New Car Finance Redress Plan Faces Industry Backlash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Car Finance Redress Plan Faces Industry Backlash

The government's proposed redress scheme for car finance irregularities is facing significant opposition from the automotive industry, raising concerns about its feasibility and potential impact. The plan, designed to address widespread complaints about mis-selling and unfair practices in car finance agreements, has been met with criticism from major lenders, dealerships, and industry bodies. This article delves into the specifics of the proposed scheme and the reasons behind the growing backlash.

What is the Proposed Redress Plan?

The government's plan aims to create a streamlined process for consumers to claim compensation for issues relating to car finance, including:

- Mis-selling of products: This includes instances where consumers were pressured into accepting unsuitable finance deals, or where the terms and conditions were not clearly explained.

- Unfair contract terms: The plan targets agreements containing hidden fees, excessive interest rates, or clauses that unfairly penalize consumers.

- Lack of transparency: The redress scheme addresses complaints concerning inadequate disclosure of information related to finance options.

The plan proposes a centralized system, potentially involving an independent ombudsman, to handle claims efficiently and fairly. However, the details of this system remain largely unspecified, fueling much of the industry's apprehension.

Industry Concerns: Cost and Feasibility

The automotive finance industry is expressing significant concerns regarding the financial burden of implementing such a scheme. Many lenders argue that the cost of processing potentially thousands of claims, coupled with the potential for substantial payouts, could be crippling. The Financial Conduct Authority (FCA), the UK's financial regulatory body, has already been active in tackling issues within the car finance sector, leading some to believe that the new redress plan is unnecessarily duplicative and costly.

Furthermore, concerns are being raised about the practicality of the plan. Determining liability in individual cases can be complex, particularly given the often-lengthy periods between the agreement being signed and a complaint being made. Industry bodies are calling for a more targeted approach, focusing on specific instances of proven wrongdoing rather than a blanket redress scheme.

The Voice of Dealerships

Dealerships are also voicing their concerns, arguing that they are often caught in the middle of disputes between lenders and consumers. The potential for reputational damage, as well as the administrative burden of dealing with complaints, is creating significant anxieties. Many dealerships are emphasizing their commitment to fair and ethical business practices, suggesting that the proposed scheme unfairly casts a shadow over the entire industry.

What Happens Next?

The government is currently reviewing the feedback received from the industry and consumer groups. Amendments to the scheme are likely, but the extent of these changes remains unclear. The coming months will be crucial in determining the future of the car finance redress plan and its impact on both consumers and the automotive industry. This ongoing debate underscores the importance of careful consideration and a balanced approach to addressing consumer protection concerns within the highly regulated financial sector. Consumers should remain vigilant and ensure they understand the terms of any car finance agreements before signing. Seeking independent financial advice is always recommended.

Keywords: Car finance, redress scheme, automotive industry, industry backlash, mis-selling, unfair contract terms, FCA, consumer protection, financial regulation, complaints, compensation, ombudsman.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Car Finance Redress Plan Faces Industry Backlash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brooklyn Mirages Owner Files For Bankruptcy Impact On Concerts And Events

Aug 06, 2025

Brooklyn Mirages Owner Files For Bankruptcy Impact On Concerts And Events

Aug 06, 2025 -

Mr Beasts Le Bron Vs Jordan A Handicapped Goat Debate Ignites The Internet

Aug 06, 2025

Mr Beasts Le Bron Vs Jordan A Handicapped Goat Debate Ignites The Internet

Aug 06, 2025 -

Discover Oregons Unbeatable Outdoor Recreation

Aug 06, 2025

Discover Oregons Unbeatable Outdoor Recreation

Aug 06, 2025 -

Bankruptcy Delays Sale Of Historic Oheka Castle Meliuss Chapter 11

Aug 06, 2025

Bankruptcy Delays Sale Of Historic Oheka Castle Meliuss Chapter 11

Aug 06, 2025 -

Kate Forbes Stands Down What Next For Scottish Politics

Aug 06, 2025

Kate Forbes Stands Down What Next For Scottish Politics

Aug 06, 2025

Latest Posts

-

Wednesday Weather Alert Showers Likely

Aug 07, 2025

Wednesday Weather Alert Showers Likely

Aug 07, 2025 -

Do Or Die A Ukrainian Soldiers Cycling Escape From Russian Forces

Aug 07, 2025

Do Or Die A Ukrainian Soldiers Cycling Escape From Russian Forces

Aug 07, 2025 -

First Alert Prepare For Showers Wednesday

Aug 07, 2025

First Alert Prepare For Showers Wednesday

Aug 07, 2025 -

Sec Announces Complete 2026 Womens Basketball Season Schedule

Aug 07, 2025

Sec Announces Complete 2026 Womens Basketball Season Schedule

Aug 07, 2025 -

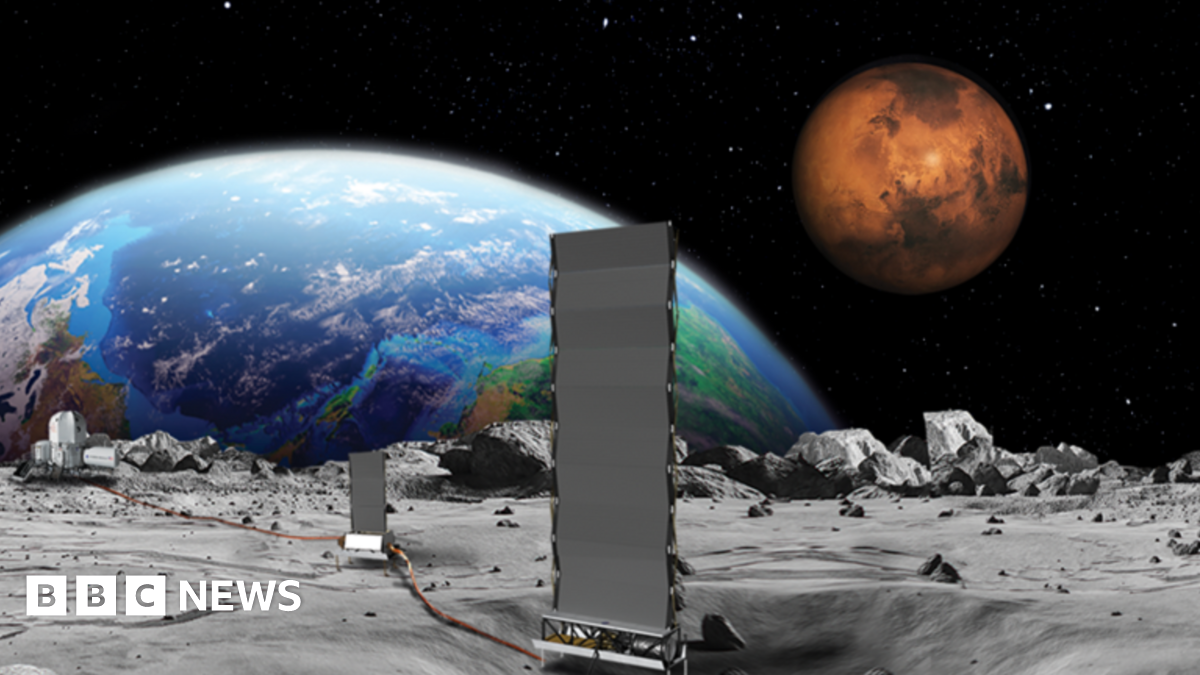

Nuclear Power On The Moon Nasas 2030 Ambitious Goal

Aug 07, 2025

Nuclear Power On The Moon Nasas 2030 Ambitious Goal

Aug 07, 2025