New Buy Now Pay Later Regulations: What Shoppers Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Buy Now Pay Later Regulations: What Shoppers Need to Know

Buy Now Pay Later (BNPL) services have exploded in popularity, offering a seemingly effortless way to purchase goods and services. But with this convenience comes responsibility, and recent regulatory changes are designed to protect consumers. Understanding these new regulations is crucial for anyone using or considering using BNPL services. This article breaks down the key changes and what they mean for you.

What are Buy Now Pay Later Services?

BNPL services allow consumers to purchase items and pay for them in installments, typically over a few weeks or months. Popular services like Klarna, Affirm, and Afterpay offer this option at checkout, making it easy to spread the cost of purchases. While offering convenience, they also carry potential risks if not managed carefully. Understanding the terms and conditions is paramount before committing to a BNPL agreement.

The New Wave of Regulations: Protecting Consumers

Recent regulatory changes aim to address concerns around BNPL's potential for debt accumulation and its impact on credit scores. These regulations vary by country and region, but generally focus on the following key areas:

-

Increased Transparency: Regulations are mandating greater transparency in the terms and conditions of BNPL agreements. This includes clearer explanations of fees, interest rates (if applicable), and the potential impact on credit scores. Expect to see more upfront information about the total cost of the purchase, not just the monthly payments.

-

Credit Checks and Risk Assessments: Some jurisdictions are introducing requirements for BNPL providers to conduct more thorough credit checks before approving applications. This helps ensure that consumers are only taking on debt they can realistically manage. This is a significant change from the previously less stringent application processes.

-

Debt Collection Practices: Stricter regulations are being implemented regarding debt collection practices. Aggressive or unfair debt collection tactics will be more heavily penalized, offering greater protection to consumers struggling to make payments.

-

Impact on Credit Reports: The impact of BNPL usage on credit reports is becoming clearer. While not all BNPL services report to credit bureaus, an increasing number are, and regulations are ensuring consistent reporting practices to prevent misleading or inaccurate information.

What Does This Mean for Shoppers?

These new regulations translate to several key benefits for consumers:

-

Better Informed Decisions: With increased transparency, you'll have a clearer understanding of the costs and implications of using BNPL before you commit. This allows for more informed financial decisions.

-

Reduced Risk of Overspending: More stringent credit checks can help prevent you from taking on more debt than you can handle, reducing the risk of falling into a debt trap.

-

Fairer Debt Collection Practices: You'll be better protected from unfair or aggressive debt collection methods if you find yourself struggling with repayments.

Tips for Using BNPL Responsibly:

- Only use BNPL for necessary purchases: Avoid using it for impulse buys.

- Always read the terms and conditions carefully: Understand the fees, interest rates, and repayment schedule before agreeing to the agreement.

- Create a realistic budget: Ensure you can afford the repayments without impacting your other financial commitments.

- Pay on time: Late payments can lead to penalties and negatively impact your credit score.

- Consider the long-term financial implications: Don't let the convenience overshadow the potential risks.

The landscape of BNPL is evolving, and these regulations represent a crucial step towards greater consumer protection. By staying informed and using BNPL responsibly, you can harness its convenience while mitigating potential risks. Understanding these changes will empower you to make smarter financial decisions and avoid potential pitfalls.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Buy Now Pay Later Regulations: What Shoppers Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Retirement Hint And Aspinall Contract Stalemate Rock Ufc World

