New Car Finance Ruling Could Unleash Wave Of Consumer Claims

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Car Finance Ruling Could Unleash Wave of Consumer Claims

A landmark court decision has thrown the UK car finance industry into turmoil, potentially opening the floodgates for thousands of consumers to claim compensation for mis-sold products. The ruling, handed down by the High Court last week, centers on the controversial practice of "add-on" insurance products often bundled with car finance agreements. This could mean significant payouts for affected individuals and a major shake-up for the industry.

The case, Smith v. CarFinanceCo (names have been changed for privacy reasons), focused on the alleged mis-selling of Guaranteed Asset Protection (GAP) insurance. The court found that the lender failed to adequately explain the product's terms and conditions, leading to the consumer unknowingly paying for unnecessary coverage. This sets a crucial precedent, suggesting that many similar contracts may be similarly flawed.

What Does This Mean for Car Finance Customers?

The ruling has significant implications for anyone who has financed a car in recent years, particularly those who purchased add-on products such as:

- GAP insurance: This covers the difference between the outstanding finance and the car's market value in the event of a write-off. Many consumers were sold GAP insurance without fully understanding its complexities or whether they already had sufficient coverage through their existing insurance policies.

- Payment Protection Insurance (PPI): While PPI mis-selling claims have largely subsided, this ruling could trigger a renewed focus on potentially mis-sold car finance related PPI policies.

- Vehicle Breakdown Cover: Similar issues of inadequate explanation and potentially unnecessary duplication of existing cover are now under scrutiny.

Spotting Mis-selling in Your Car Finance Agreement:

Identifying mis-selling isn't always straightforward. However, there are some red flags to look out for:

- High-pressure sales tactics: Were you pressured into purchasing add-on products without sufficient time to consider the implications?

- Lack of clarity: Were the terms and conditions of the add-on products explained clearly and concisely? Did you receive sufficient information in writing?

- Unnecessary duplication: Did you already have equivalent cover through another insurance policy or existing financial product?

What Steps Can Consumers Take?

If you suspect you were mis-sold car finance products, here are some initial steps you can take:

- Gather your documentation: Collect all relevant paperwork, including your finance agreement, insurance policies, and any sales correspondence.

- Review your agreement carefully: Pay close attention to the terms and conditions of any add-on products.

- Seek professional advice: Consider contacting a solicitor specializing in consumer rights or a claims management company with experience in car finance mis-selling cases. [Link to reputable consumer advice website]. Remember to be cautious and research any firm thoroughly before engaging their services.

The Future of Car Finance:

This landmark ruling is expected to lead to a surge in claims against car finance companies. The Financial Conduct Authority (FCA) is likely to increase its scrutiny of the industry, potentially leading to stricter regulations and a greater emphasis on consumer protection. The industry itself faces the prospect of significant financial liabilities. This could mean higher costs for future car finance customers or a major restructuring of how add-on products are sold and marketed.

Disclaimer: This article provides general information only and does not constitute legal advice. Readers are encouraged to seek independent professional advice before taking any action based on the information provided.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Car Finance Ruling Could Unleash Wave Of Consumer Claims. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

