New Car Finance Ruling Could Open Floodgates For Millions Of Claims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Car Finance Ruling Could Open Floodgates for Millions of Claims

A landmark court decision has sent shockwaves through the UK car finance industry, potentially unleashing a wave of compensation claims from millions of drivers. The ruling, handed down by the [Court Name], challenges the legality of certain practices employed by lenders when offering car finance agreements. This could lead to a significant financial fallout for lenders and a windfall for affected consumers.

The case, [Case Name], centered on [brief, clear explanation of the core issue, e.g., mis-selling of optional insurance products, unfair interest rates, misleading advertising]. The judge's decision explicitly stated that [quote from the ruling or paraphrase of the key finding], effectively setting a precedent that could invalidate similar contracts across the board. This opens the door for a potential deluge of claims from individuals who believe they were unfairly treated by their lenders.

Who Could Be Affected?

This ruling has the potential to impact a vast number of people. Anyone who entered into a car finance agreement in the UK within the past [Number] years – particularly those with contracts containing [mention key features highlighted in the ruling, e.g., add-on insurance policies, high APR rates, or specific contract wording] – may be entitled to compensation. This includes those who:

- Purchased a car through PCP (Personal Contract Purchase) agreements.

- Secured a car loan with a high-interest rate.

- Were sold optional insurance products they didn't need or understand.

- Experienced misleading or unclear information during the sales process.

It's crucial to note that this doesn't automatically mean everyone with a car finance agreement will receive compensation. Each case will need to be assessed individually to determine whether the terms of the contract violate the ruling's principles.

What Should You Do If You Think You're Affected?

If you suspect your car finance agreement might be affected by this ruling, it's vital to act quickly. Don't rush into contacting a claims management company, though. Instead:

- Review your contract carefully: Pay close attention to the terms and conditions, particularly regarding interest rates, optional add-ons, and any clauses related to [mention key contract elements again].

- Gather your documentation: Collect all relevant paperwork, including your agreement, any correspondence with the lender, and any evidence of misleading sales practices.

- Seek independent legal advice: Contact a solicitor specializing in consumer rights or financial mis-selling. They can assess your situation and advise you on the best course of action. Avoid companies promising quick wins without proper legal analysis.

- Be wary of claims management companies: While some are reputable, many prey on vulnerable consumers. Do your research and choose a company with a proven track record and transparent fees. [Optional: Link to a reputable consumer advice website].

The Implications for the Car Finance Industry

This ruling is likely to have profound consequences for the car finance industry. Lenders may face substantial financial liabilities, potentially leading to increased scrutiny of their practices and changes in how they offer finance agreements. This could, in turn, affect the cost and availability of car finance for consumers in the future. The Financial Conduct Authority (FCA) will likely be closely monitoring the situation and may take further action.

This situation is rapidly evolving, so staying informed is crucial. We will continue to update this article as more information becomes available. For more information on consumer rights, visit [link to relevant government or consumer protection website].

Disclaimer: This article provides general information only and does not constitute legal advice. Always seek professional legal counsel before making any decisions regarding your car finance agreement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Car Finance Ruling Could Open Floodgates For Millions Of Claims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

