Navigating The New US Small Parcel Tax: Practical Advice For UK Companies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Navigating the New US Small Parcel Tax: Practical Advice for UK Companies

The US has introduced new regulations impacting small parcel shipments from overseas, creating a significant hurdle for UK businesses trading across the Atlantic. This new tax, impacting shipments valued at less than $800, requires careful navigation to avoid costly delays and penalties. This article provides essential guidance for UK companies to successfully navigate these changes.

Understanding the New US Small Parcel Tax

The recent changes to US import regulations significantly impact small parcel shipments, including those frequently used by UK e-commerce businesses and retailers. Previously, smaller packages often escaped certain customs processes. Now, all shipments, regardless of value (below the de minimis threshold of $800), are subject to:

- Increased Customs Fees: Expect higher customs brokerage fees and processing charges. These fees can significantly impact profit margins if not properly accounted for.

- Pre-Arrival Information Requirements: US Customs and Border Protection (CBP) now requires more detailed information about shipments before they arrive. This includes accurate product descriptions, HS codes (Harmonized System codes for classifying goods), and declared values. Failure to provide this accurately and in advance can lead to delays and penalties.

- Increased Scrutiny: The CBP is increasing its scrutiny of small parcel imports to combat counterfeit goods and ensure compliance with import regulations. This means more packages may be subject to physical inspections.

Practical Advice for UK Companies

Successfully navigating this new landscape requires proactive planning and a thorough understanding of the updated regulations. Here's what UK companies should do:

1. Accurate Product Classification: Accurately determining the HS code for each product is crucial. Incorrect classification can result in significant delays and penalties. Utilize resources like the World Customs Organization (WCO) website or consult with a customs broker for assistance.

2. Prepare Comprehensive Documentation: Ensure all necessary documentation is prepared well in advance of shipping. This includes commercial invoices, packing lists, and certificates of origin (where applicable). Electronic submission is often preferred by couriers to expedite processing.

3. Choose the Right Courier: Partnering with a reputable international courier with experience handling US customs regulations is essential. They can provide guidance on documentation, customs brokerage, and ensure smooth processing. Research couriers that offer integrated customs solutions.

4. Understand Duty and Tax Obligations: Familiarize yourself with US import duties and taxes applicable to your products. Accurate declaration of value is critical to avoid underpayment penalties. Consider using a duty calculator to estimate these costs upfront.

5. Factor Costs into Pricing: The added costs associated with the new regulations must be factored into your pricing strategy to maintain profitability. Transparent communication with customers about these changes is also beneficial.

6. Consider a Customs Broker: For complex shipments or high volumes, engaging a customs broker can streamline the process and significantly reduce the risk of errors. They handle the intricate paperwork and navigate customs regulations on your behalf.

Looking Ahead:

The new US small parcel tax presents challenges, but with careful planning and attention to detail, UK businesses can continue to successfully trade with the US market. Proactive preparation is key to minimizing disruptions and maximizing efficiency. Regularly review updates to US import regulations to stay informed about any further changes.

Call to Action: Begin reviewing your current shipping processes and consult with your courier or a customs broker to ensure compliance with the new regulations. Don't let these changes catch you off guard – proactive planning is your best defense.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Navigating The New US Small Parcel Tax: Practical Advice For UK Companies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

