Navigating The New US Small Parcel Tax: A Headache For UK Companies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating the New US Small Parcel Tax: A Headache for UK Companies

The new US small parcel tax is causing significant headaches for UK businesses. This significant change in US import regulations, impacting shipments weighing less than 165lbs, has introduced complexity and increased costs for companies reliant on transatlantic trade. Understanding these changes is crucial to avoid costly penalties and maintain smooth operations. This article will break down the key aspects of the new tax, its implications for UK companies, and offer practical advice for navigating this challenging landscape.

What is the New US Small Parcel Tax?

The recent changes to US import regulations have significantly altered the landscape for small parcel shipments. Previously, many smaller packages slipped under the radar of customs duties and taxes, particularly those valued below a certain threshold. However, this loophole has been closed, leading to unexpected fees and administrative burdens for many UK companies exporting goods to the US. This means that even small businesses shipping items like clothing, electronics, or craft supplies now face increased taxation. The implications are wide-ranging and demand careful consideration.

Key Impacts on UK Businesses

The new tax has several key impacts on UK companies exporting goods to the US:

- Increased Costs: The most immediate effect is higher shipping costs. Companies must now factor in duties, taxes, and potentially increased handling fees, significantly impacting profit margins.

- Administrative Burden: The increased paperwork and customs processing requirements add considerable administrative overhead. UK businesses need to allocate more resources to comply with the new regulations.

- Delayed Shipments: The additional checks and processing time can lead to delays in shipments, potentially impacting customer satisfaction and business relationships.

- Potential for Penalties: Failure to comply with the new regulations can result in significant penalties, further impacting profitability.

How to Navigate the New Tax Landscape

Successfully navigating this new tax landscape requires proactive measures:

- Understand the Regulations: Thoroughly research the specific requirements for your product category and shipment weight. The official US Customs and Border Protection (CBP) website is an excellent resource: [link to CBP website].

- Accurate Documentation: Ensure all required documentation is accurate and complete. This includes commercial invoices, packing lists, and any other necessary certificates. Inaccurate documentation can lead to delays and penalties.

- Choose the Right Carrier: Select a shipping carrier with experience handling US customs regulations. They can provide valuable support and guidance in navigating the complexities of the new tax.

- Utilize Customs Brokers: For larger shipments or more complex product categories, consider using a customs broker. They can handle the paperwork and customs clearance process, reducing your administrative burden.

- Factor in Costs: Accurately estimate the additional costs associated with the new tax when pricing your goods. Transparency with your customers is crucial.

- Stay Updated: Customs regulations can change, so it's important to stay informed about any updates or modifications.

Looking Ahead: Strategies for Mitigation

For UK businesses, adapting to the new US small parcel tax requires a multifaceted approach. This includes:

- Negotiating with Suppliers: Explore options to negotiate with US suppliers to share the burden of these increased costs.

- Review Pricing Strategies: Carefully review pricing strategies to account for the increased costs and ensure continued profitability.

- Diversification of Markets: Consider diversifying your export markets to reduce reliance on the US market and mitigate the impact of these new regulations.

The new US small parcel tax represents a significant challenge for UK businesses. However, by understanding the regulations, adopting best practices, and staying informed, companies can effectively navigate this complex landscape and maintain their competitiveness in the US market. Proactive planning and a clear understanding of the implications are key to mitigating the negative impacts and ensuring continued success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating The New US Small Parcel Tax: A Headache For UK Companies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Frank Grillo Admits He Was Unfamiliar With John Cena Before Filming Peacemaker

Aug 30, 2025

Frank Grillo Admits He Was Unfamiliar With John Cena Before Filming Peacemaker

Aug 30, 2025 -

Deliver Me From Nowhere Jeremiah Fraites Discusses Scoring The Bruce Springsteen Film

Aug 30, 2025

Deliver Me From Nowhere Jeremiah Fraites Discusses Scoring The Bruce Springsteen Film

Aug 30, 2025 -

Contractor Ordered To Abandon Heathrow Airport Immigration Centre Balloon Installation

Aug 30, 2025

Contractor Ordered To Abandon Heathrow Airport Immigration Centre Balloon Installation

Aug 30, 2025 -

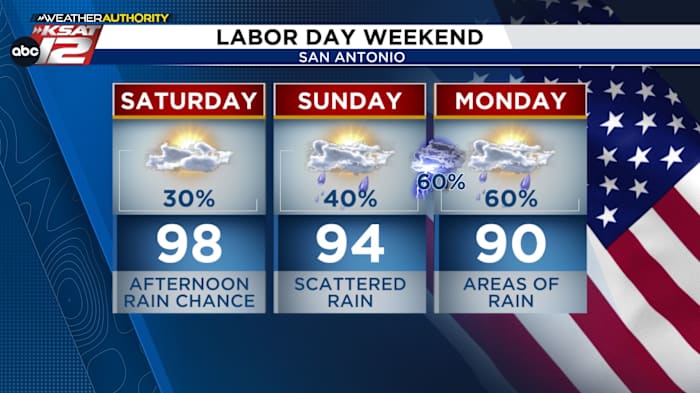

Labor Day Weekend In San Antonio Prepare For Potential Rainfall

Aug 30, 2025

Labor Day Weekend In San Antonio Prepare For Potential Rainfall

Aug 30, 2025 -

Kari Lakes Bid To Oust Voice Of America Director Rejected By Federal Judge

Aug 30, 2025

Kari Lakes Bid To Oust Voice Of America Director Rejected By Federal Judge

Aug 30, 2025

Latest Posts

-

An Interview With Julio Torres Perspectives On Color Toys And Hollywood

Sep 05, 2025

An Interview With Julio Torres Perspectives On Color Toys And Hollywood

Sep 05, 2025 -

Tropical Storm Lorena Pummels Northwestern Mexico Heavy Rainfall And Flooding Reported

Sep 05, 2025

Tropical Storm Lorena Pummels Northwestern Mexico Heavy Rainfall And Flooding Reported

Sep 05, 2025 -

College Football Power Rankings A First Look At The Top 25 Teams

Sep 05, 2025

College Football Power Rankings A First Look At The Top 25 Teams

Sep 05, 2025 -

Hollywood Diversity Film Aesthetics And Toys A Conversation With Julio Torres

Sep 05, 2025

Hollywood Diversity Film Aesthetics And Toys A Conversation With Julio Torres

Sep 05, 2025 -

Middle Of The Night Rescue Repatriating Guatemalan Children From Us Immigration Custody

Sep 05, 2025

Middle Of The Night Rescue Repatriating Guatemalan Children From Us Immigration Custody

Sep 05, 2025