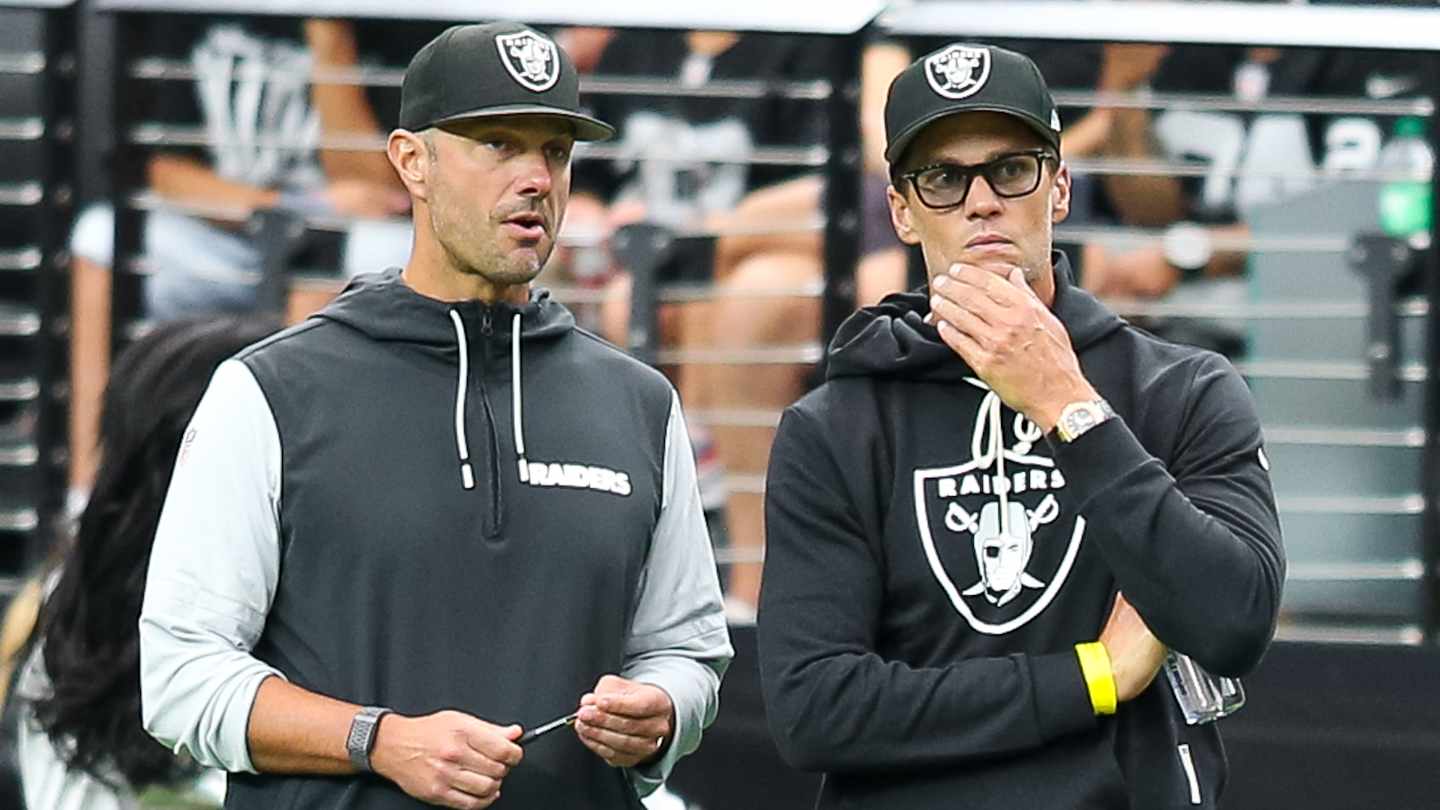

Raiders Scrimmage Analysis Promising Plays And Areas For Improvement

Aug 03, 2025

Raiders Scrimmage Analysis Promising Plays And Areas For Improvement

Aug 03, 2025 -

Robert Pattinsons Batman Future Uncertain After Gunns Dcu Reveal

Aug 03, 2025

Robert Pattinsons Batman Future Uncertain After Gunns Dcu Reveal

Aug 03, 2025 -

James Gunn Sets The Record Straight Robert Pattinson Is Out As Batman

Aug 03, 2025

James Gunn Sets The Record Straight Robert Pattinson Is Out As Batman

Aug 03, 2025 -

Quentin Tarantinos Emotional Tribute At Michael Madsen Memorial

Aug 03, 2025

Quentin Tarantinos Emotional Tribute At Michael Madsen Memorial

Aug 03, 2025 -

When Is Dexter Resurrection Coming Out Release Date Time And Streaming Details

Aug 03, 2025

When Is Dexter Resurrection Coming Out Release Date Time And Streaming Details

Aug 03, 2025