New Federal Loan Limits: Higher Education Costs Price Out Aspiring Doctors And Lawyers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Federal Loan Limits: Higher Education Costs Price Out Aspiring Doctors and Lawyers

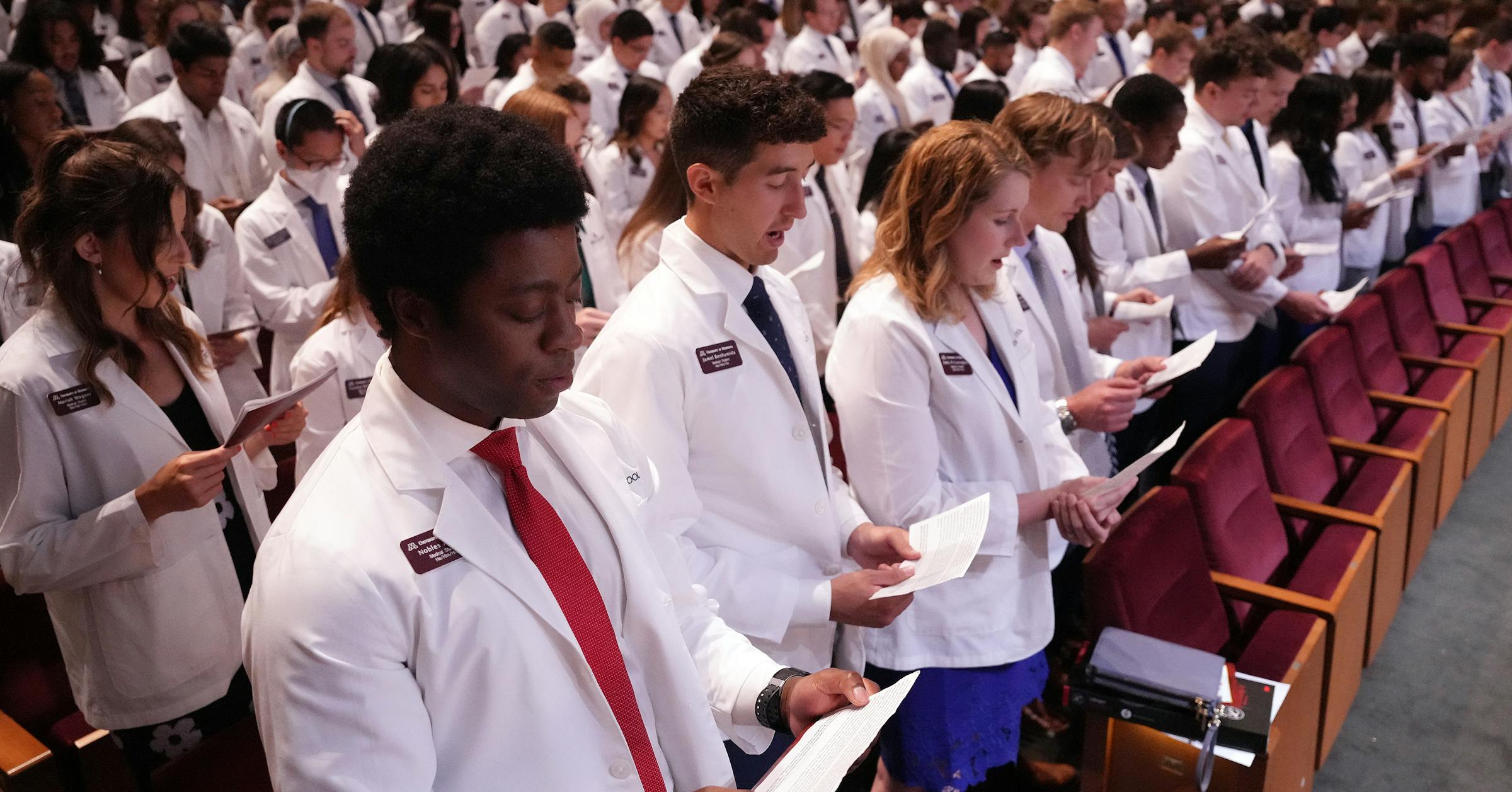

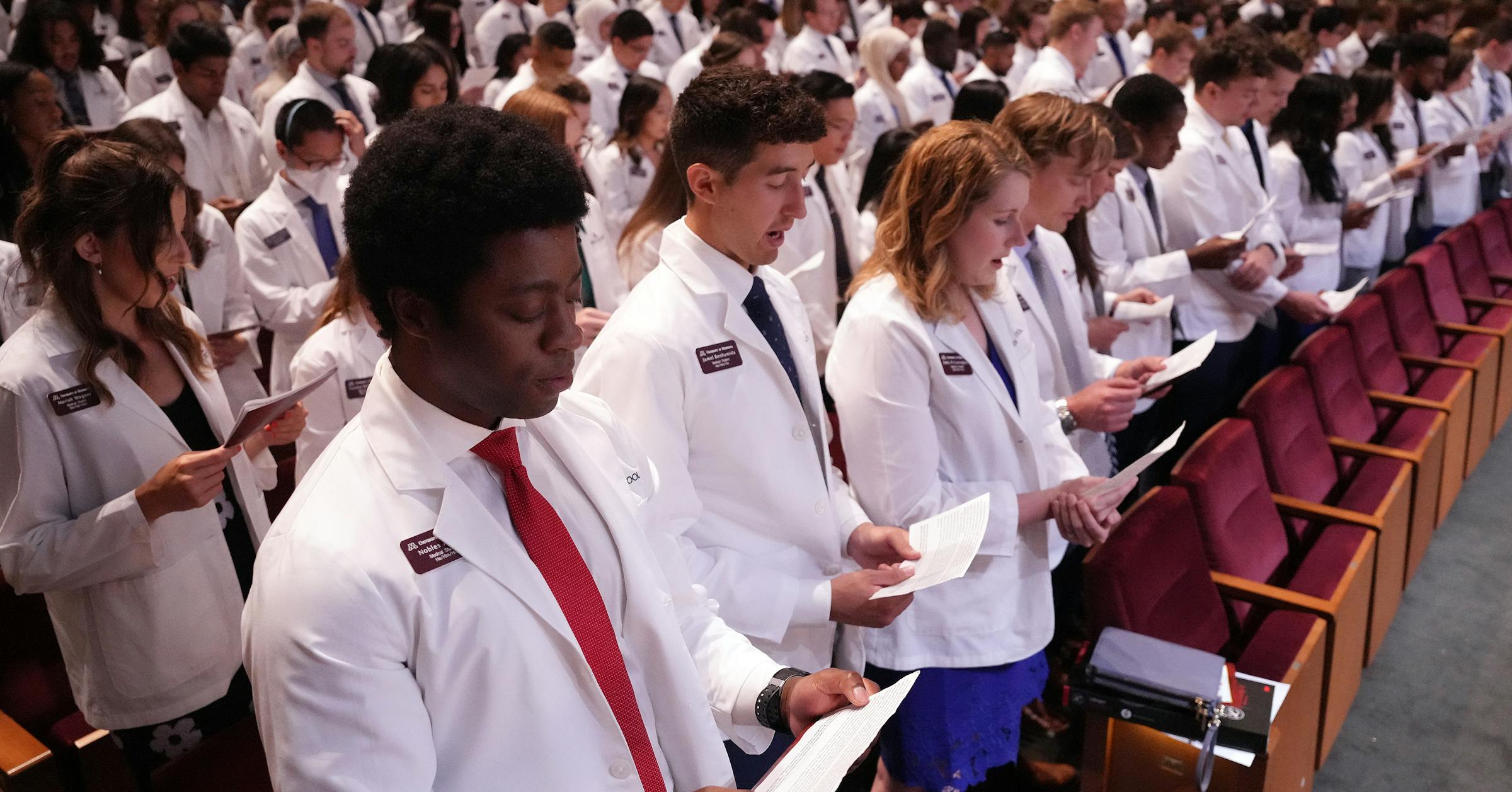

The rising cost of higher education has long been a concern, but recent changes to federal loan limits are exacerbating the problem, particularly for students pursuing careers in high-demand fields like medicine and law. Aspiring doctors and lawyers are facing unprecedented financial hurdles, raising serious questions about access to these vital professions.

The Impact of Increased Loan Limits (and Costs): A Double-Edged Sword

While the increase in federal student loan limits might seem like a positive step, allowing students to borrow more money to cover tuition, the reality is more nuanced. The increases, intended to address rising tuition costs, have instead inadvertently fueled further inflation in higher education pricing. Universities, seeing students with access to larger loans, have increased tuition accordingly, creating a vicious cycle of debt.

