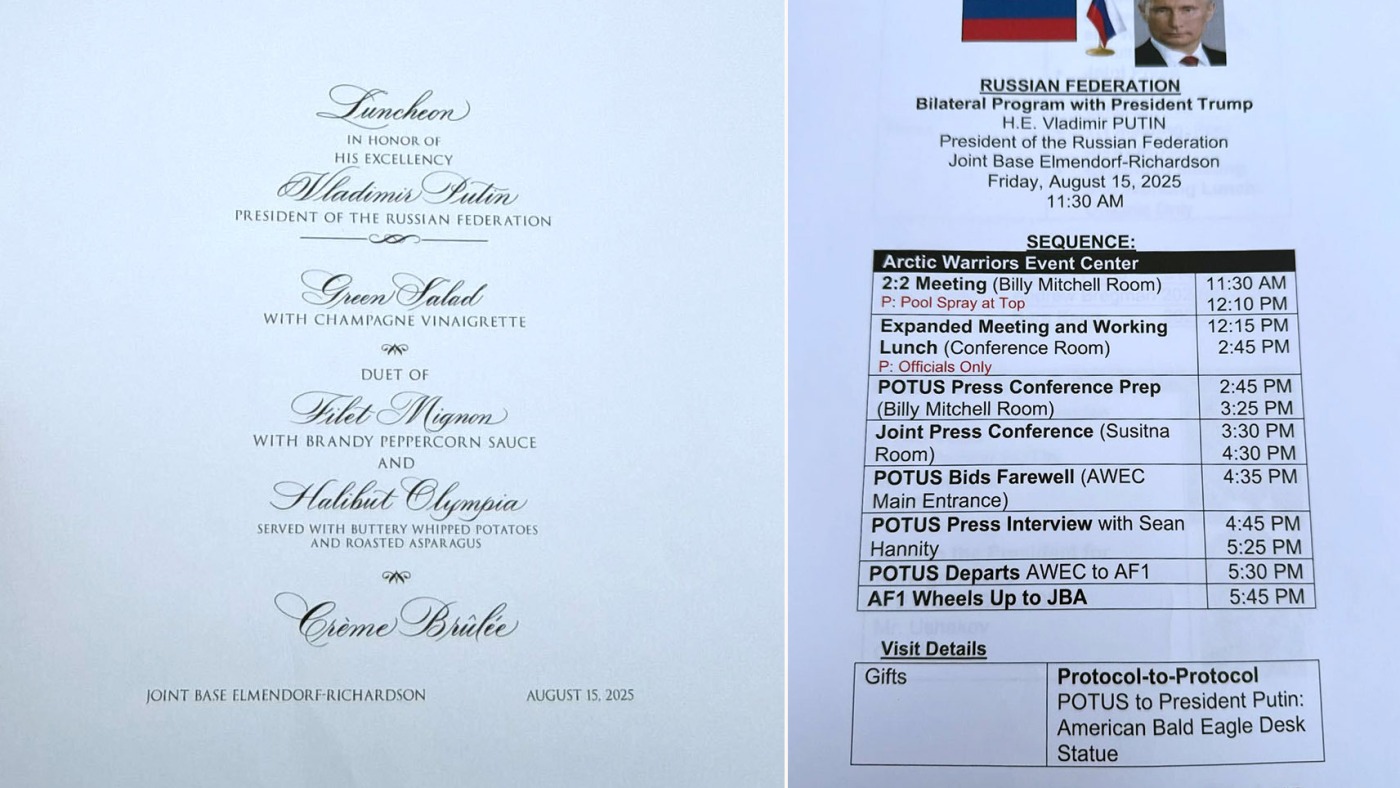

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025