New Federal Loan Limits: Higher Education Costs Price Out Students

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

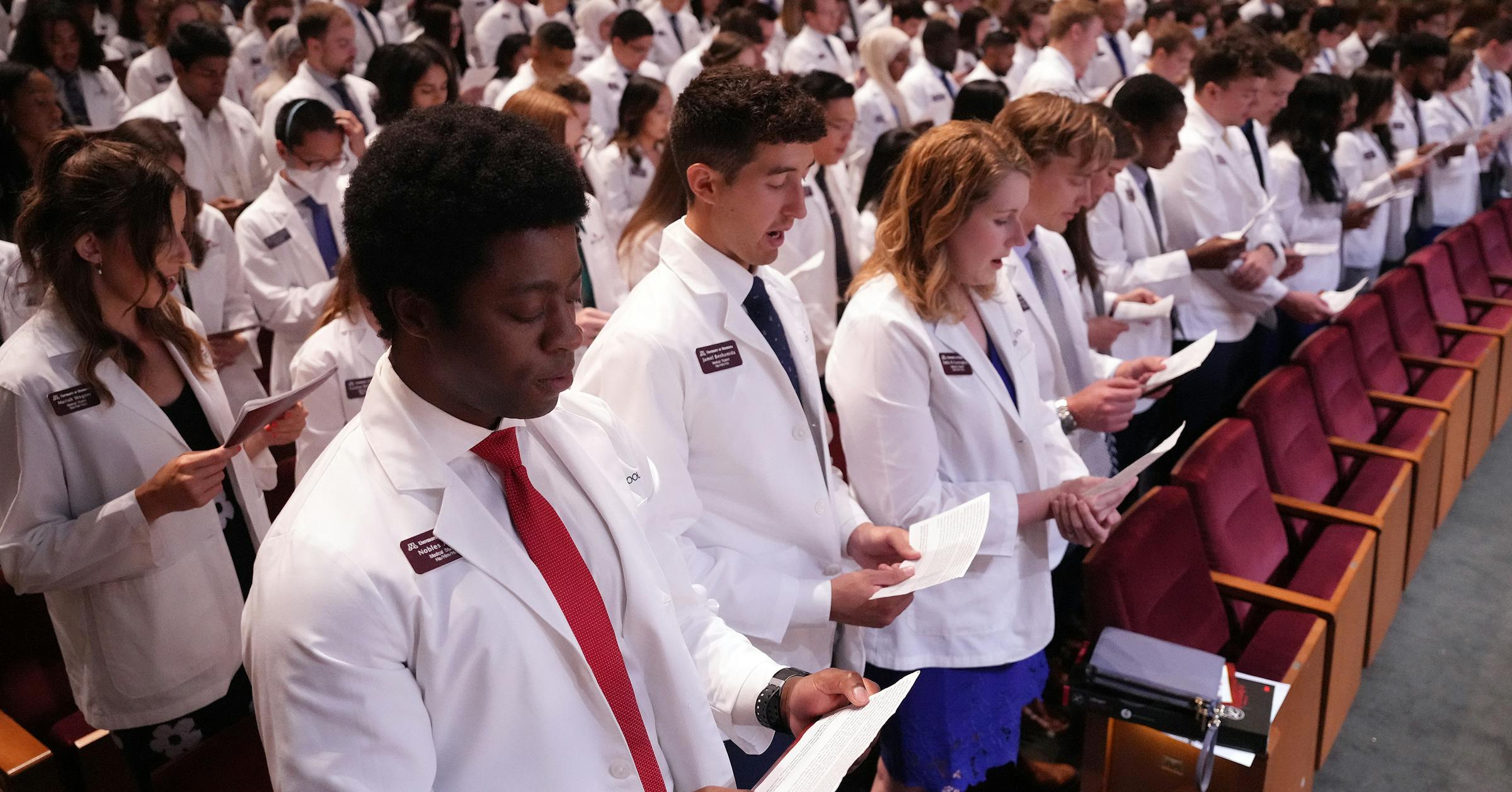

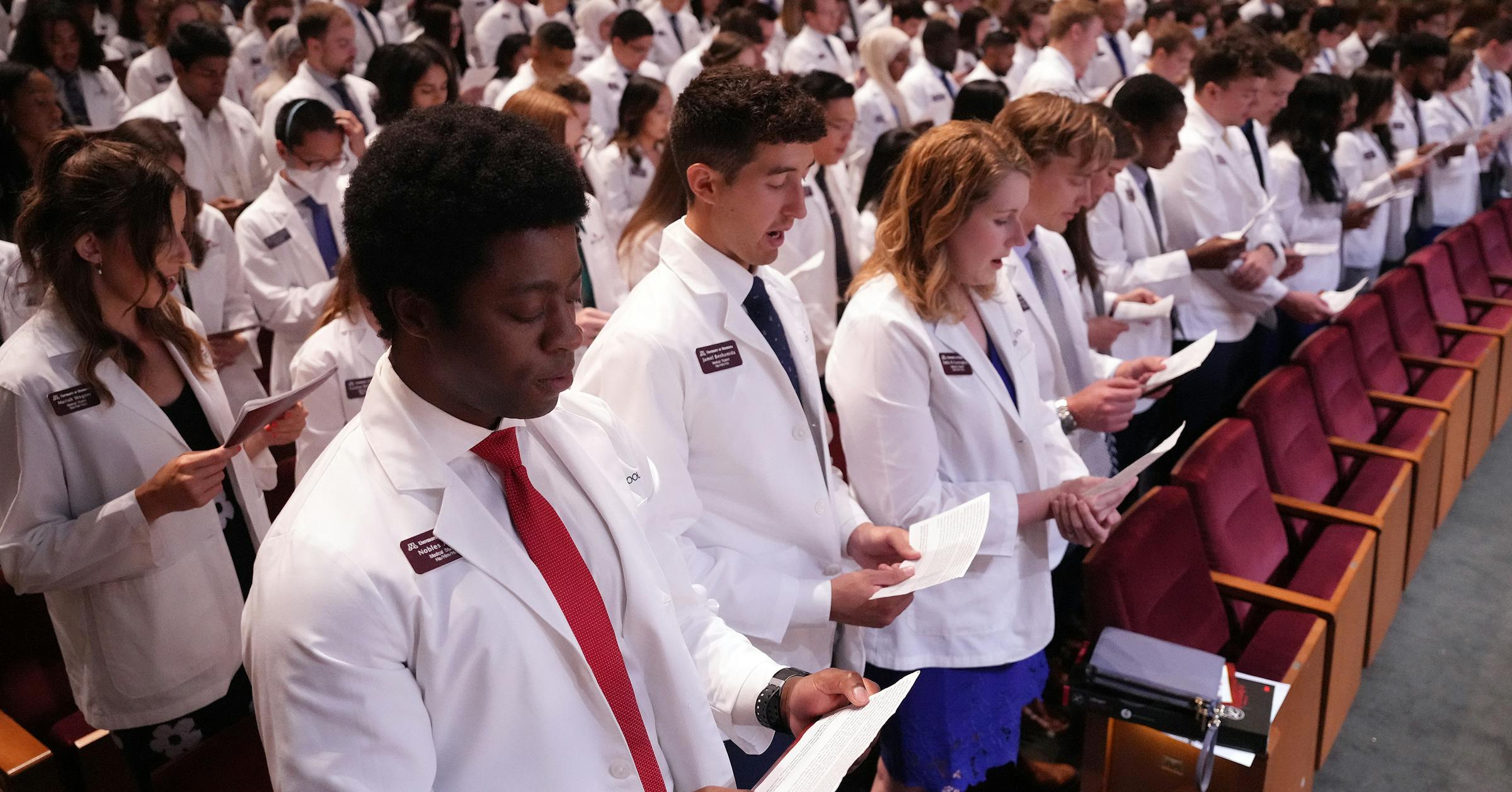

New Federal Loan Limits: Higher Education Costs Price Out Students Despite Increased Funding

The cost of higher education continues to climb, leaving many prospective students struggling to afford even with increased federal loan limits. While the recent announcement of higher federal student loan limits offers some relief, it's not enough to address the escalating tuition fees and living expenses that are pricing many students out of a college education. This leaves many questioning whether the current system is truly accessible and equitable.

Increased Limits, Increased Burden?