May 21, 2025

Jon Jones Retirement Hint And Aspinall Contract Stalemate Rock Ufc World

May 21, 2025 -

Helping Your Child Quit Pacifiers And Thumb Sucking A Parents Guide

May 21, 2025

Helping Your Child Quit Pacifiers And Thumb Sucking A Parents Guide

May 21, 2025 -

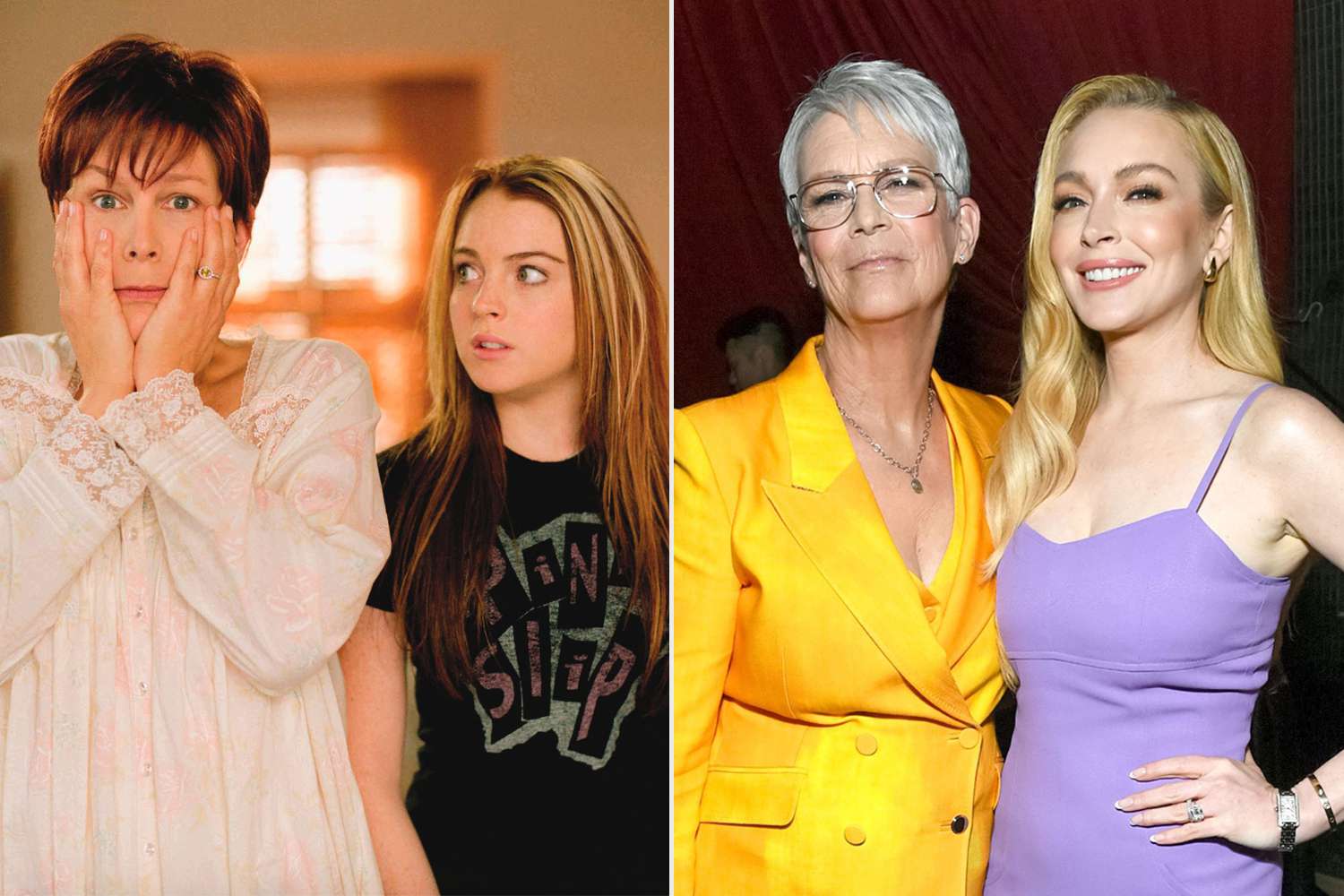

Jamie Lee Curtis On Maintaining Her Relationship With Lindsay Lohan Post Freaky Friday

May 21, 2025

Jamie Lee Curtis On Maintaining Her Relationship With Lindsay Lohan Post Freaky Friday

May 21, 2025 -

Slight Dip In U S Treasury Yields Follows Feds Rate Cut Projection

May 21, 2025

Slight Dip In U S Treasury Yields Follows Feds Rate Cut Projection

May 21, 2025 -

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025

Jamie Lee Curtis Opens Up About Her Bond With Lindsay Lohan Years After Freaky Friday Exclusive

May 21, 2025

Latest Posts

-

Wall Street Rebounds S And P 500 Dow And Nasdaq Climb Despite Moodys Rating Cut

May 21, 2025

Wall Street Rebounds S And P 500 Dow And Nasdaq Climb Despite Moodys Rating Cut

May 21, 2025 -

The Fallout From Untold Brett Favre A J Perez Discusses Threats And The Documentarys Impact

May 21, 2025

The Fallout From Untold Brett Favre A J Perez Discusses Threats And The Documentarys Impact

May 21, 2025 -

Helping Your Child Stop Sucking Thumbs And Pacifiers A Parents Guide

May 21, 2025

Helping Your Child Stop Sucking Thumbs And Pacifiers A Parents Guide

May 21, 2025 -

Aspinall Injury Information Withheld Jon Jones Blasts Ufc Transparency

May 21, 2025

Aspinall Injury Information Withheld Jon Jones Blasts Ufc Transparency

May 21, 2025 -

President Bidens Health Official Confirmation Of Prostate Cancer Diagnosis

May 21, 2025

President Bidens Health Official Confirmation Of Prostate Cancer Diagnosis

May 21, 2025