New Republican Retirement Bill: A $420,000 Hit To Gen X And Millennials?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Republican Retirement Bill: A $420,000 Hit to Gen X and Millennials?

The proposed GOP retirement plan sparks controversy, raising concerns about long-term financial security for younger generations.

The Republican Party's newly unveiled retirement bill has ignited a firestorm of debate, particularly among financial experts and younger Americans. While proponents hail it as a crucial step towards strengthening retirement savings, critics argue its provisions could significantly harm Gen X and Millennials, potentially costing them hundreds of thousands of dollars over their lifetimes. The proposed changes center around modifications to 401(k) plans and individual retirement accounts (IRAs), impacting how individuals save for their golden years. This article delves into the key aspects of the bill and analyzes its potential impact on younger generations.

Understanding the Proposed Changes:

The core of the controversy revolves around proposed changes to tax incentives for retirement savings. Specifically, the bill aims to:

- Reduce tax deductions for traditional 401(k) contributions: This could lessen the immediate tax benefits of contributing to a 401(k), making it less attractive for those already struggling with student loan debt and high cost of living.

- Limit Roth IRA contributions: Restricting contributions to Roth IRAs, which offer tax-free withdrawals in retirement, would disproportionately affect younger individuals who typically have lower incomes early in their careers and may benefit most from the tax advantages of Roth accounts.

- Increase restrictions on early withdrawals: Making it harder to access retirement funds before retirement age could leave younger generations vulnerable during unexpected financial emergencies.

The $420,000 Question: A Realistic Estimate?

While the exact financial impact varies significantly based on individual circumstances, some financial analysts estimate that the cumulative effect of these changes could cost the average Gen X or Millennial worker over $420,000 in retirement savings over their lifetime. This staggering figure considers the reduced tax benefits, limitations on contributions, and potential lost investment growth over the long term. This estimate is based on modelling various scenarios and is not a precise prediction for each individual but serves to highlight the potential severity of the consequences.

Who is Most Affected?

The proposed changes would disproportionately impact:

- Lower-income earners: The reduced tax benefits would be felt more acutely by those in lower tax brackets, making saving for retirement even more challenging.

- Young professionals with student loan debt: Individuals already burdened with student loan repayments may find it difficult to allocate sufficient funds towards retirement savings, making the reduced incentives particularly detrimental.

- Individuals relying on tax advantages for retirement planning: Those who have built their retirement strategies around tax-advantaged accounts would need to reassess and potentially adapt their plans.

Long-Term Implications for Retirement Security:

This bill raises serious questions about the long-term financial security of younger generations. The potential loss of hundreds of thousands of dollars in retirement savings could significantly impact their ability to maintain a comfortable standard of living in their later years. This could lead to increased reliance on Social Security and other government assistance programs, potentially straining public resources.

What Can You Do?

Staying informed about the bill's progress and its potential effects is crucial. Consider exploring alternative retirement saving strategies, consulting with a financial advisor to assess your personal situation, and contacting your elected officials to voice your concerns. Understanding the intricacies of retirement planning is more crucial than ever, and seeking professional advice can provide clarity and peace of mind.

Conclusion:

The Republican retirement bill presents a complex issue with potentially far-reaching implications for younger generations. While the long-term consequences remain to be seen, understanding the potential financial impact and engaging in informed discussions is paramount to ensuring a secure financial future for Gen X and Millennials. The debate continues, and further analysis is necessary to fully comprehend the bill's complete ramifications.

(Note: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor for personalized guidance.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Republican Retirement Bill: A $420,000 Hit To Gen X And Millennials?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