The Department of Education recently raised the maximum federal student loan limits for the 2024-2025 academic year. While this increase represents a significant change for some, critics argue that it simply exacerbates the problem of student loan debt without addressing the root cause: the ever-increasing cost of tuition. The new limits, while higher, still fall short of covering the total cost of attendance for many institutions, particularly private universities and those in high-cost areas.

The increase in loan limits means students can borrow more money, but it also translates to a larger debt burden upon graduation. This debt can significantly impact a graduate's ability to purchase a home, start a family, or simply achieve financial stability. The long-term consequences of massive student loan debt are a growing concern for economists and policymakers alike.

The Tuition Inflation Crisis

The rising cost of tuition has far outpaced inflation for decades. Several factors contribute to this persistent increase, including:

- Reduced State Funding: Many states have significantly reduced funding for public universities, forcing institutions to raise tuition to compensate.

- Administrative Costs: The administrative bloat within universities has also contributed to increased costs, with a smaller percentage of tuition dollars going directly towards instruction.

- Demand and Limited Supply: In some fields, high demand and limited capacity drive up tuition prices.

Beyond the Loan Limits: Addressing the Core Issue

Simply increasing loan limits is a temporary band-aid solution. A more comprehensive approach is needed to address the affordability crisis in higher education. This includes:

- Increased Transparency in College Costs: Making college costs more transparent and easily comparable across institutions could empower students to make informed decisions.

- Incentivizing Affordability: Incentivizing universities to control costs through grants or other funding mechanisms could encourage responsible budgeting.

- Investing in Public Institutions: Increased state funding for public universities would alleviate pressure on tuition increases.

- Exploring Alternative Funding Models: Exploring alternative funding models, such as income-share agreements or expanding grant programs, could offer more sustainable options for students.

The Path Forward: A Call to Action

The escalating cost of higher education is a complex issue requiring multifaceted solutions. While increased federal loan limits offer some immediate relief, they ultimately fail to address the underlying problem of tuition inflation. Students, parents, policymakers, and universities need to collaborate to find sustainable solutions that make higher education accessible and affordable for all. This requires a shift in perspective, moving beyond simply increasing loan limits to addressing the core issues driving up the cost of a college education. We must advocate for policies that prioritize affordability and equity in higher education, ensuring that a college degree remains a pathway to opportunity, not a gateway to crushing debt.

Further Reading:

Keywords: Federal student loans, student loan debt, higher education costs, tuition inflation, college affordability, student loan limits, college tuition, financial aid, student debt crisis, higher education, college costs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Federal Loan Limits: Higher Education Costs Price Out Students. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Issues Warning To Canada Over Palestine Recognition

Jul 31, 2025

Trump Issues Warning To Canada Over Palestine Recognition

Jul 31, 2025 -

Insider Exposes Reality Of Trumps Budget An Unintentional Confession

Jul 31, 2025

Insider Exposes Reality Of Trumps Budget An Unintentional Confession

Jul 31, 2025 -

Googles New Ai Search Feature Arrives In The Uk

Jul 31, 2025

Googles New Ai Search Feature Arrives In The Uk

Jul 31, 2025 -

Coinbases Bitcoin Premium Streak A 60 Day Run At Risk

Jul 31, 2025

Coinbases Bitcoin Premium Streak A 60 Day Run At Risk

Jul 31, 2025 -

Greece Steps Up Border Security On Crete Amidst Surge In Asylum Seekers

Jul 31, 2025

Greece Steps Up Border Security On Crete Amidst Surge In Asylum Seekers

Jul 31, 2025

Latest Posts

-

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025

Brazilian Government Actions Potential Threats To Us National Interests

Aug 01, 2025 -

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025

Oyster Bay Womans 30 Million Fraud Scheme A Guilty Plea And Political Connections

Aug 01, 2025 -

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025

Cnn Politics Examining The Maga Medias Rally Around Trump On Epstein Allegations

Aug 01, 2025 -

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025

Market Movers Apples Earnings Surprise Amazons Stock Slip Reddits Rally

Aug 01, 2025 -

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025

Pop Cap Reimagines Plants Vs Zombies Replanted As Franchise Cornerstone

Aug 01, 2025