New Car Loan Interest Deduction: Who Qualifies?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Car Loan Interest Deduction: Who Qualifies?

Are you dreaming of driving off the lot in a brand-new car? The prospect of lower monthly payments might make that dream even sweeter, especially if you qualify for a car loan interest deduction. But navigating the complexities of tax deductions can be tricky. This article breaks down who qualifies for the car loan interest deduction and what you need to know. Spoiler alert: Unfortunately, there's no longer a federal deduction specifically for car loan interest. However, there are still some potential avenues you might explore.

The Myth of the Federal Car Loan Interest Deduction

Let's address the elephant in the room. There isn't a federal tax deduction specifically for car loan interest in the United States. Many websites and articles promoting such a deduction are outdated or misleading. The deduction for home mortgage interest is often confused with a similar deduction for car loans, but they are entirely separate. The elimination of various itemized deductions under the Tax Cuts and Jobs Act of 2017 significantly altered the landscape of personal tax deductions.

So, What Can You Deduct?

While you can't directly deduct car loan interest, there might be indirect ways to reduce your tax burden related to your vehicle purchase:

-

Home-Based Business: If you use your car primarily for business purposes, a portion of your car loan interest might be deductible as a business expense. This requires meticulous record-keeping and adhering to IRS guidelines for home-based businesses. Consult a tax professional for guidance on this complex area.

-

State and Local Taxes (SALT): Depending on your state, you might be able to deduct some state and local taxes (SALT). However, there are limitations on the amount you can deduct under the 2017 Tax Cuts and Jobs Act. Check your state's tax regulations for details.

-

Itemized Deductions: If your total itemized deductions exceed the standard deduction, you might find it advantageous to itemize. This could indirectly benefit you if you have other significant itemized deductions that lower your overall taxable income.

Understanding the Standard Deduction

Before considering itemized deductions, understand the standard deduction. The IRS sets an annual standard deduction amount, which varies depending on your filing status (single, married filing jointly, etc.). If your itemized deductions are less than your standard deduction, it's generally more beneficial to claim the standard deduction.

Who Benefits Most from Tax Deductions Related to Vehicle Purchases?

Individuals with substantial business use of their vehicle, high incomes leading to higher tax brackets, and significant itemized deductions beyond the standard deduction are most likely to see any real benefit from deductions related to vehicle purchases.

Seeking Professional Advice

Navigating tax laws can be confusing. It's crucial to consult with a qualified tax advisor or accountant for personalized advice tailored to your specific financial situation and vehicle usage. They can help you determine the most effective strategies for minimizing your tax liability.

Keywords: Car loan interest deduction, tax deduction, car loan, tax tips, IRS, home-based business, itemized deductions, standard deduction, SALT, tax advisor, tax planning, auto loan, vehicle purchase, tax laws.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Car Loan Interest Deduction: Who Qualifies?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us Firm Bcg Under Scrutiny Uk Parliament Probes Gaza Operations

Jul 11, 2025

Us Firm Bcg Under Scrutiny Uk Parliament Probes Gaza Operations

Jul 11, 2025 -

World Renowned Cancer Institute In Turmoil Amidst Funding Cuts

Jul 11, 2025

World Renowned Cancer Institute In Turmoil Amidst Funding Cuts

Jul 11, 2025 -

Justice Jacksons Powerful Dissents A Defining Feature Of The Trump Presidencys Legal Legacy

Jul 11, 2025

Justice Jacksons Powerful Dissents A Defining Feature Of The Trump Presidencys Legal Legacy

Jul 11, 2025 -

Public Health England Confirms Stratus As Dominant Covid 19 Variant

Jul 11, 2025

Public Health England Confirms Stratus As Dominant Covid 19 Variant

Jul 11, 2025 -

Waddell Earns Game 2 Starting Role For Thursdays Match

Jul 11, 2025

Waddell Earns Game 2 Starting Role For Thursdays Match

Jul 11, 2025

Latest Posts

-

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025

A Students Guide To Personal Injury Law Challenges And Rewards Of The Legal Profession

Jul 16, 2025 -

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025

Putin And Trump A Continuing Conflict Despite Trumps Disappointment

Jul 16, 2025 -

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025

The Shocking Details Of The Marten And Gordon Case A Nations Disbelief

Jul 16, 2025 -

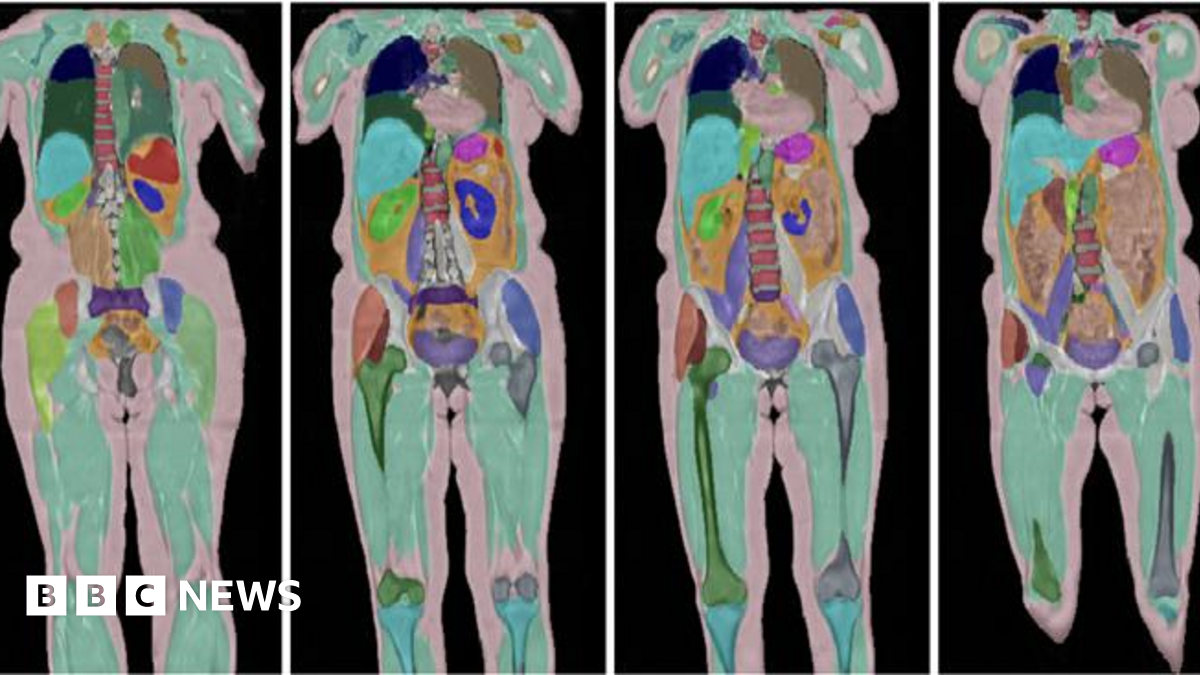

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025

100 000 Uk Volunteers Contribute To Massive Human Imaging Study

Jul 16, 2025 -

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025

Laid Off King Employees Replaced By Ai They Helped Create

Jul 16, 2025