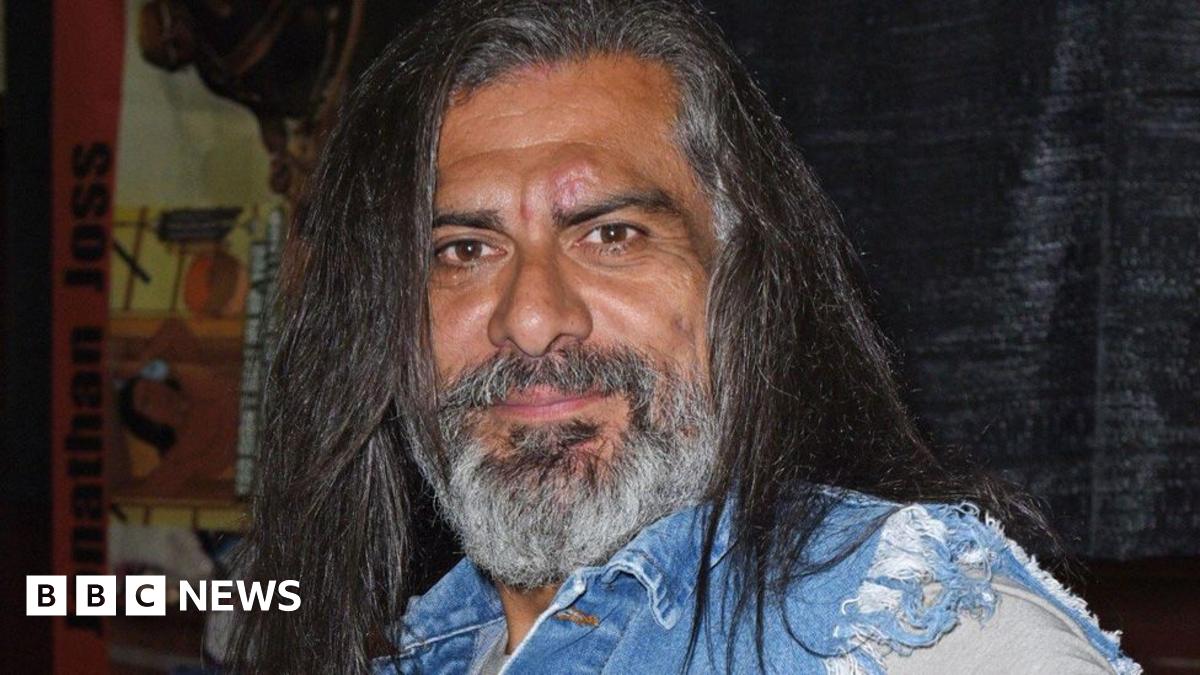

Death Of Jonathan Joss King Of The Hill Actor Killed In Shooting Incident

Jun 05, 2025

Death Of Jonathan Joss King Of The Hill Actor Killed In Shooting Incident

Jun 05, 2025 -

Joe Sacco Departs Bruins Next Nhl Destination Revealed

Jun 05, 2025

Joe Sacco Departs Bruins Next Nhl Destination Revealed

Jun 05, 2025 -

Major Supplier To Australias Big Battery Projects On Brink Of Collapse

Jun 05, 2025

Major Supplier To Australias Big Battery Projects On Brink Of Collapse

Jun 05, 2025 -

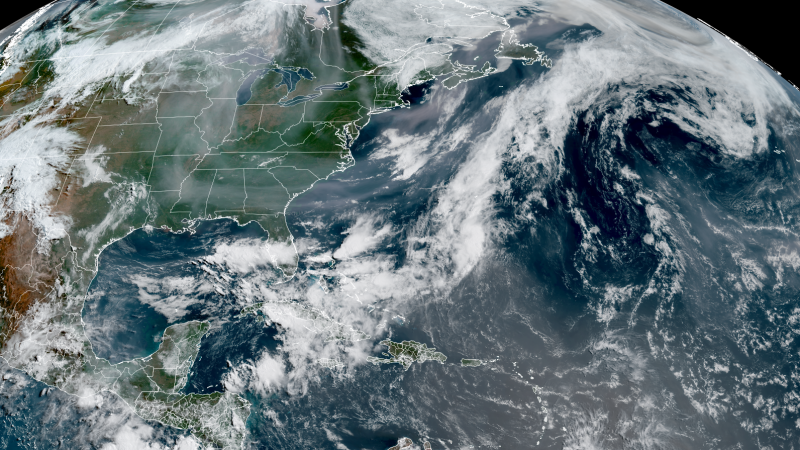

Double Threat African Dust And Canadian Wildfire Smoke To Affect Southern Us This Week

Jun 05, 2025

Double Threat African Dust And Canadian Wildfire Smoke To Affect Southern Us This Week

Jun 05, 2025 -

Joe Sacco Departs Bruins New Nhl Team Announced For Coaching Staff

Jun 05, 2025

Joe Sacco Departs Bruins New Nhl Team Announced For Coaching Staff

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025