This is especially problematic for aspiring doctors and lawyers, whose educations are notoriously expensive. Medical school tuition alone can easily surpass $200,000, and law school isn't far behind. These costs, compounded by living expenses and other fees, are leaving graduates with crippling debt, often delaying or even preventing them from entering their chosen professions.

The Crushing Weight of Debt: Long-Term Consequences

The immense debt burden these students face has far-reaching implications:

- Delayed Career Entry: Graduates are forced to prioritize debt repayment over pursuing their chosen careers immediately. This can lead to significant delays in entering the workforce and contributing to society.

- Limited Career Choices: The pressure to repay loans quickly can restrict career choices, forcing graduates to prioritize higher-paying jobs over positions that align with their passions or values.

- Mental Health Strain: The stress of managing massive student loan debt can negatively impact mental health, leading to anxiety, depression, and other challenges.

- Reduced Access to Professions: The high cost of education is acting as a barrier to entry for talented and dedicated students from lower socioeconomic backgrounds, threatening the diversity of these crucial professions.

What Can Be Done? Addressing the Root of the Problem

The current system isn't sustainable. Simply increasing loan limits without addressing the underlying problem of escalating tuition costs is a short-sighted approach. Several solutions need to be explored:

- Tuition Reform: Governments and institutions need to work together to control tuition inflation and make higher education more affordable. This could involve increased government funding for higher education, stricter regulations on tuition increases, and incentives for universities to prioritize affordability.

- Increased Funding for Need-Based Aid: Expanding access to grants and scholarships, particularly for students from disadvantaged backgrounds, is essential to level the playing field.

- Loan Forgiveness Programs: Targeted loan forgiveness programs for students pursuing careers in high-demand fields like medicine and law could alleviate the burden of debt and encourage more individuals to enter these professions.

Looking Ahead: Securing the Future of Vital Professions

The escalating cost of higher education and the increasing reliance on student loans are creating a crisis for aspiring doctors and lawyers. Addressing this issue requires a multifaceted approach involving government intervention, university reform, and a renewed commitment to making higher education accessible to all, regardless of their socioeconomic background. Failure to do so risks jeopardizing the future of these vital professions and limiting access to essential services for all. We need to move beyond simply increasing loan limits and tackle the root causes of this growing problem. The future of healthcare and the legal system depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Federal Loan Limits: Higher Education Costs Price Out Aspiring Doctors And Lawyers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Newsom Signs Bill Securing Funding For Californias High Speed Rail

Aug 01, 2025

Newsom Signs Bill Securing Funding For Californias High Speed Rail

Aug 01, 2025 -

From Luxury Death Trap To Restoration Project The De Havilland Comets Story

Aug 01, 2025

From Luxury Death Trap To Restoration Project The De Havilland Comets Story

Aug 01, 2025 -

Loss At Reagan National Airport Spurs Campaign For Enhanced Aviation Safety

Aug 01, 2025

Loss At Reagan National Airport Spurs Campaign For Enhanced Aviation Safety

Aug 01, 2025 -

Historic Appointment First Woman Astronomer Royal In Uk History

Aug 01, 2025

Historic Appointment First Woman Astronomer Royal In Uk History

Aug 01, 2025 -

Cnn Reports Lifestyle Changes Effective In Combating Early Alzheimers

Aug 01, 2025

Cnn Reports Lifestyle Changes Effective In Combating Early Alzheimers

Aug 01, 2025

Latest Posts

-

Break In Arkansas Killing Case Suspect Captured At Local Barbershop

Aug 02, 2025

Break In Arkansas Killing Case Suspect Captured At Local Barbershop

Aug 02, 2025 -

Only Fans Streamer Targeted In Shocking Crypto Attack Cctv Footage Released

Aug 02, 2025

Only Fans Streamer Targeted In Shocking Crypto Attack Cctv Footage Released

Aug 02, 2025 -

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025

A Mothers Final Days Unraveling The Mystery Behind Her Alleged Poisoning

Aug 02, 2025 -

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025

Community Grieves Remembering The Service Of Officer Didarul Islam

Aug 02, 2025 -

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025

Illegal House Shares A Breeding Ground For Rats Mold And Overcrowding

Aug 02, 2025