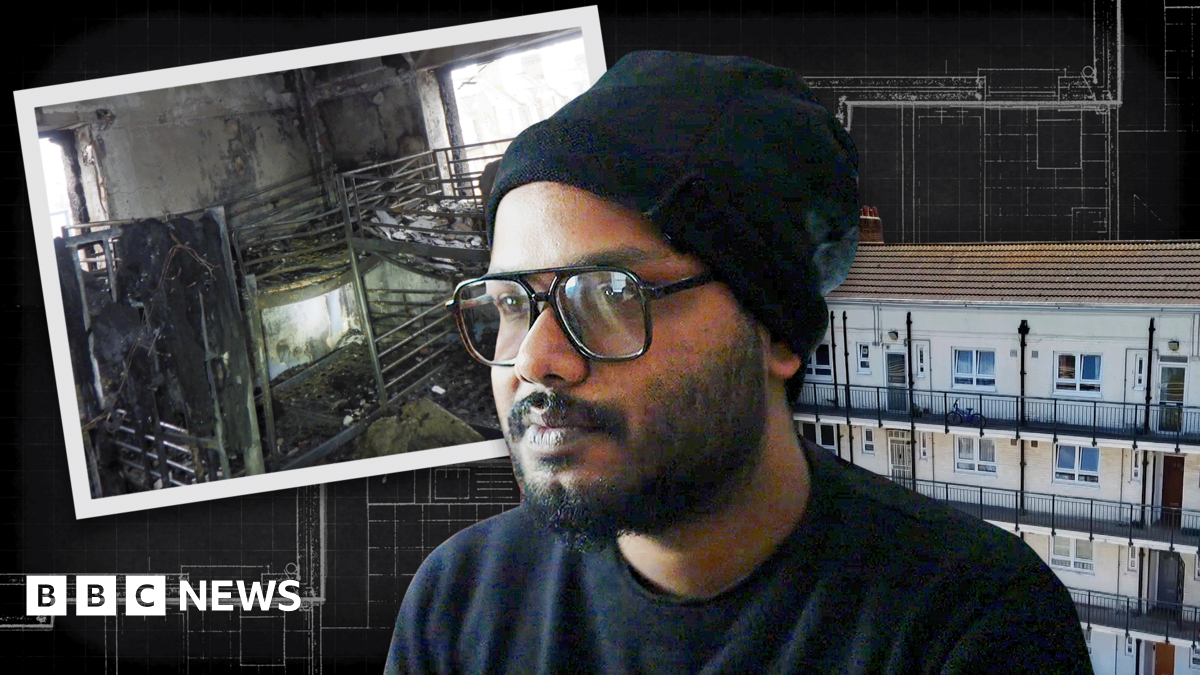

The Grim Reality Of Illegal House Shares Rats Mold And Health Risks

Aug 03, 2025

The Grim Reality Of Illegal House Shares Rats Mold And Health Risks

Aug 03, 2025 -

Watch Juventus Vs Reggiana Live Stream Free Online Soccer Tv Channel

Aug 03, 2025

Watch Juventus Vs Reggiana Live Stream Free Online Soccer Tv Channel

Aug 03, 2025 -

Landmark Car Finance Ruling Millions Of Potential Compensation Claims

Aug 03, 2025

Landmark Car Finance Ruling Millions Of Potential Compensation Claims

Aug 03, 2025 -

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025

Increased Nuclear Tensions Trump Shifts Submarine Deployments After Medvedevs Statements

Aug 03, 2025 -

How Much Did Robert Downey Jr Earn For Avengers Endgame

Aug 03, 2025

How Much Did Robert Downey Jr Earn For Avengers Endgame

Aug 03, 2025

Latest Posts

-

Montana Business Shooting Multiple Victims Law Enforcement Investigating

Aug 03, 2025

Montana Business Shooting Multiple Victims Law Enforcement Investigating

Aug 03, 2025 -

Raiders Training Camp Scrimmage Positive And Negative Observations

Aug 03, 2025

Raiders Training Camp Scrimmage Positive And Negative Observations

Aug 03, 2025 -

Henry Cavill On Superman Reboot All My Focus Confirms Dedication

Aug 03, 2025

Henry Cavill On Superman Reboot All My Focus Confirms Dedication

Aug 03, 2025 -

Fox News Flash Top Sports Headlines For August 2nd

Aug 03, 2025

Fox News Flash Top Sports Headlines For August 2nd

Aug 03, 2025 -

See The Photos Jennifer Lopezs Golden Hair Hidden Under A Turban In Egypt

Aug 03, 2025

See The Photos Jennifer Lopezs Golden Hair Hidden Under A Turban In Egypt

Aug 03, 2025