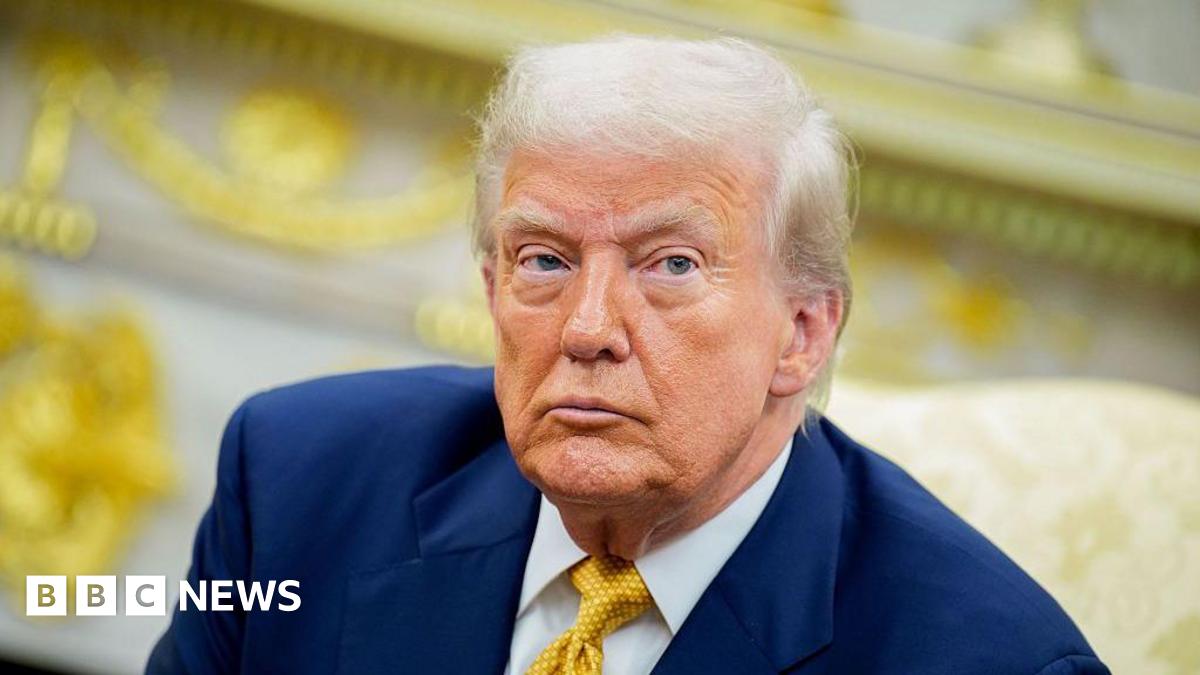

Trumps Global Tariffs Deemed Illegal By Us Court

Aug 31, 2025

Trumps Global Tariffs Deemed Illegal By Us Court

Aug 31, 2025 -

Singer Sza Appointed Vans Inaugural Creative Director

Aug 31, 2025

Singer Sza Appointed Vans Inaugural Creative Director

Aug 31, 2025 -

Shakira Y Antonio De La Rua Una Cancion Reaviva Viejos Sentimientos

Aug 31, 2025

Shakira Y Antonio De La Rua Una Cancion Reaviva Viejos Sentimientos

Aug 31, 2025 -

Us Open Singles Full Schedule For Day 8 August 31st 2025

Aug 31, 2025

Us Open Singles Full Schedule For Day 8 August 31st 2025

Aug 31, 2025 -

Felony Charge Dropped Dc Sandwich Incident Leads To Misdemeanor

Aug 31, 2025

Felony Charge Dropped Dc Sandwich Incident Leads To Misdemeanor

Aug 31, 2025

Latest Posts

-

Mac De Marco Preps For Greek Theatre Show With Intimate La Gig

Sep 02, 2025

Mac De Marco Preps For Greek Theatre Show With Intimate La Gig

Sep 02, 2025 -

Dune 3 Filming Abu Dhabis Liwa Desert Takes Center Stage

Sep 02, 2025

Dune 3 Filming Abu Dhabis Liwa Desert Takes Center Stage

Sep 02, 2025 -

Uk Politics Today Examining The Gift Of The Jab And Rayner Lobbying Controversy

Sep 02, 2025

Uk Politics Today Examining The Gift Of The Jab And Rayner Lobbying Controversy

Sep 02, 2025 -

The Echo Plays Host Mac De Marcos Pre Greek Theatre Performance

Sep 02, 2025

The Echo Plays Host Mac De Marcos Pre Greek Theatre Performance

Sep 02, 2025 -

8 Quotes From The 1 Billion Sci Fi Franchise That Predict The Sequel

Sep 02, 2025

8 Quotes From The 1 Billion Sci Fi Franchise That Predict The Sequel

Sep 02, 2025